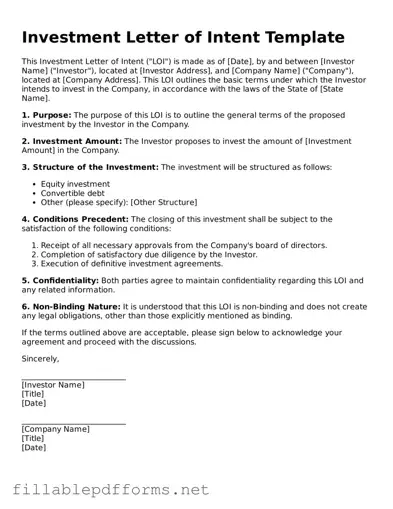

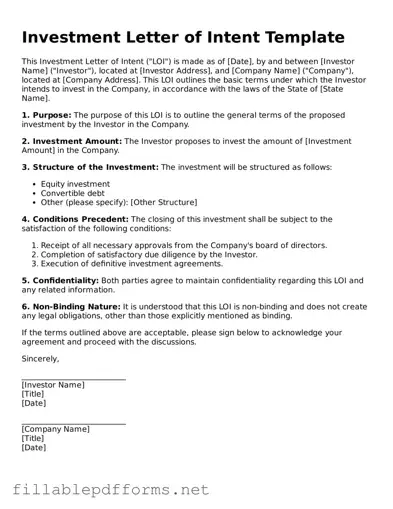

The Investment Letter of Intent form is a preliminary document that outlines the terms and conditions of a potential investment agreement between parties. It serves as a roadmap for negotiations, helping both investors and businesses clarify their intentions before formalizing...

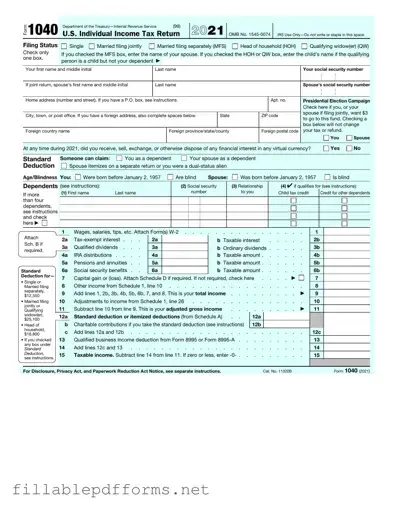

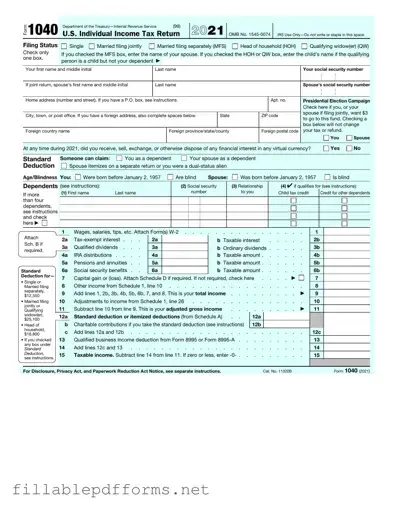

The IRS 1040 form is the standard individual income tax return used by U.S. taxpayers to report their annual income and calculate their tax liability. This form allows individuals to detail their earnings, claim deductions, and determine any tax refunds...

The IRS 1099-MISC form is used to report various types of income received by individuals who are not employees. This form is essential for freelancers, independent contractors, and other non-employee service providers. Understanding its purpose and requirements can help ensure...

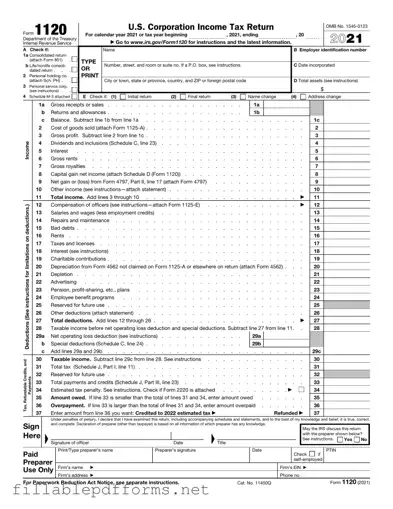

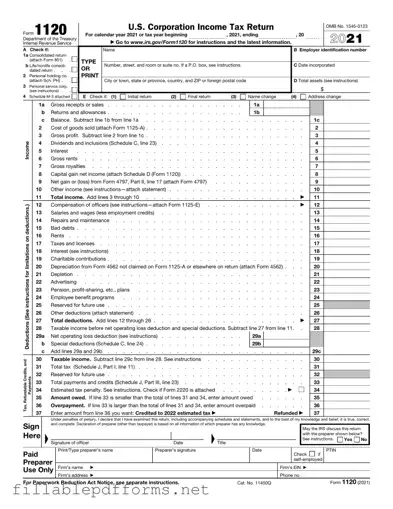

The IRS 1120 form is a tax return used by corporations to report their income, gains, losses, deductions, and credits. This form plays a crucial role in determining a corporation's tax liability. Understanding how to properly complete and file the...

