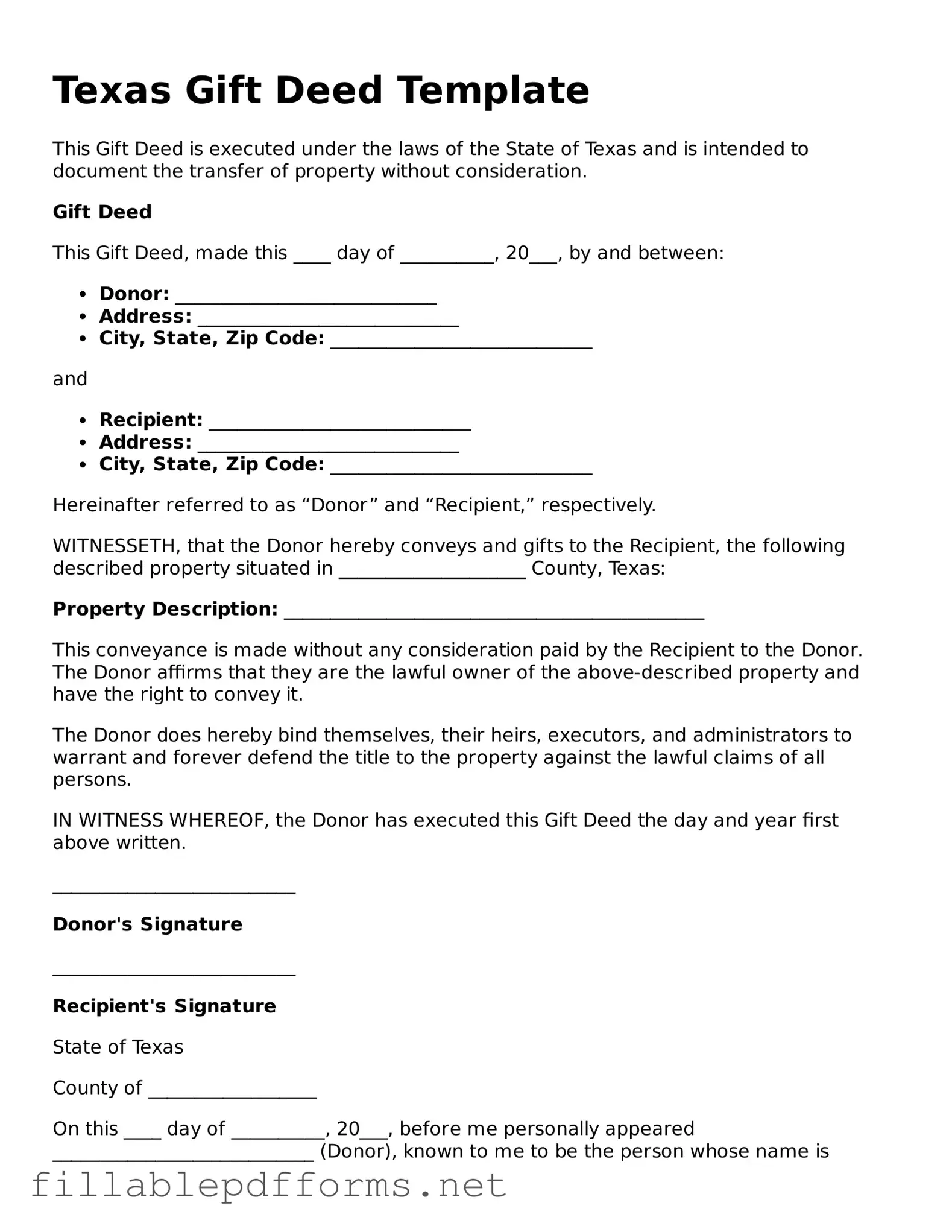

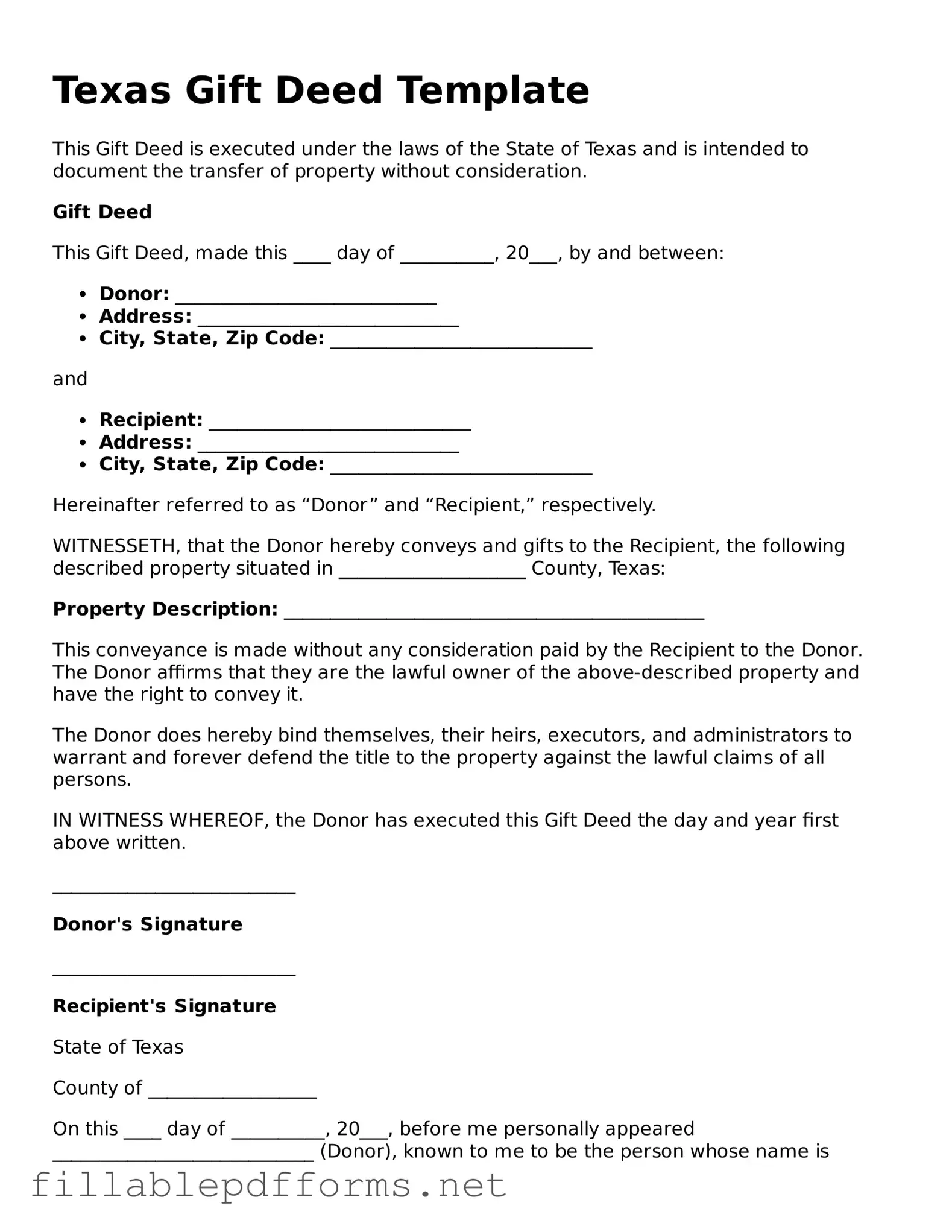

Attorney-Verified Gift Deed Form for Texas State

A Texas Gift Deed is a legal document used to transfer property ownership without any exchange of money. This form allows individuals to give real estate to someone else as a gift, simplifying the process of transferring property rights. Understanding how to properly complete and file this deed can help ensure a smooth transfer of ownership.

Launch Editor Here

Attorney-Verified Gift Deed Form for Texas State

Launch Editor Here

Launch Editor Here

or

▼ Gift Deed PDF

Almost there — finish the form

Complete Gift Deed online fast — no printing, no scanning.