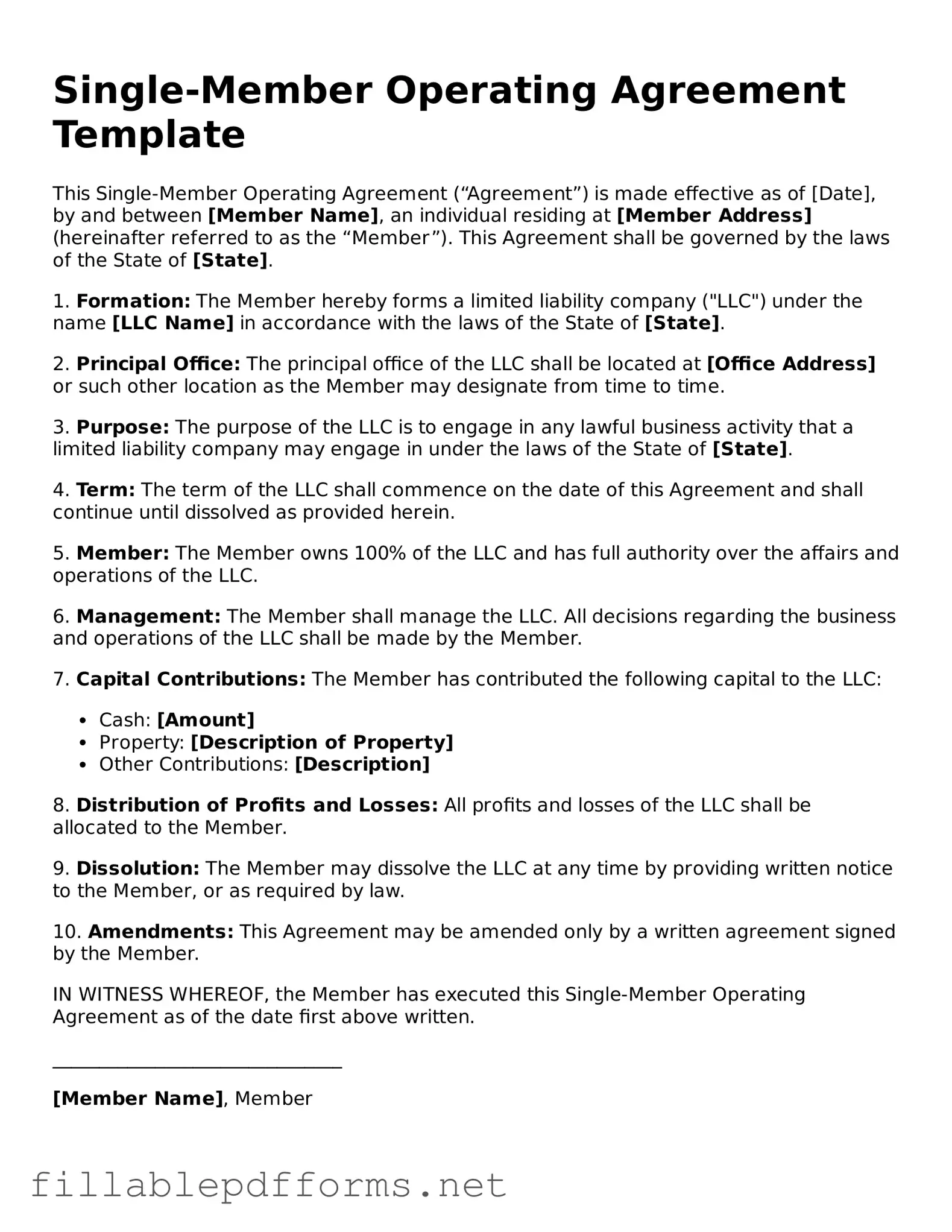

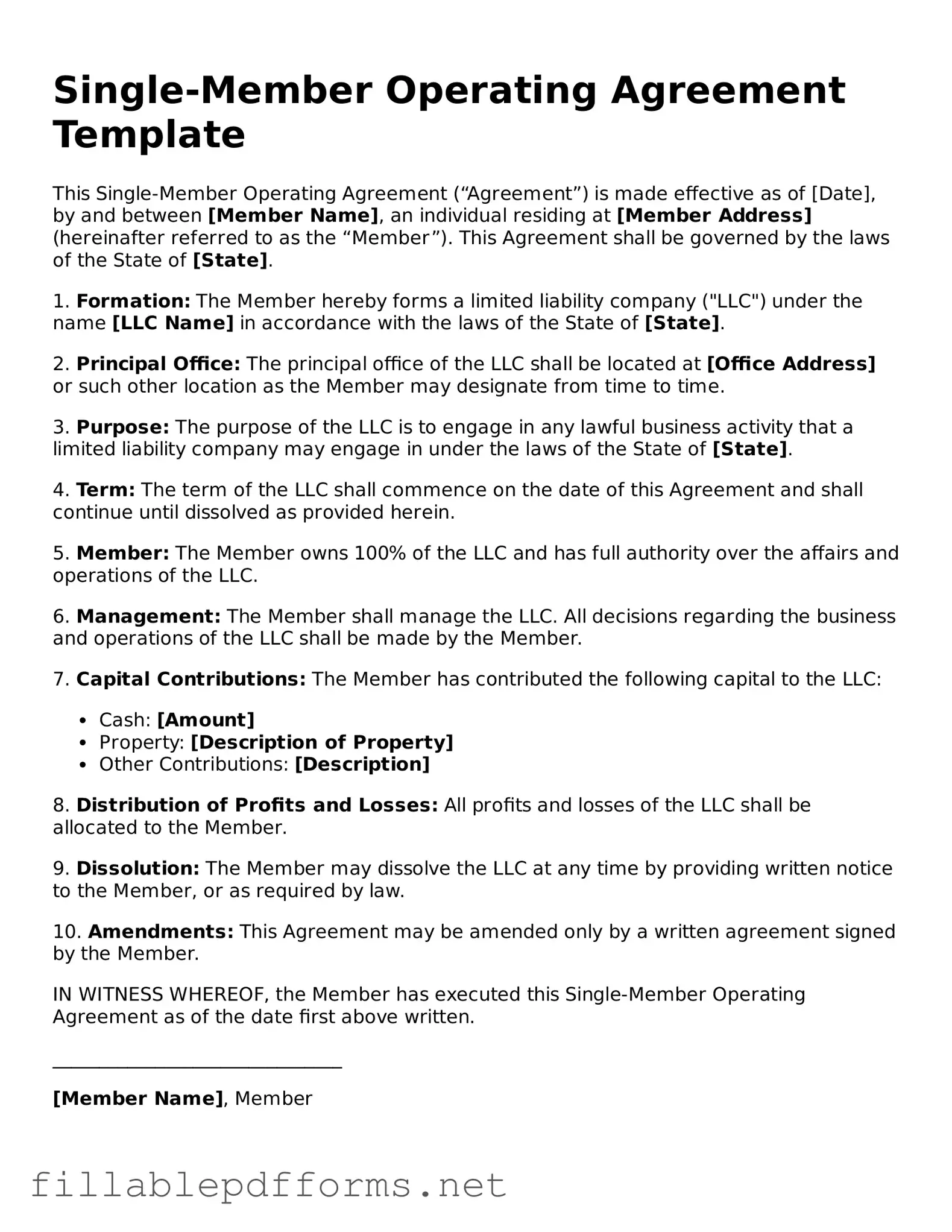

Blank Single-Member Operating Agreement Template

A Single-Member Operating Agreement is a legal document that outlines the management structure and operational guidelines for a single-member limited liability company (LLC). This agreement serves as a crucial tool for establishing the rights and responsibilities of the owner, ensuring clarity in business operations. Understanding this form is essential for anyone looking to protect their personal assets while managing their LLC effectively.

Launch Editor Here

Blank Single-Member Operating Agreement Template

Launch Editor Here

Launch Editor Here

or

▼ Single-Member Operating Agreement PDF

Almost there — finish the form

Complete Single-Member Operating Agreement online fast — no printing, no scanning.