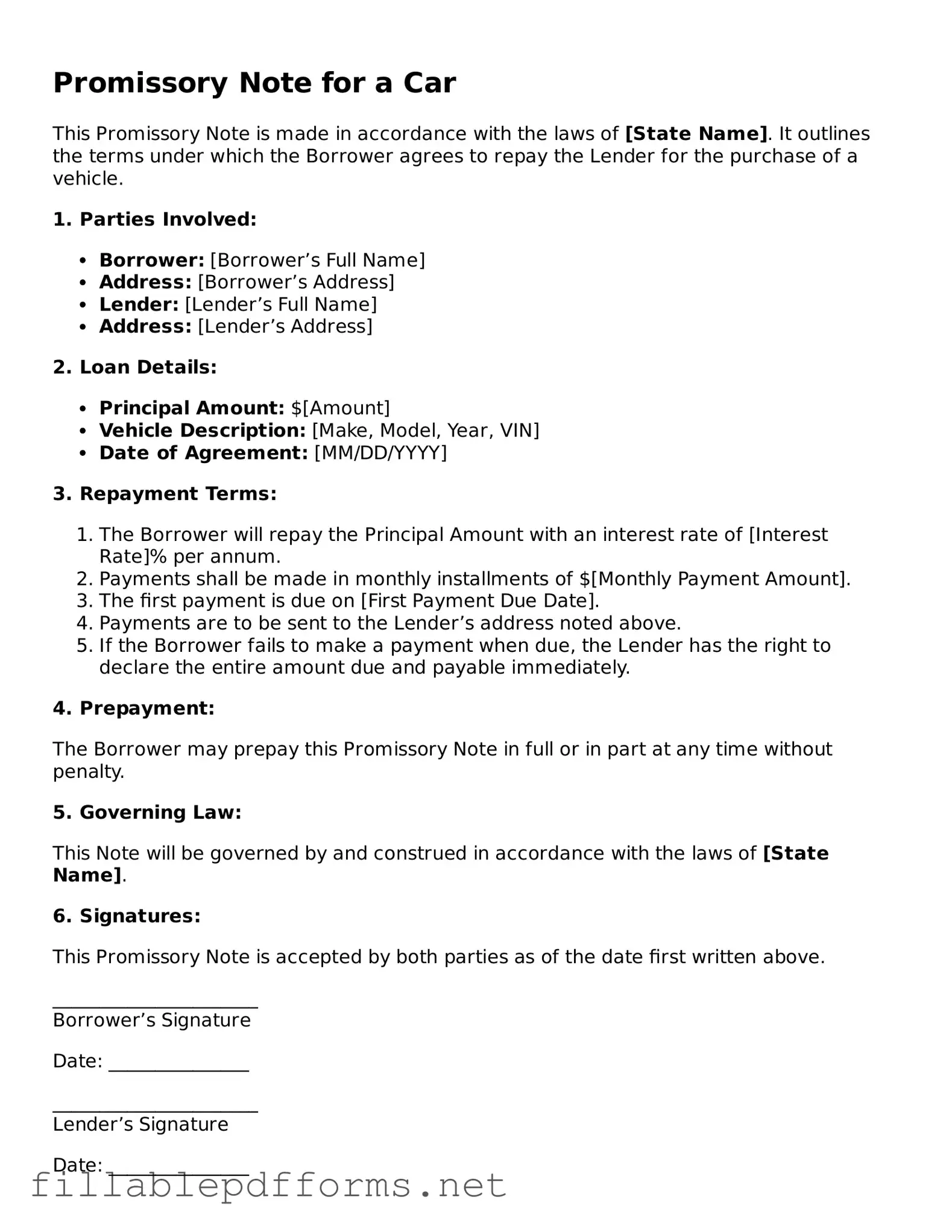

Blank Promissory Note for a Car Template

A Promissory Note for a Car is a legal document in which one party agrees to pay a specified amount of money to another party in exchange for a vehicle. This note outlines the terms of the loan, including the payment schedule and interest rate. Understanding this form is crucial for both buyers and sellers to ensure a smooth transaction.

Launch Editor Here

Blank Promissory Note for a Car Template

Launch Editor Here

Launch Editor Here

or

▼ Promissory Note for a Car PDF

Almost there — finish the form

Complete Promissory Note for a Car online fast — no printing, no scanning.