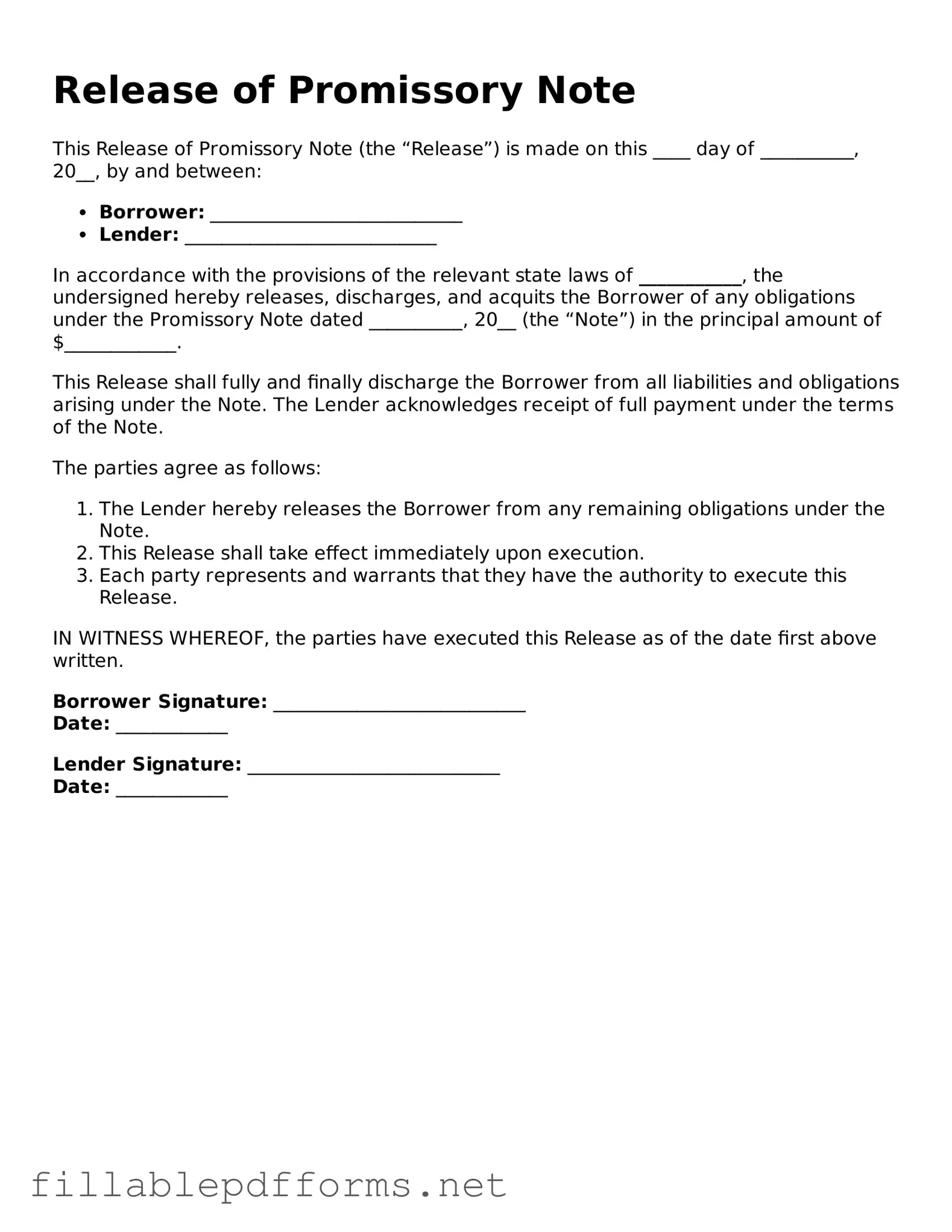

Blank Release of Promissory Note Template

A Release of Promissory Note form is a legal document that signifies the cancellation of a promissory note, indicating that the borrower has fulfilled their obligation to repay the loan. This form serves as proof that the lender relinquishes any claim to the debt. Understanding its purpose and proper usage is essential for both borrowers and lenders to ensure a clear and documented release of financial obligations.

Launch Editor Here

Blank Release of Promissory Note Template

Launch Editor Here

Launch Editor Here

or

▼ Release of Promissory Note PDF

Almost there — finish the form

Complete Release of Promissory Note online fast — no printing, no scanning.