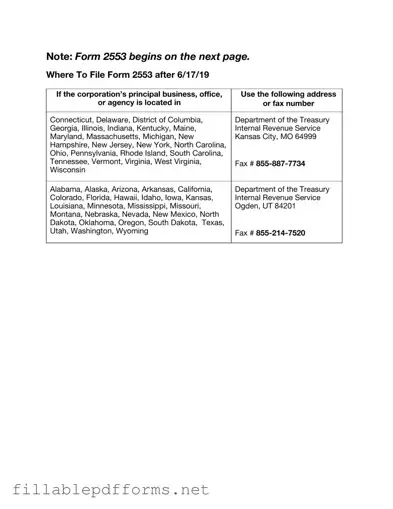

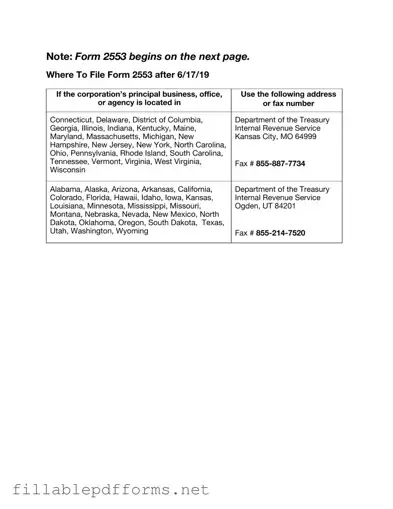

The IRS Form 2553 is a crucial document that allows eligible small businesses to elect S corporation status for tax purposes. By filing this form, businesses can benefit from pass-through taxation, potentially reducing their overall tax burden. Understanding the requirements...

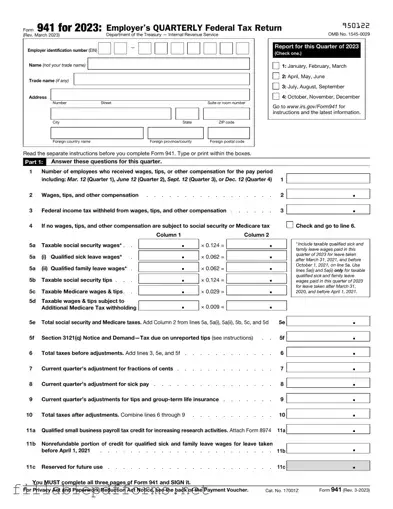

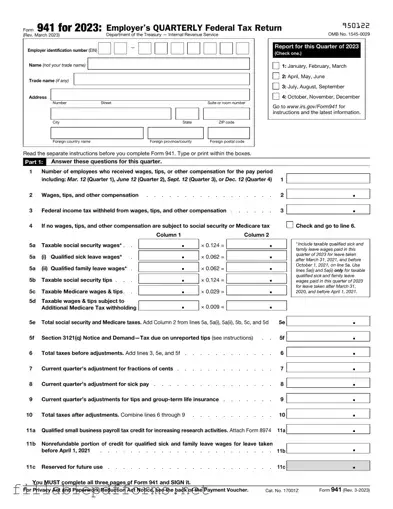

The IRS Form 941 is a quarterly tax form that employers use to report income taxes, Social Security tax, and Medicare tax withheld from employee wages. This form also helps employers calculate their share of Social Security and Medicare taxes....

