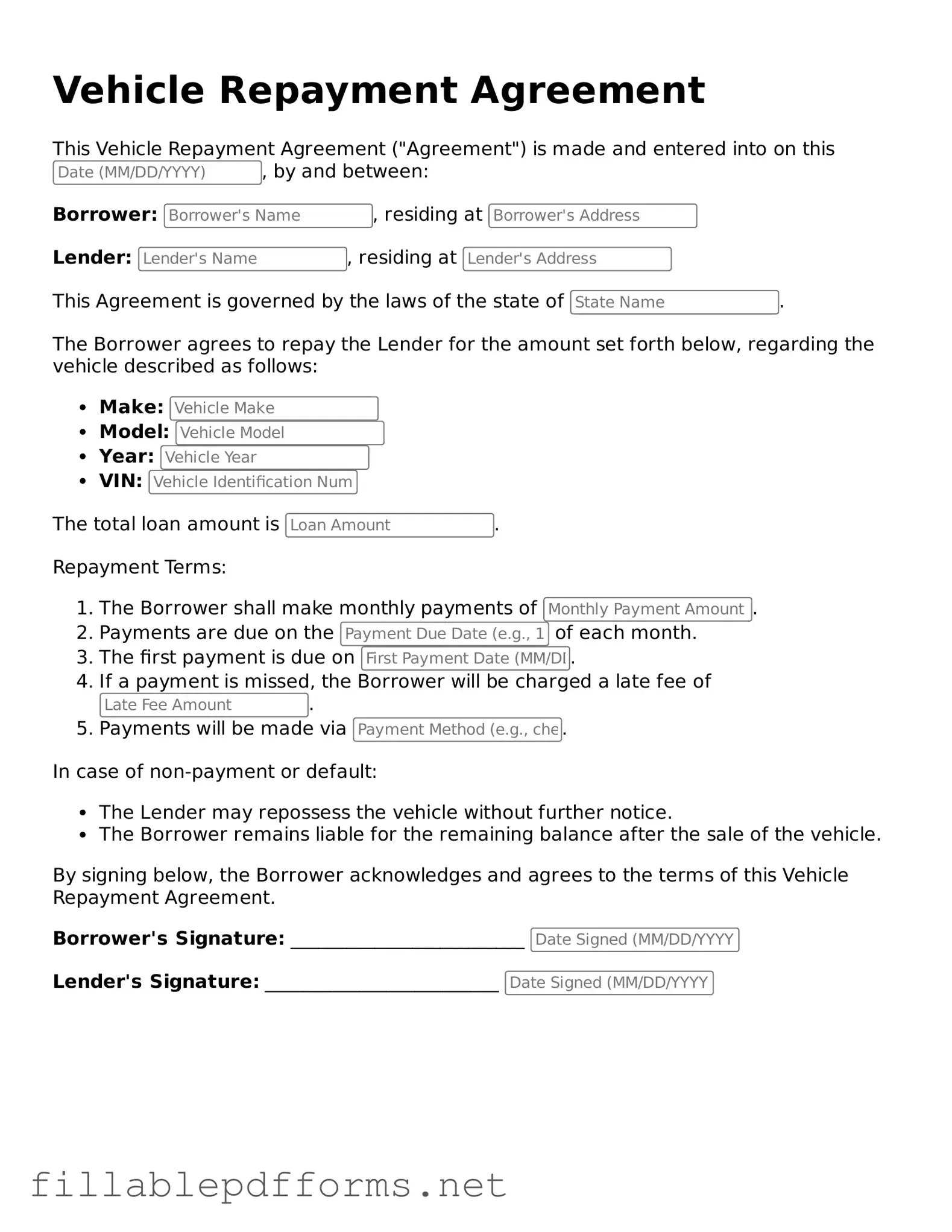

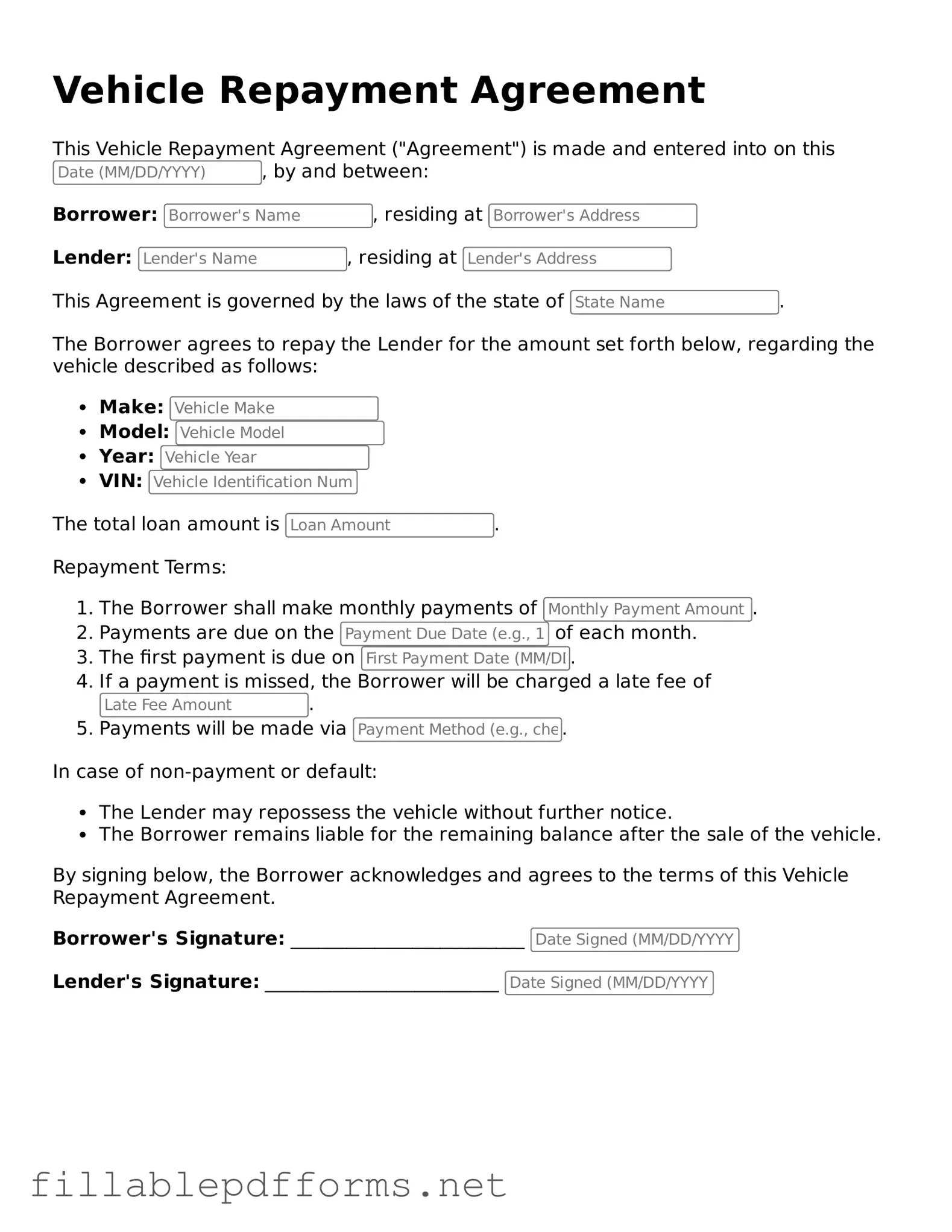

Blank Vehicle Repayment Agreement Template

The Vehicle Repayment Agreement form is a legal document that outlines the terms under which a borrower agrees to repay a loan used to purchase a vehicle. This agreement protects both the lender and the borrower by clearly stating the payment schedule, interest rates, and consequences of default. Understanding this form is essential for anyone entering into a vehicle financing arrangement, as it ensures clarity and accountability throughout the repayment process.

Launch Editor Here

Blank Vehicle Repayment Agreement Template

Launch Editor Here

Launch Editor Here

or

▼ Vehicle Repayment Agreement PDF

Almost there — finish the form

Complete Vehicle Repayment Agreement online fast — no printing, no scanning.