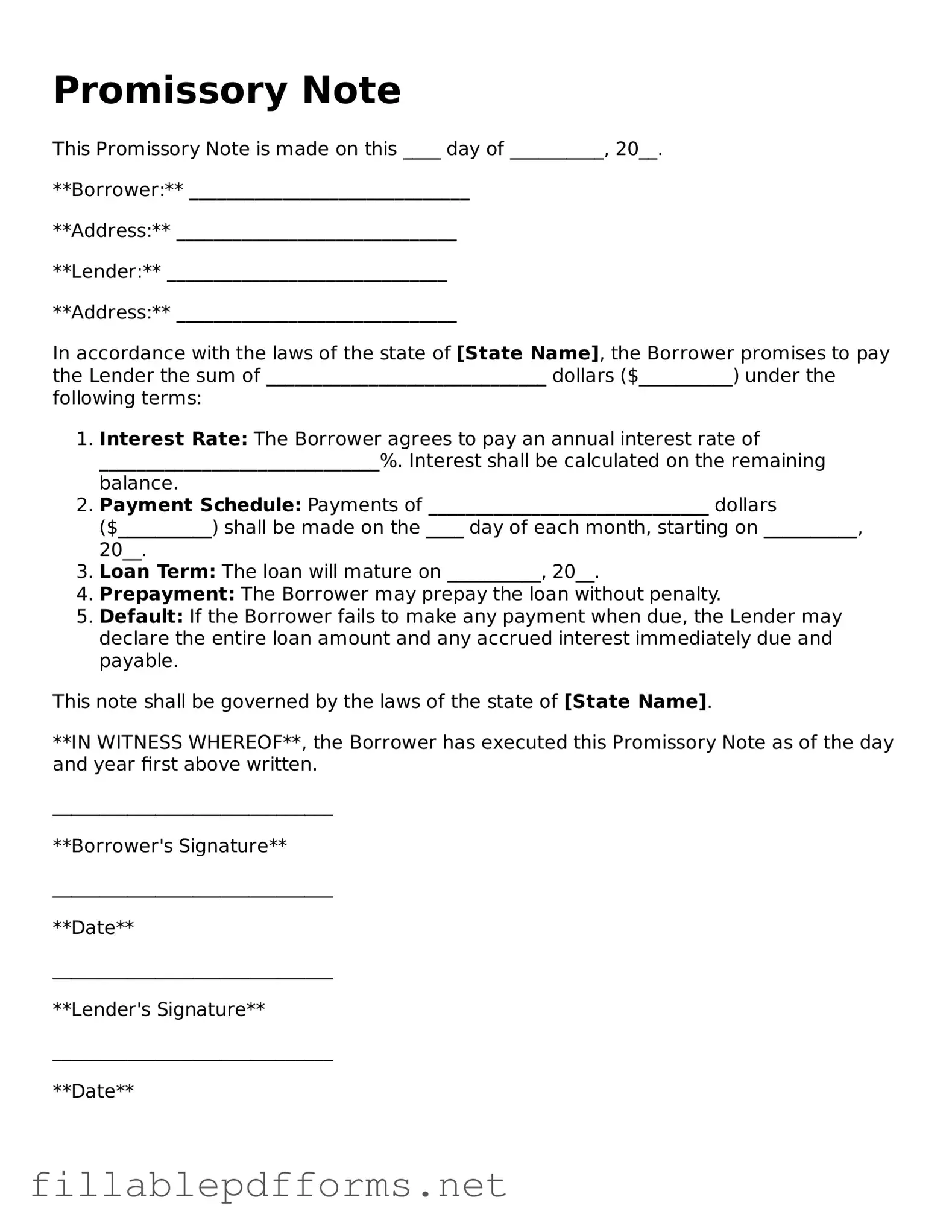

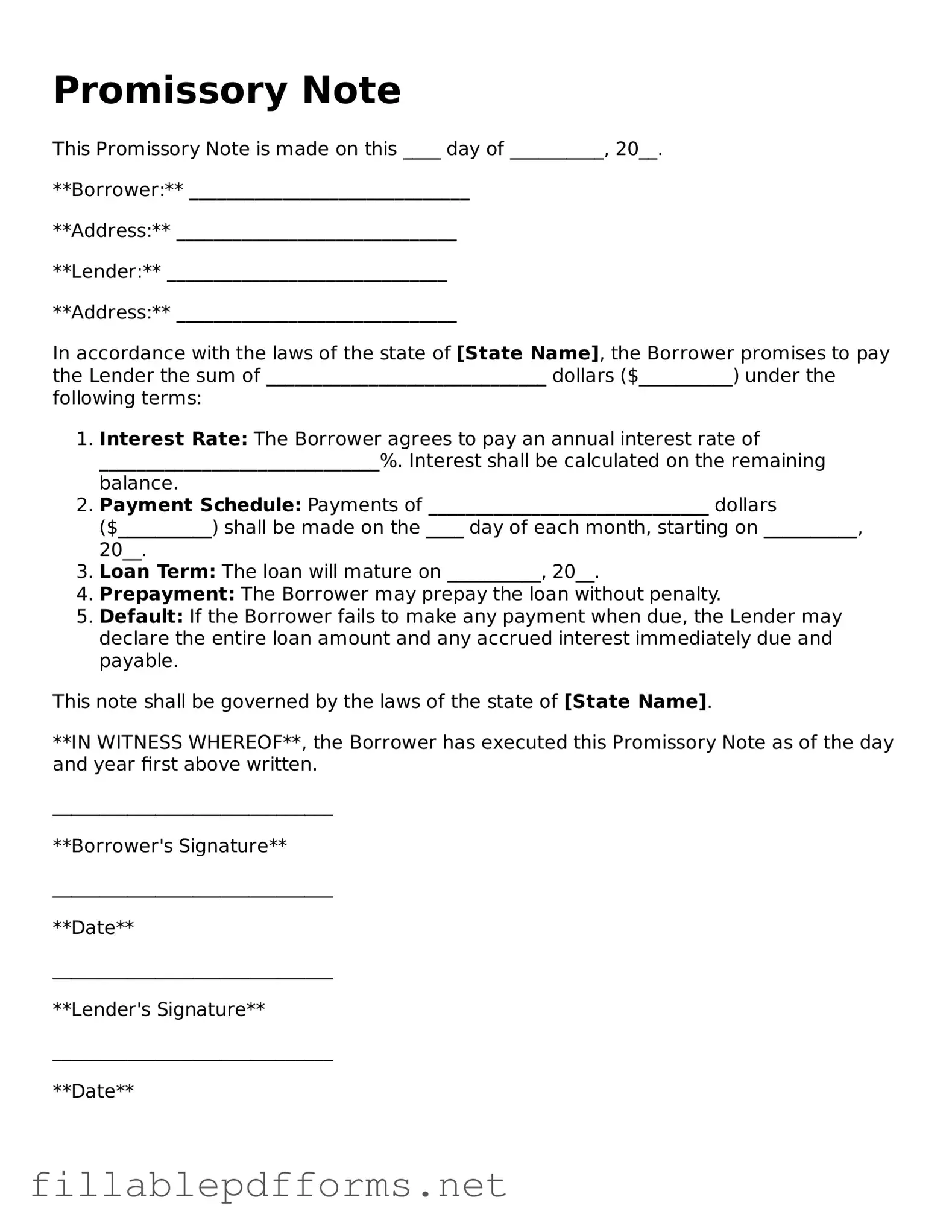

Blank Promissory Note Template

A Promissory Note is a written promise to pay a specified amount of money to a designated party at a determined time or on demand. This financial instrument serves as a crucial tool in personal and business transactions, ensuring that obligations are clear and enforceable. Understanding the components and implications of a promissory note can empower individuals and businesses to manage their financial commitments effectively.

Launch Editor Here

Blank Promissory Note Template

Launch Editor Here

Launch Editor Here

or

▼ Promissory Note PDF

Almost there — finish the form

Complete Promissory Note online fast — no printing, no scanning.