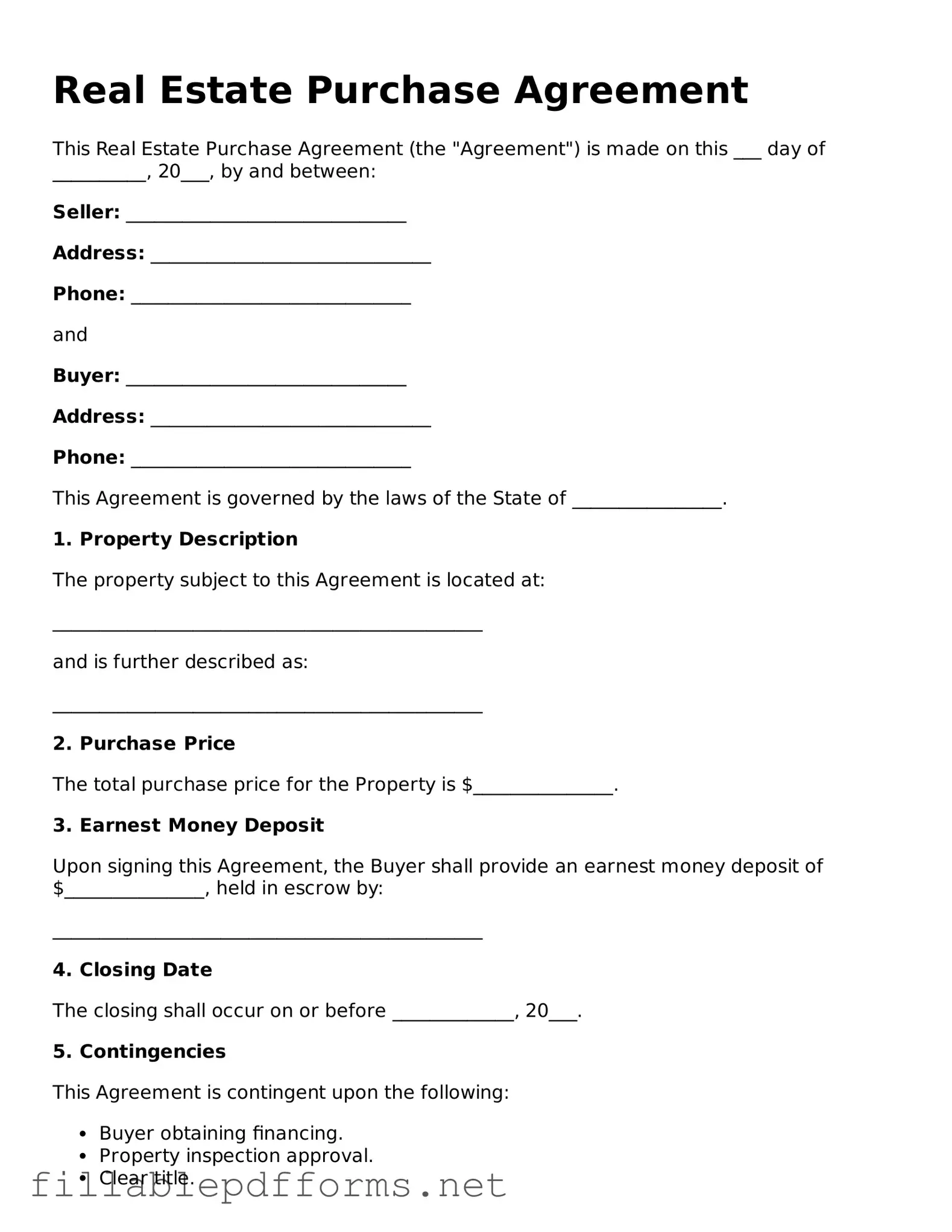

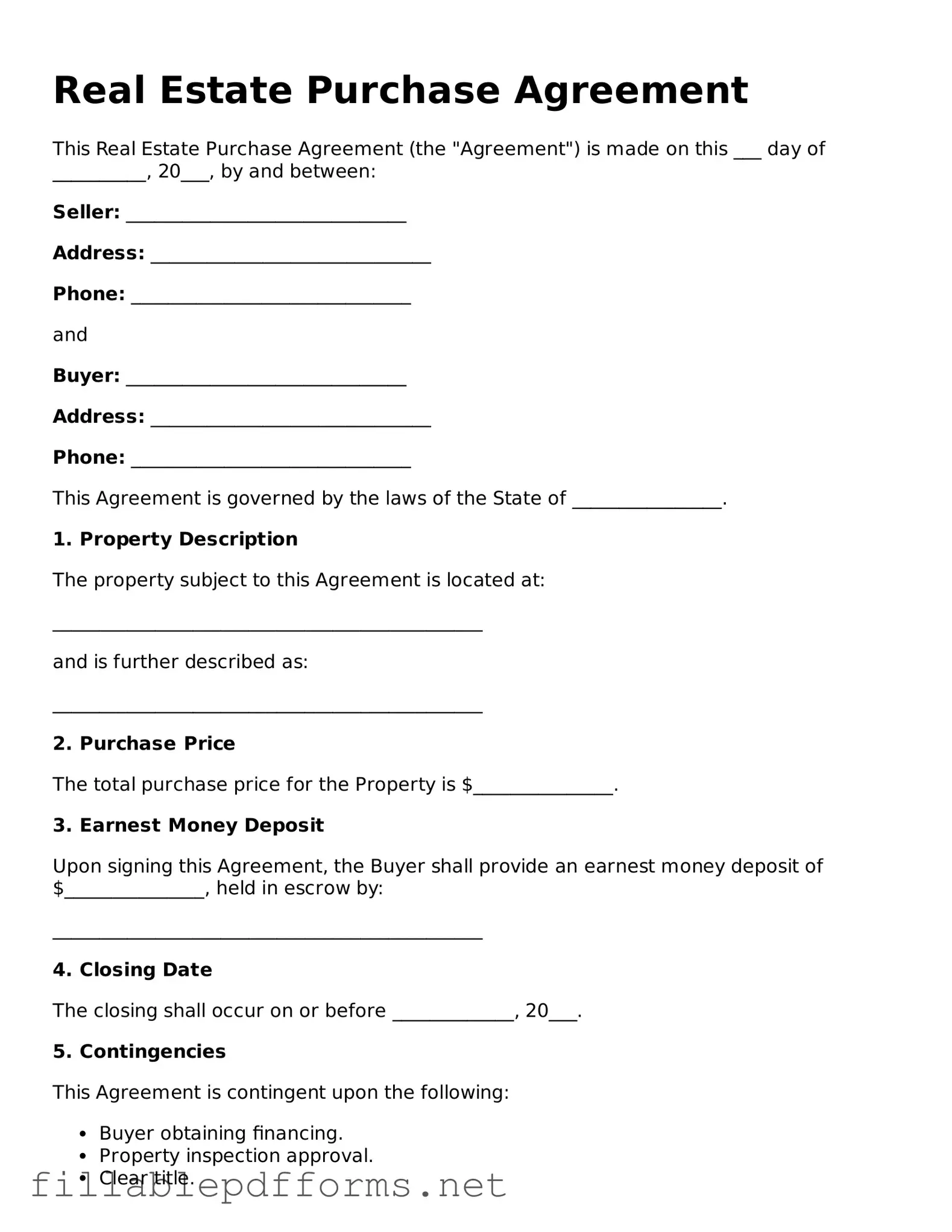

Blank Real Estate Purchase Agreement Template

A Real Estate Purchase Agreement is a legally binding document that outlines the terms and conditions of a real estate transaction between a buyer and a seller. This form serves as a roadmap for the sale, detailing the price, property description, and any contingencies that must be met. Understanding this agreement is crucial for both parties to ensure a smooth transfer of property ownership.

Launch Editor Here

Blank Real Estate Purchase Agreement Template

Launch Editor Here

Launch Editor Here

or

▼ Real Estate Purchase Agreement PDF

Almost there — finish the form

Complete Real Estate Purchase Agreement online fast — no printing, no scanning.