Attorney-Verified Transfer-on-Death Deed Form for Texas State

The Texas Transfer-on-Death Deed is a legal document that allows property owners to pass their real estate directly to their beneficiaries upon their death, avoiding the probate process. This deed provides a simple way to ensure that your loved ones receive your property without unnecessary delays or costs. Understanding how to properly use this form can help you secure your family's future and streamline the transfer of your assets.

Launch Editor Here

Attorney-Verified Transfer-on-Death Deed Form for Texas State

Launch Editor Here

Launch Editor Here

or

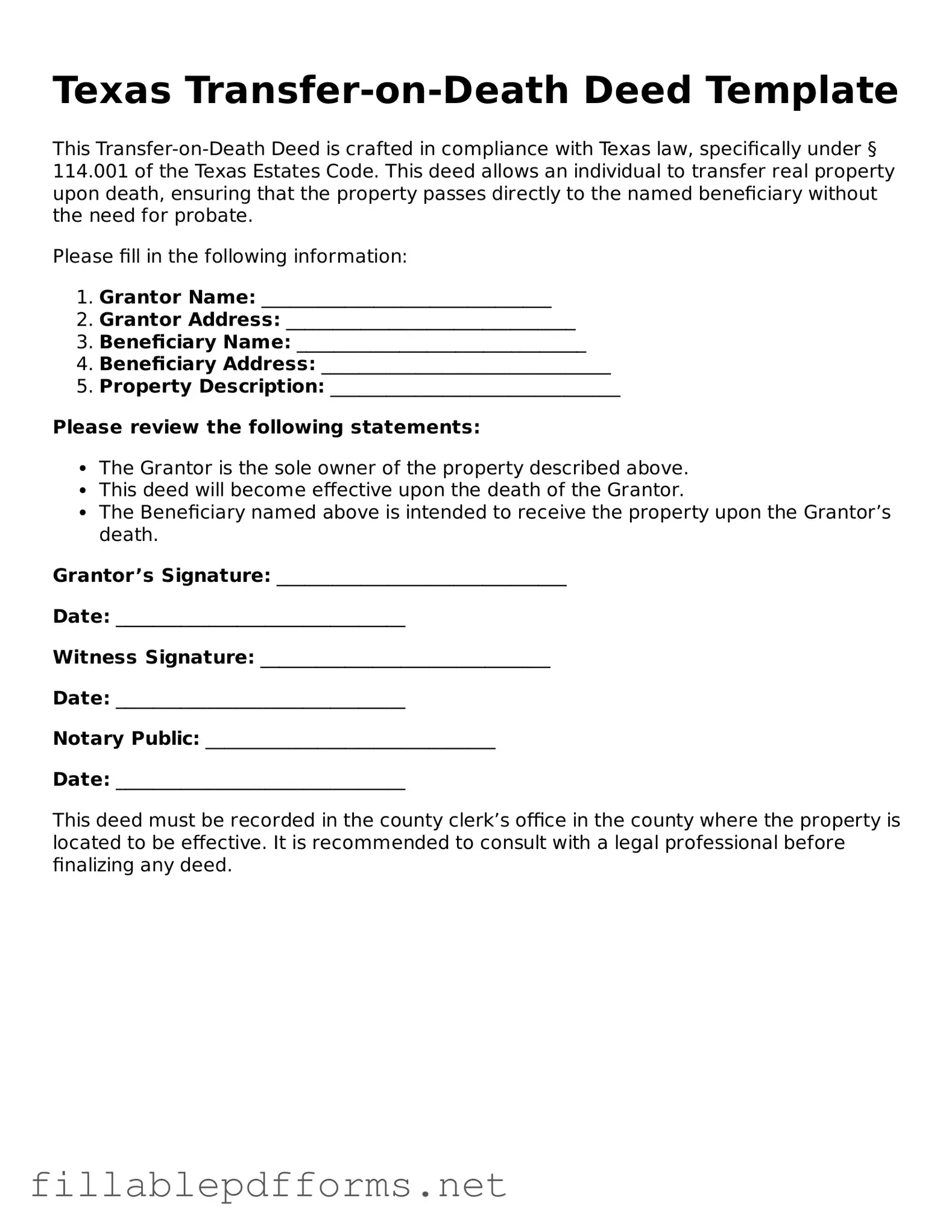

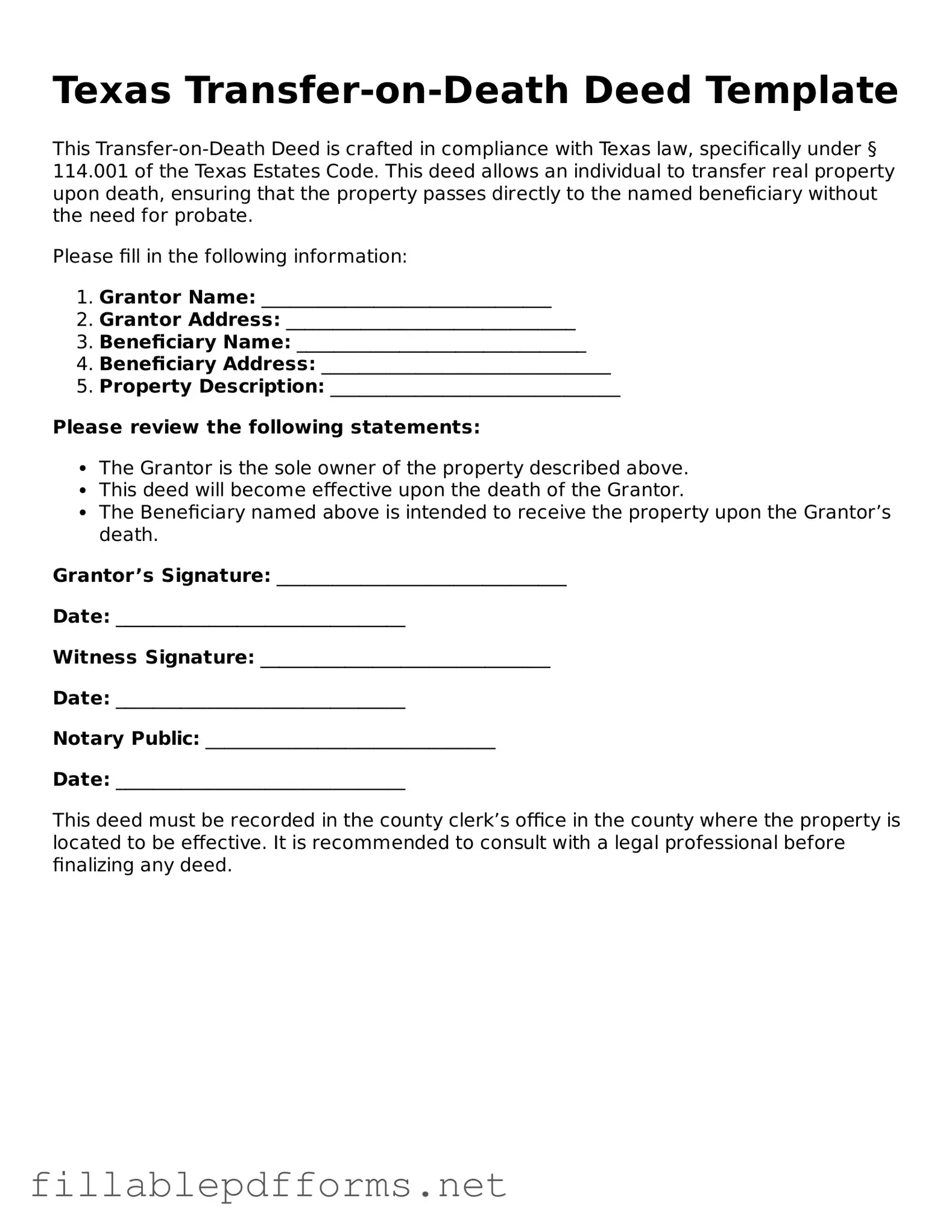

▼ Transfer-on-Death Deed PDF

Almost there — finish the form

Complete Transfer-on-Death Deed online fast — no printing, no scanning.