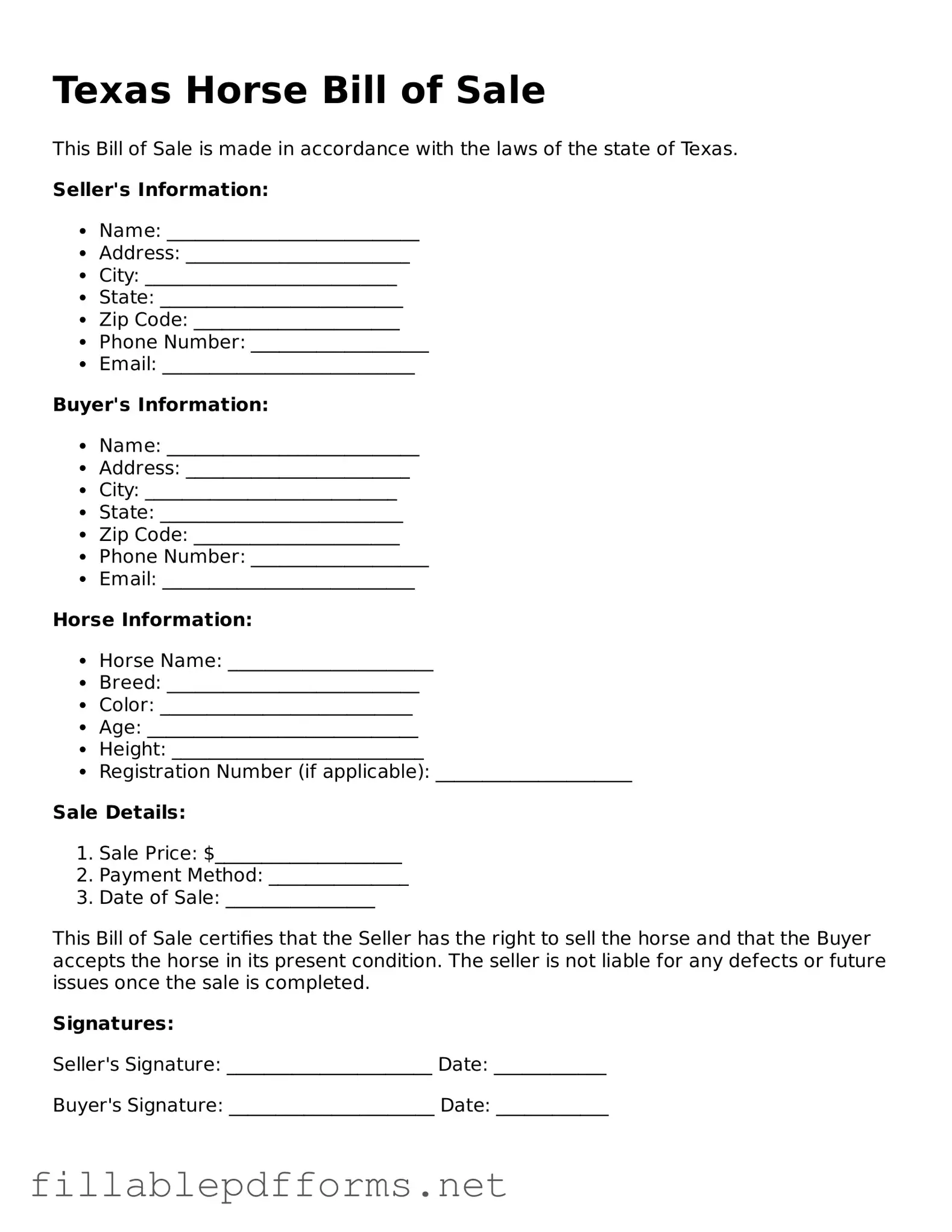

Attorney-Verified Horse Bill of Sale Form for Texas State

The Texas Horse Bill of Sale form is a legal document used to record the sale and transfer of ownership of a horse in Texas. This form protects both the buyer and seller by clearly outlining the terms of the sale. Understanding this document is essential for anyone involved in equine transactions in the state.

Launch Editor Here

Attorney-Verified Horse Bill of Sale Form for Texas State

Launch Editor Here

Launch Editor Here

or

▼ Horse Bill of Sale PDF

Almost there — finish the form

Complete Horse Bill of Sale online fast — no printing, no scanning.