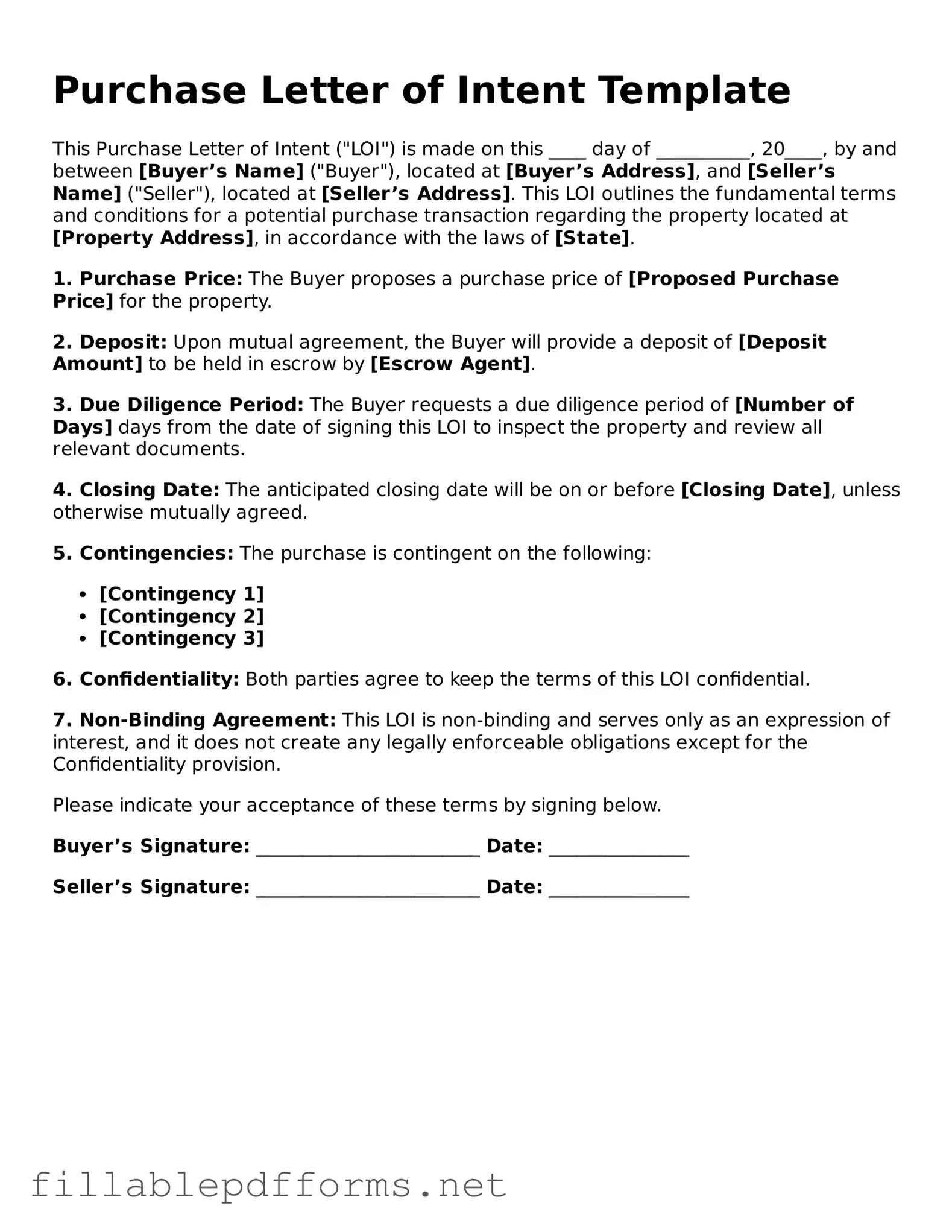

Blank Purchase Letter of Intent Template

A Purchase Letter of Intent (LOI) is a document that outlines the preliminary agreement between a buyer and a seller regarding the purchase of a property or business. This form serves as a starting point for negotiations and sets the stage for a more detailed purchase agreement. By clearly stating the intentions of both parties, the LOI helps to ensure a smoother transaction process.

Launch Editor Here

Blank Purchase Letter of Intent Template

Launch Editor Here

Launch Editor Here

or

▼ Purchase Letter of Intent PDF

Almost there — finish the form

Complete Purchase Letter of Intent online fast — no printing, no scanning.