Attorney-Verified Lady Bird Deed Form for Texas State

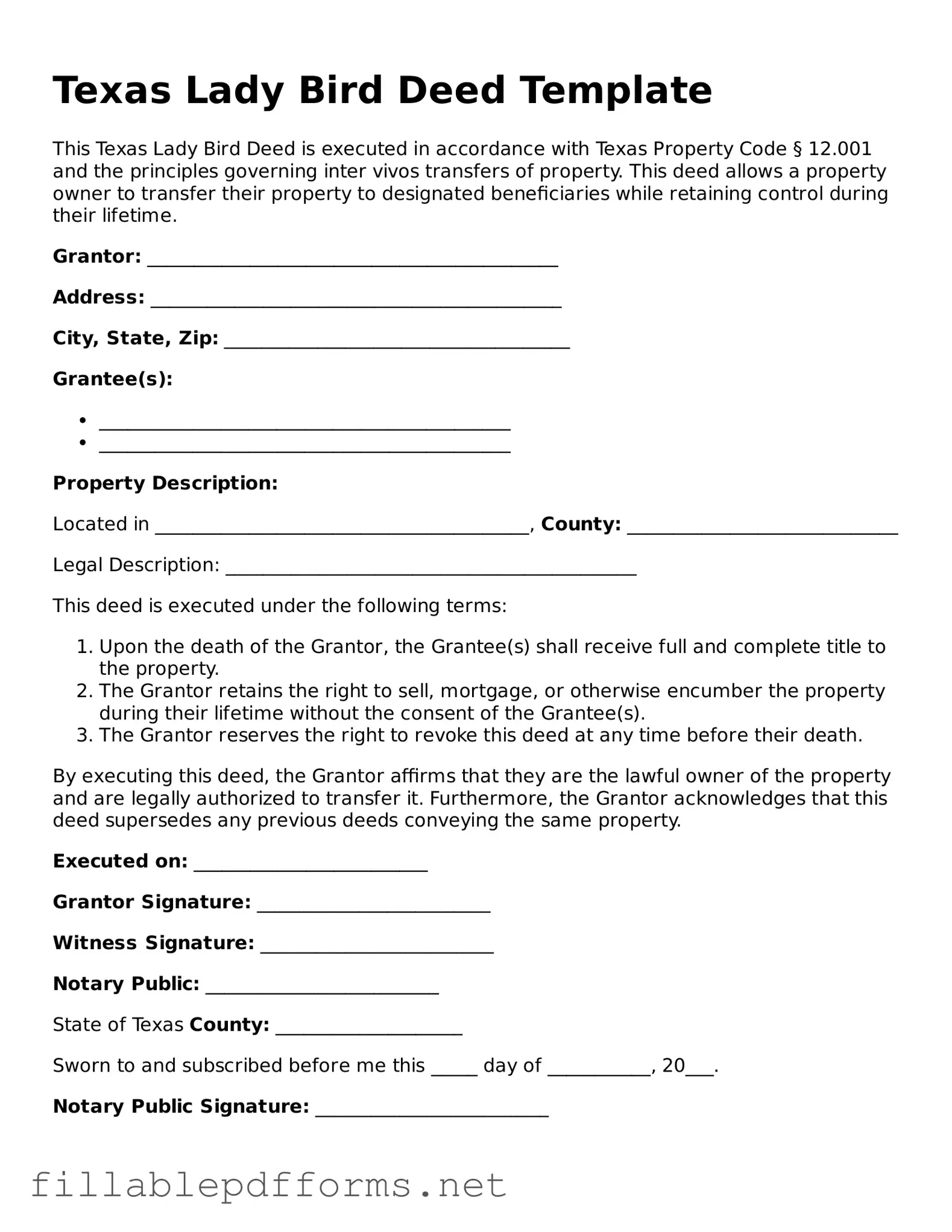

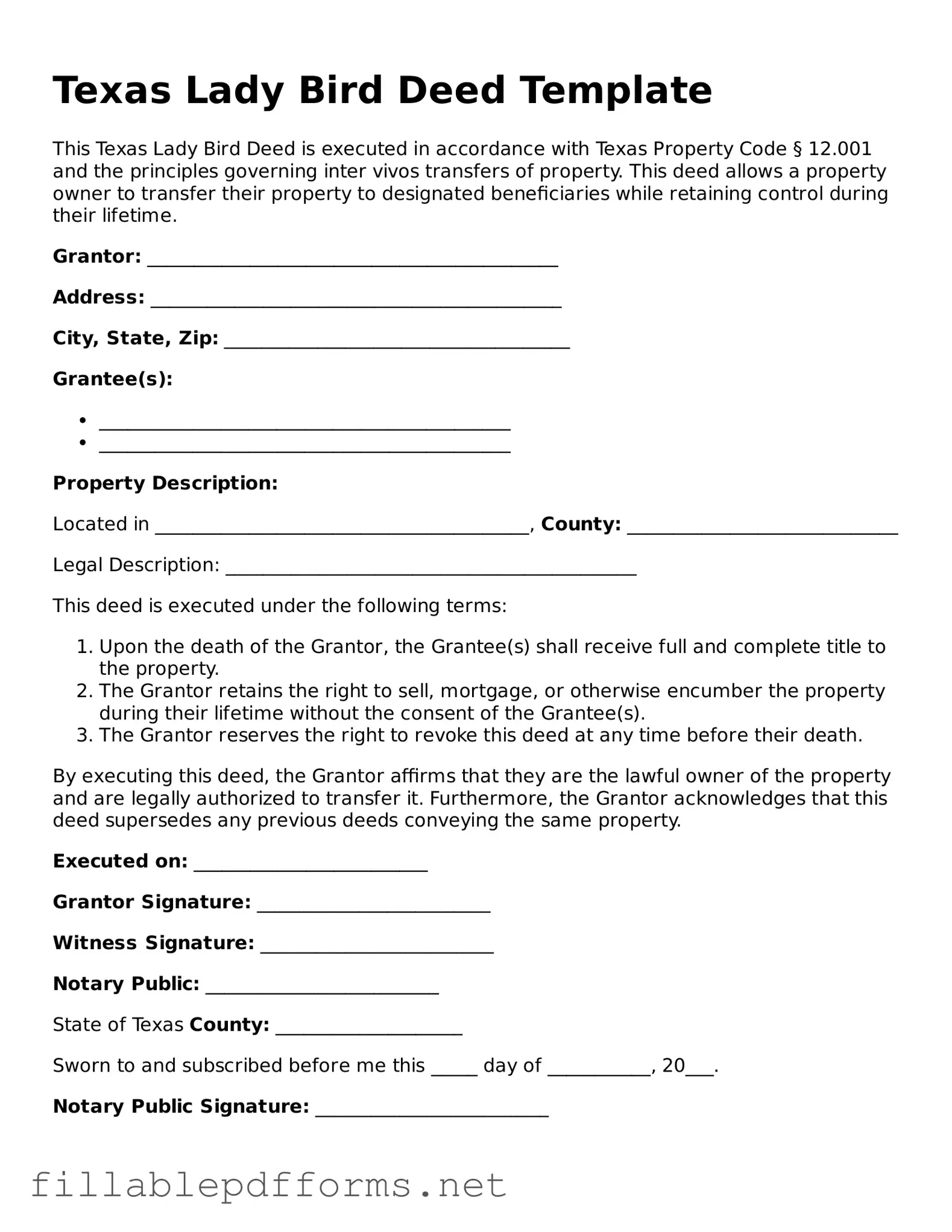

The Texas Lady Bird Deed form is a legal document that allows property owners to transfer their real estate to beneficiaries while retaining certain rights during their lifetime. This type of deed is designed to simplify the transfer process and avoid probate, providing a straightforward solution for property management. With this deed, individuals can maintain control over their property while ensuring a smooth transition to their heirs upon their passing.

Launch Editor Here

Attorney-Verified Lady Bird Deed Form for Texas State

Launch Editor Here

Launch Editor Here

or

▼ Lady Bird Deed PDF

Almost there — finish the form

Complete Lady Bird Deed online fast — no printing, no scanning.