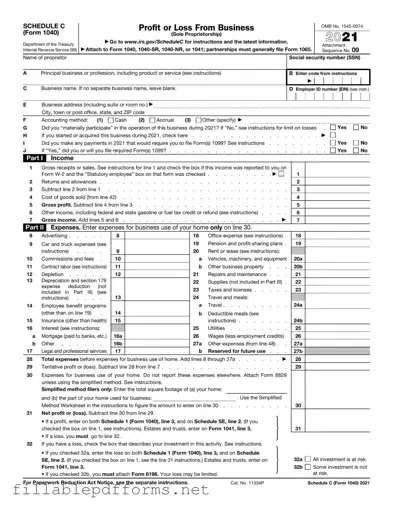

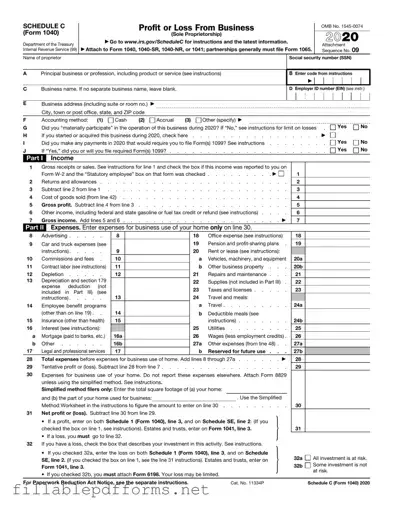

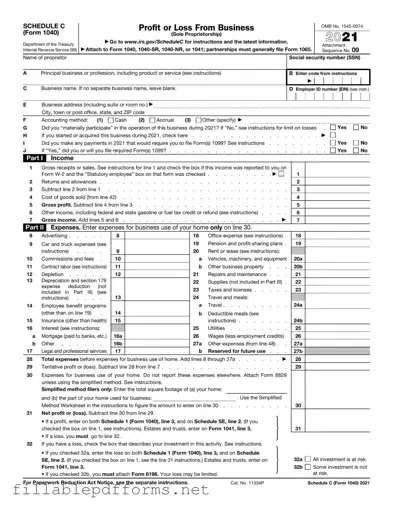

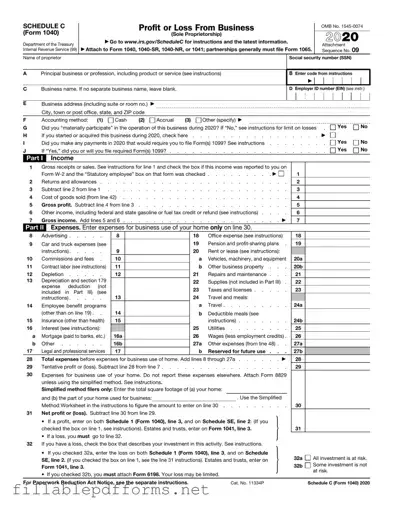

The IRS Schedule C 1040 form is a tax document used by sole proprietors to report income or loss from their business activities. This form provides a detailed account of business earnings and expenses, allowing individuals to calculate their net...

The IRS Schedule C (Form 1040) is a tax form used by sole proprietors to report income or loss from their business activities. This form allows individuals to detail their earnings and expenses, providing a clear picture of their business's...

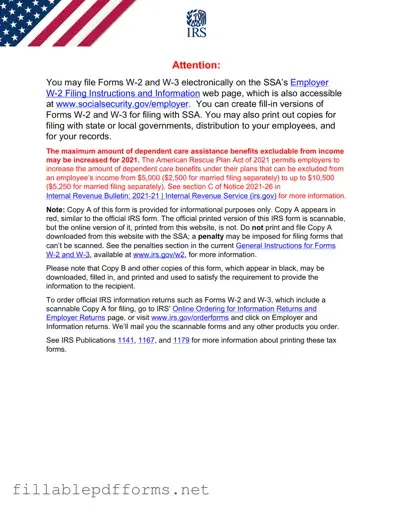

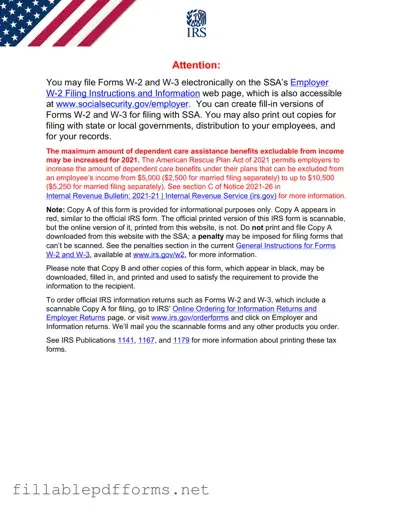

The IRS W-2 form is a document that employers are required to provide to their employees, detailing the amount of wages earned and taxes withheld during the year. This form is essential for employees when filing their annual tax returns....

