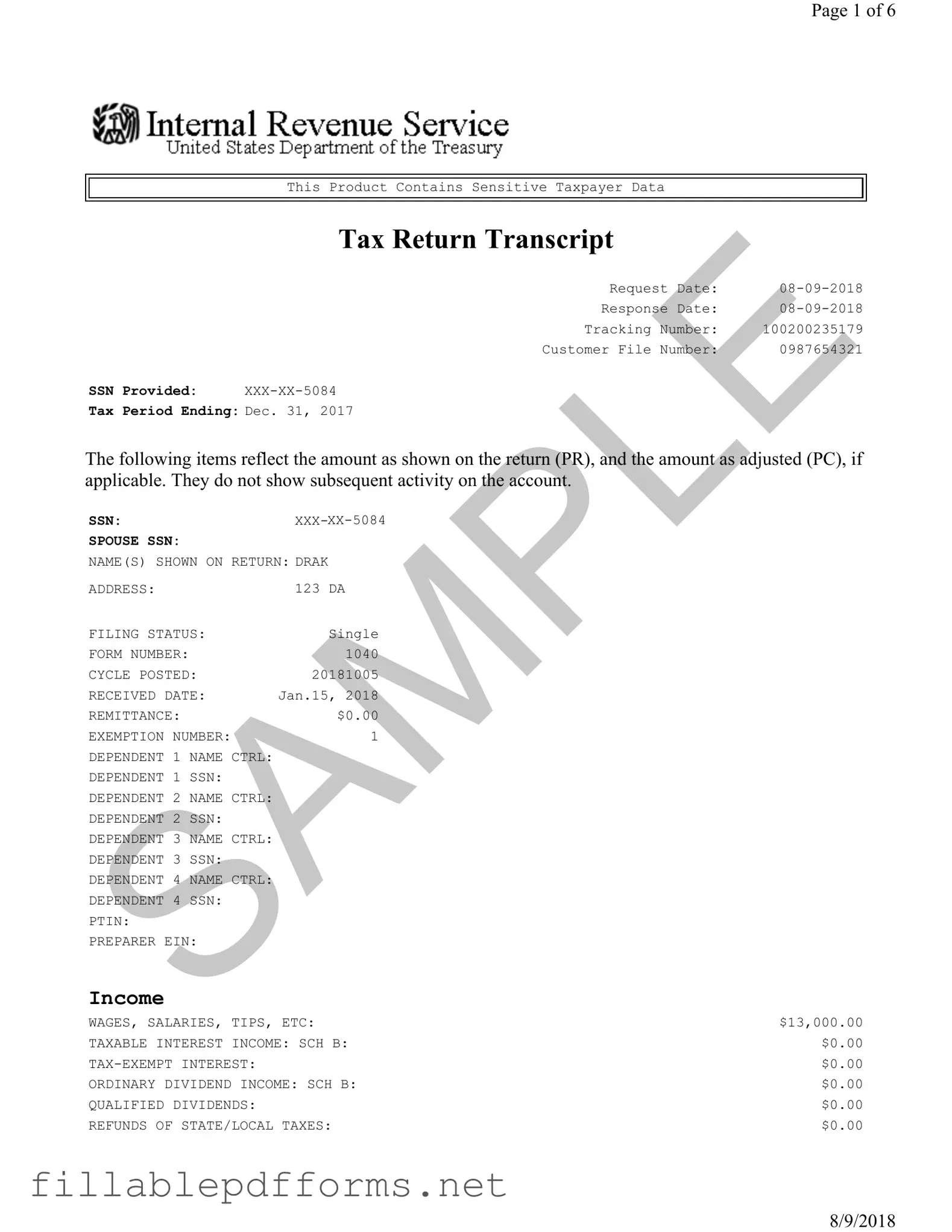

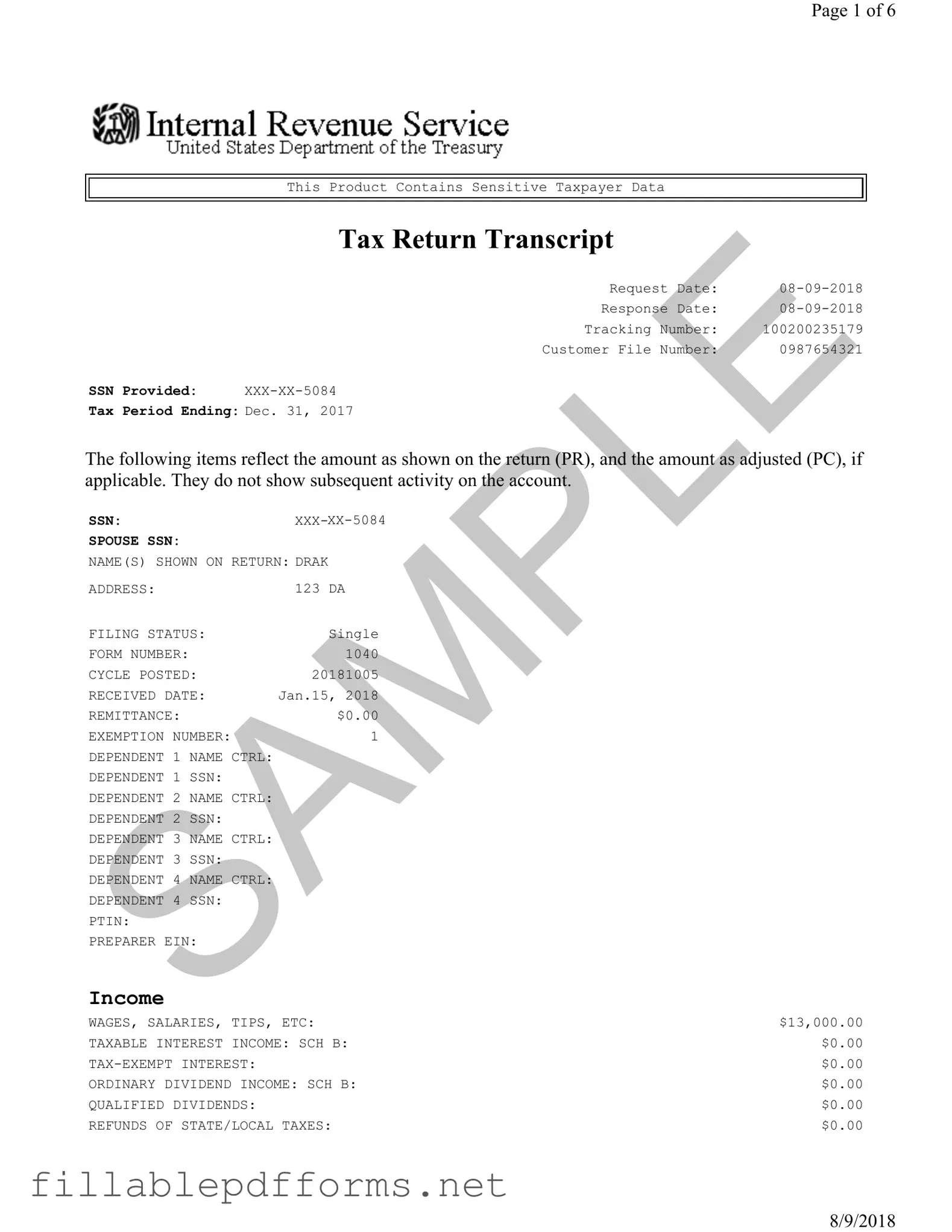

Sample Tax Return Transcript PDF Template

A Sample Tax Return Transcript is a document provided by the IRS that summarizes a taxpayer's tax return information. This transcript includes details such as income, deductions, and tax liabilities for a specific tax period. It serves as an important tool for individuals who need to verify their tax information for various purposes, such as applying for loans or financial aid.

Launch Editor Here

Sample Tax Return Transcript PDF Template

Launch Editor Here

Launch Editor Here

or

▼ Sample Tax Return Transcript PDF

Almost there — finish the form

Complete Sample Tax Return Transcript online fast — no printing, no scanning.