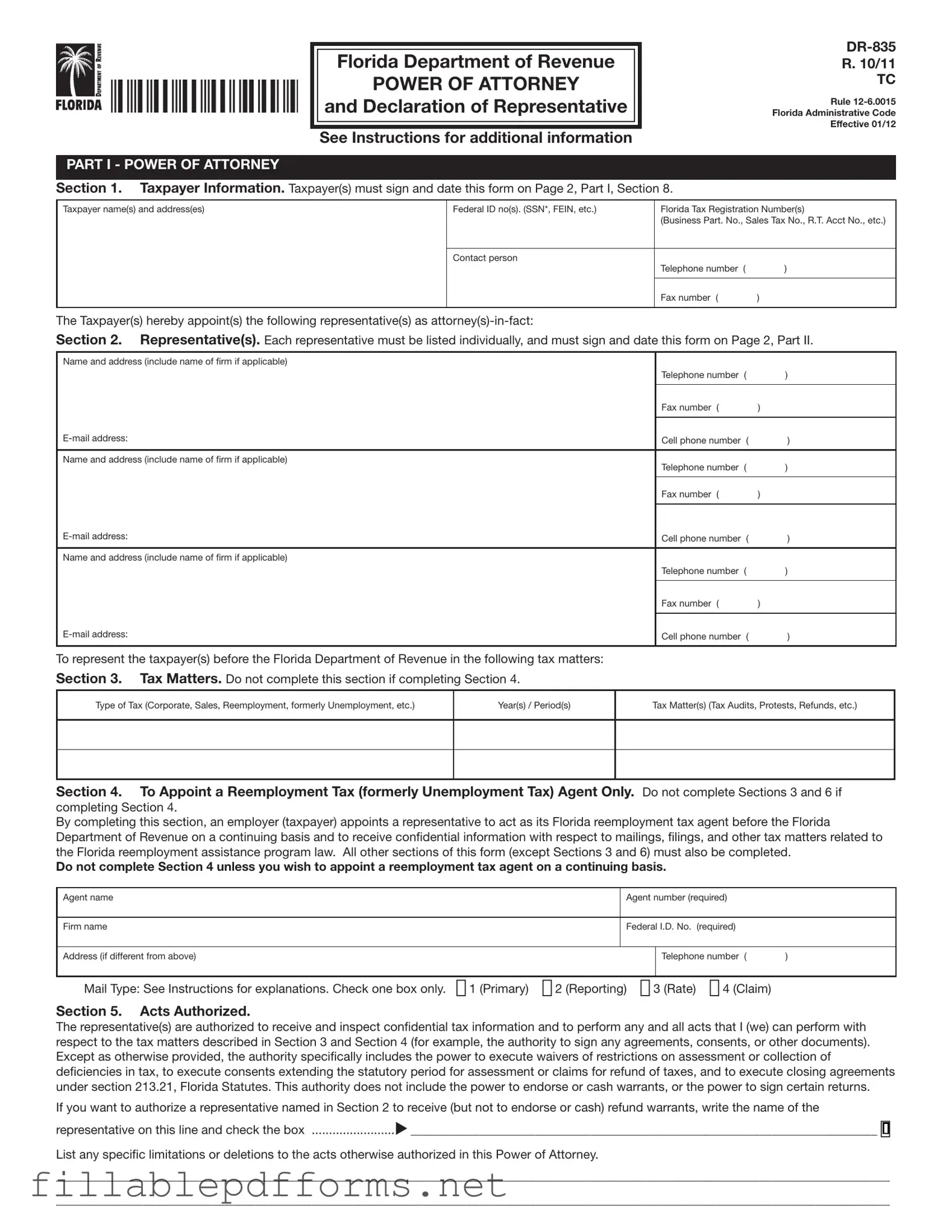

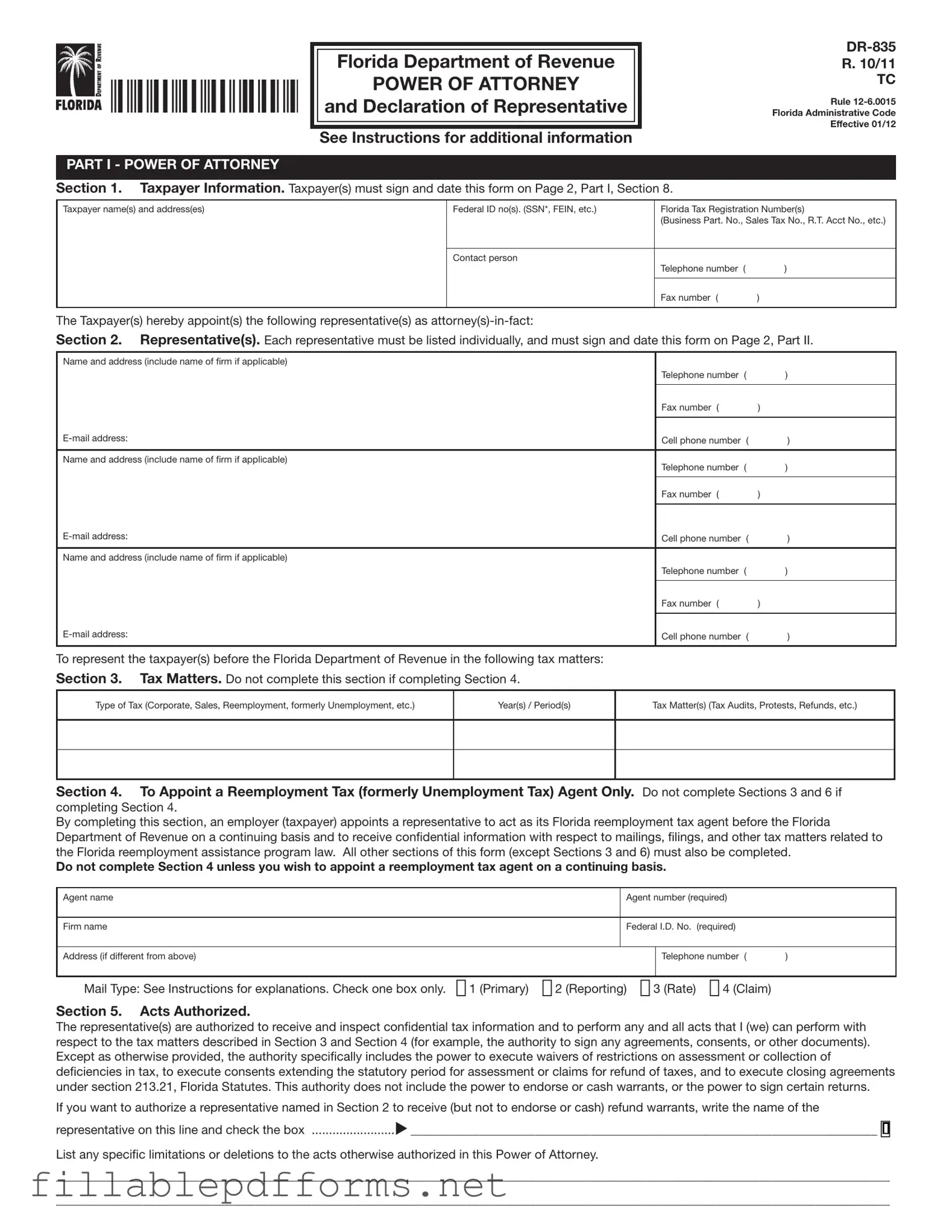

Tax POA dr 835 PDF Template

The Tax POA DR 835 form is a document used by taxpayers to authorize another individual to represent them before the Department of Revenue. This form facilitates communication between the taxpayer and the tax authority, ensuring that the appointed representative can act on behalf of the taxpayer in tax-related matters. Understanding the significance of this form is crucial for anyone seeking assistance with their tax obligations.

Launch Editor Here

Tax POA dr 835 PDF Template

Launch Editor Here

Launch Editor Here

or

▼ Tax POA dr 835 PDF

Almost there — finish the form

Complete Tax POA dr 835 online fast — no printing, no scanning.