Attorney-Verified Bill of Sale Form for Texas State

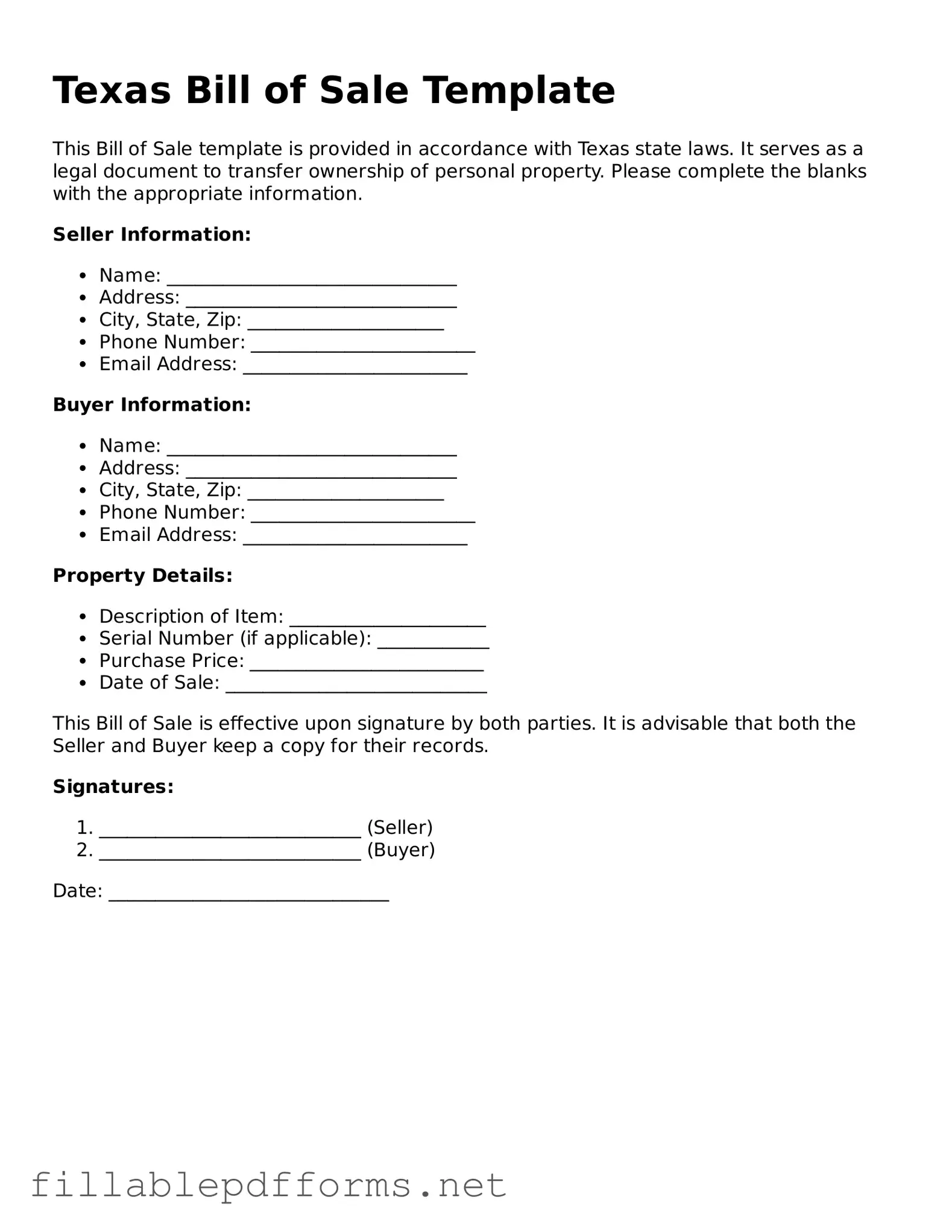

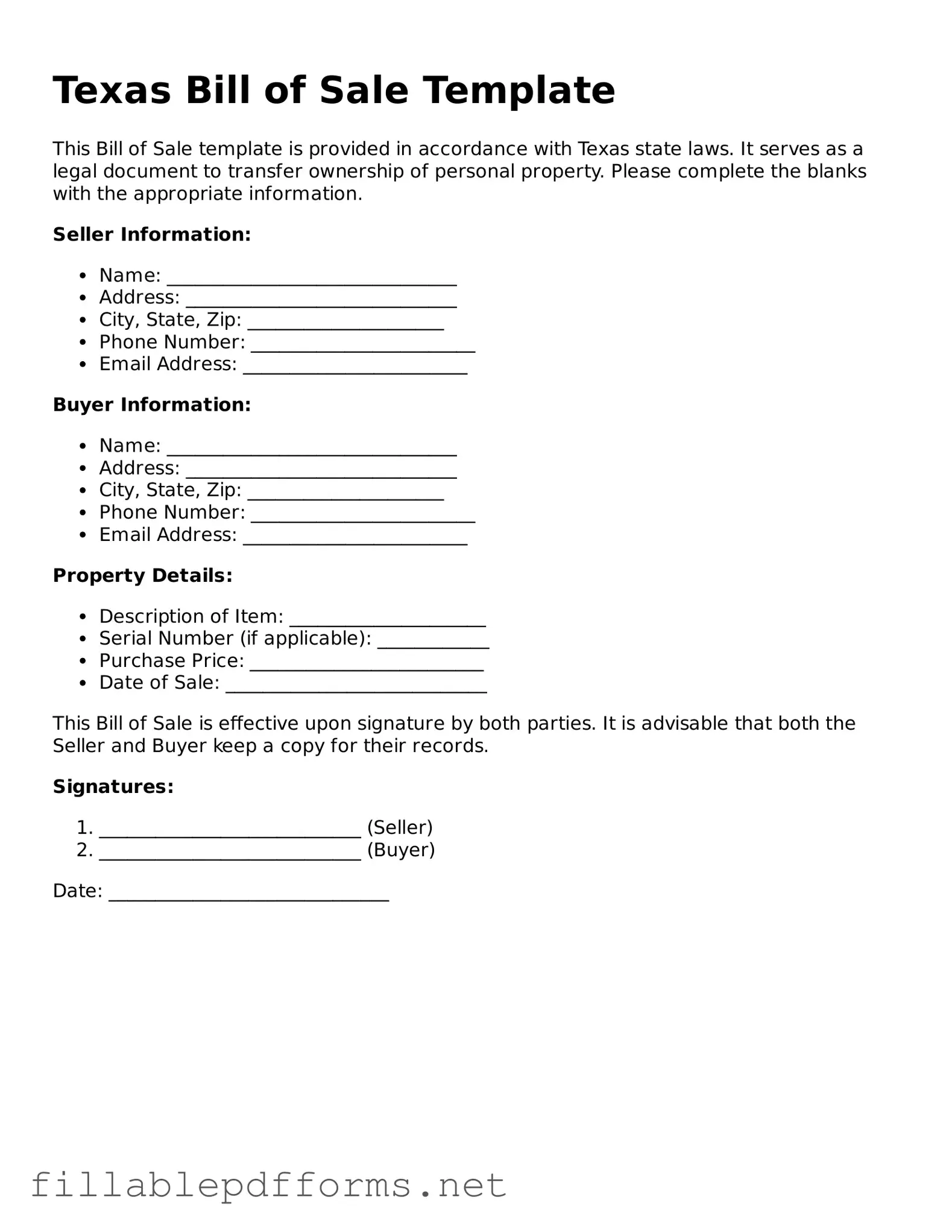

A Texas Bill of Sale form is a legal document that records the transfer of ownership of personal property from one party to another. This form serves as proof of the transaction and outlines important details such as the description of the item, the sale price, and the signatures of both the buyer and seller. Understanding how to properly complete and use this form is essential for anyone involved in buying or selling goods in Texas.

Launch Editor Here

Attorney-Verified Bill of Sale Form for Texas State

Launch Editor Here

Launch Editor Here

or

▼ Bill of Sale PDF

Almost there — finish the form

Complete Bill of Sale online fast — no printing, no scanning.