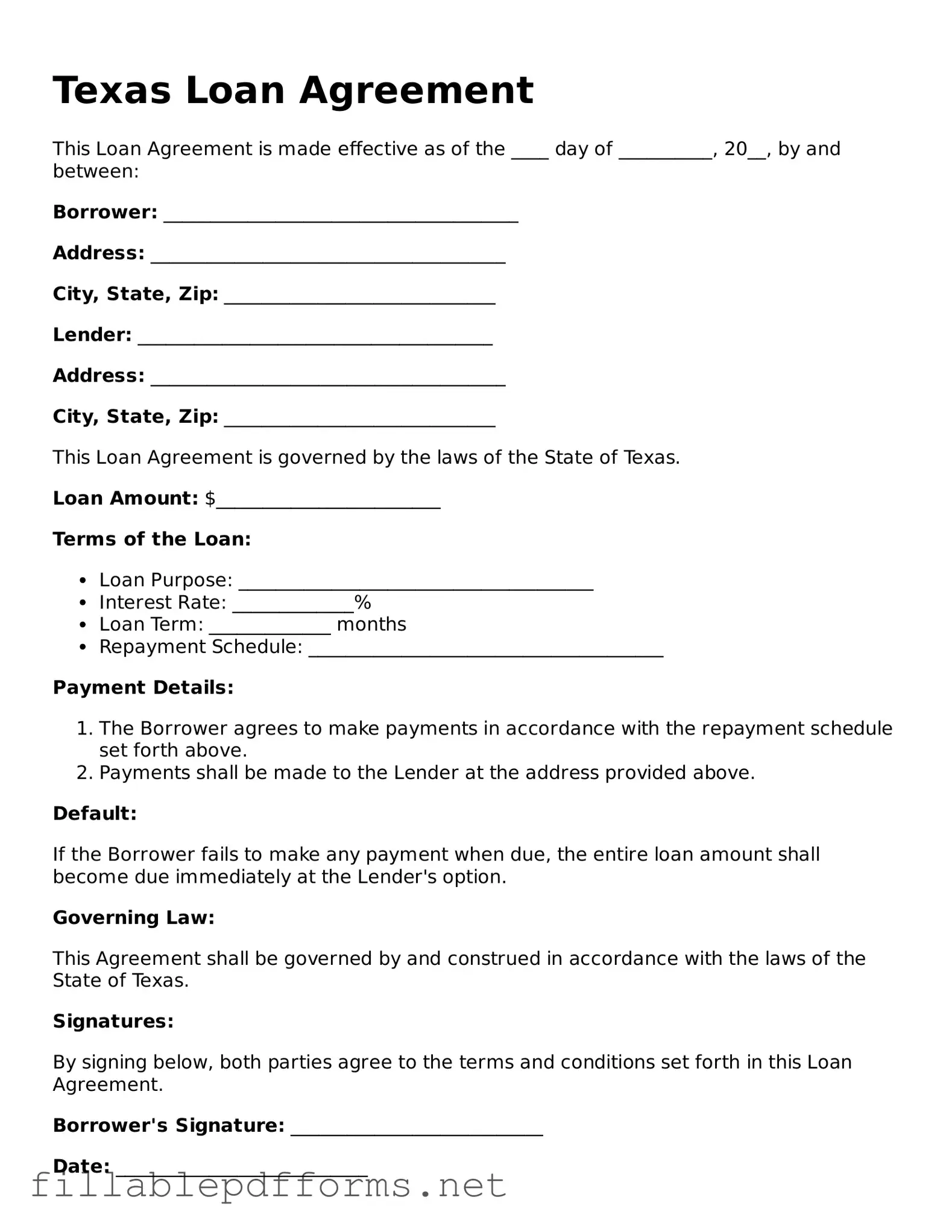

Attorney-Verified Loan Agreement Form for Texas State

A Texas Loan Agreement form is a legal document that outlines the terms and conditions of a loan between a borrower and a lender. This form serves to protect the rights of both parties by clearly detailing the loan amount, repayment schedule, and any applicable interest rates. Understanding this agreement is crucial for ensuring a smooth lending process and avoiding potential disputes.

Launch Editor Here

Attorney-Verified Loan Agreement Form for Texas State

Launch Editor Here

Launch Editor Here

or

▼ Loan Agreement PDF

Almost there — finish the form

Complete Loan Agreement online fast — no printing, no scanning.