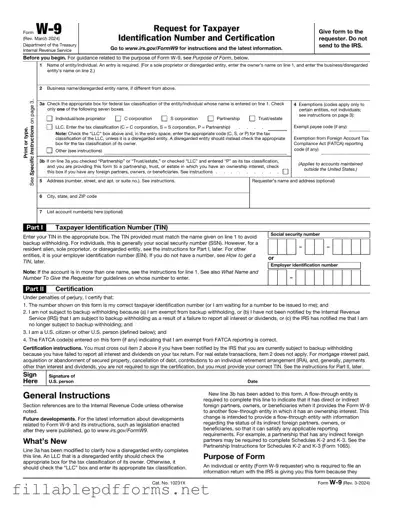

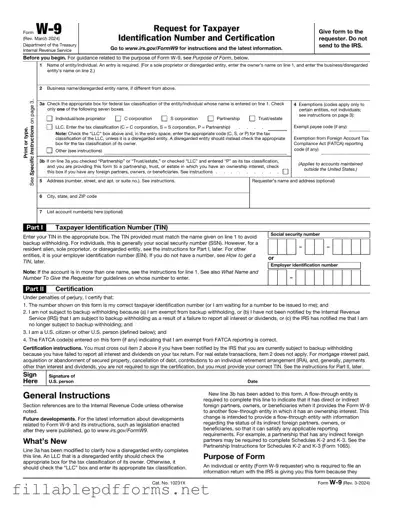

The IRS W-9 form is a document used by individuals and businesses to provide their taxpayer identification information to others, typically for tax reporting purposes. Completing this form accurately is essential to ensure proper reporting of income to the Internal...

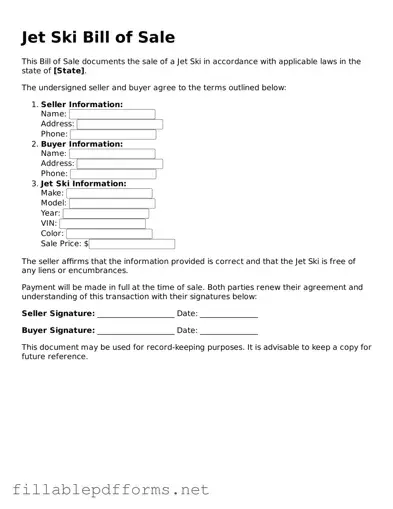

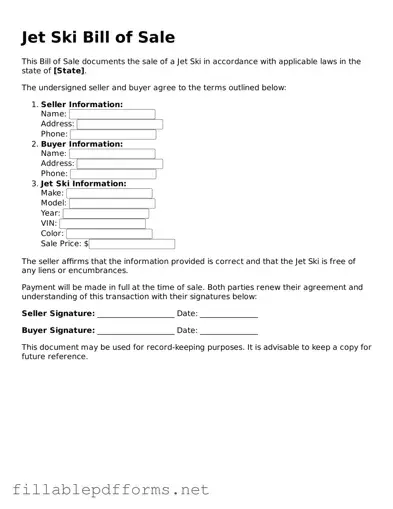

The Jet Ski Bill of Sale form is a crucial document used to record the sale and transfer of ownership of a jet ski. This form serves as proof of the transaction, detailing important information about the seller, buyer, and...

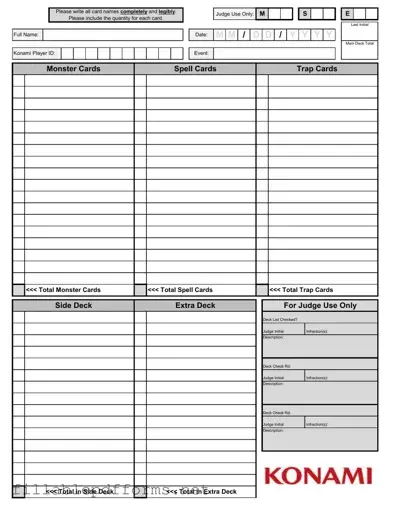

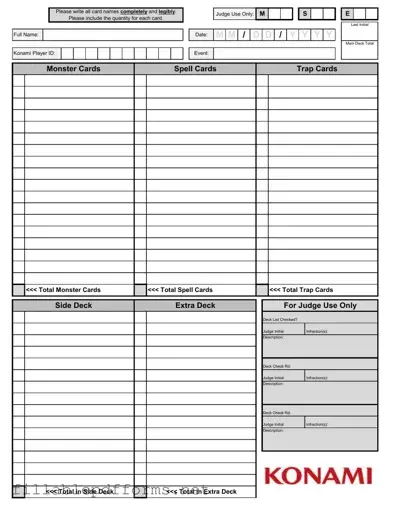

The Konami Decklist form is a crucial document used in competitive card gaming events to ensure that players accurately report their decks. This form requires players to list all card names completely and legibly, along with the quantity for each...