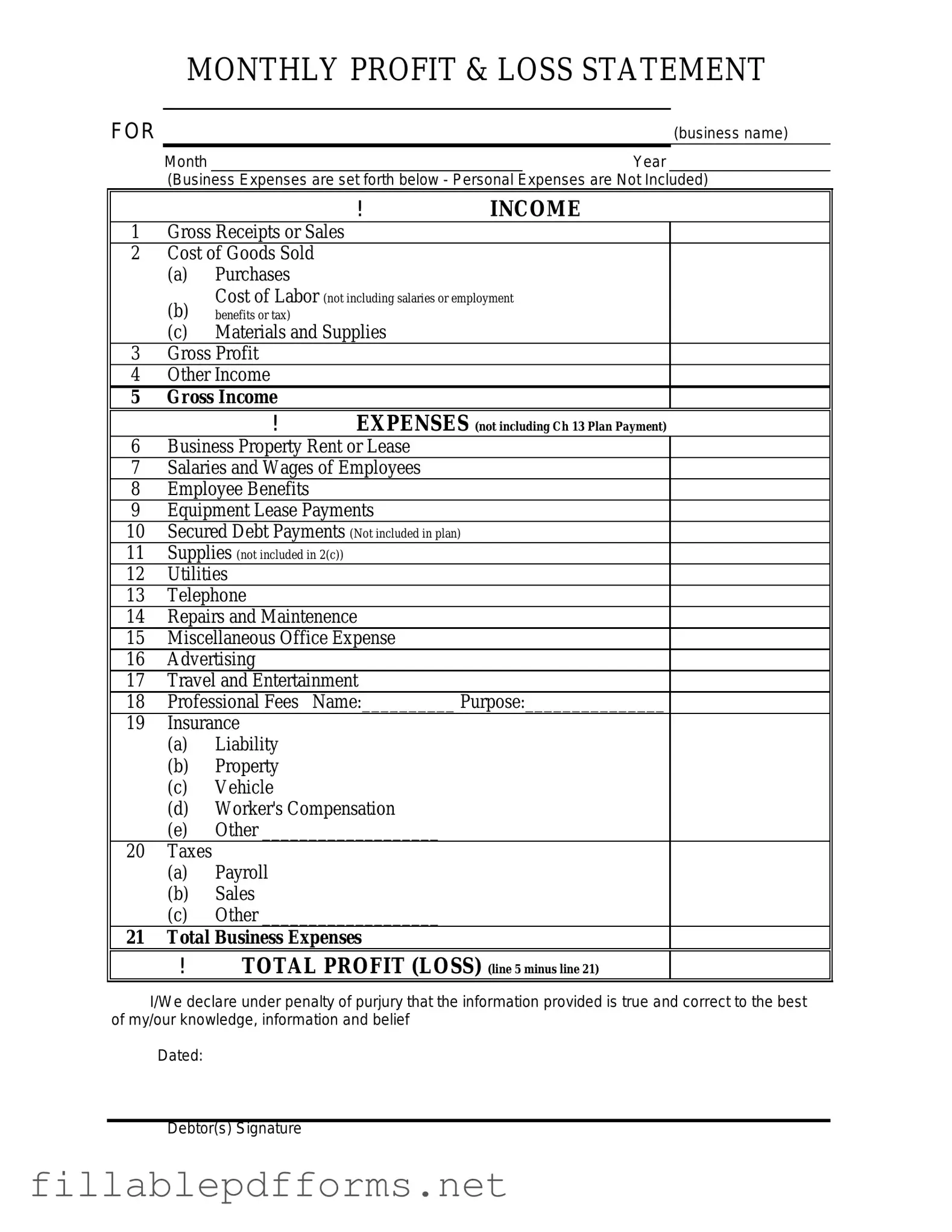

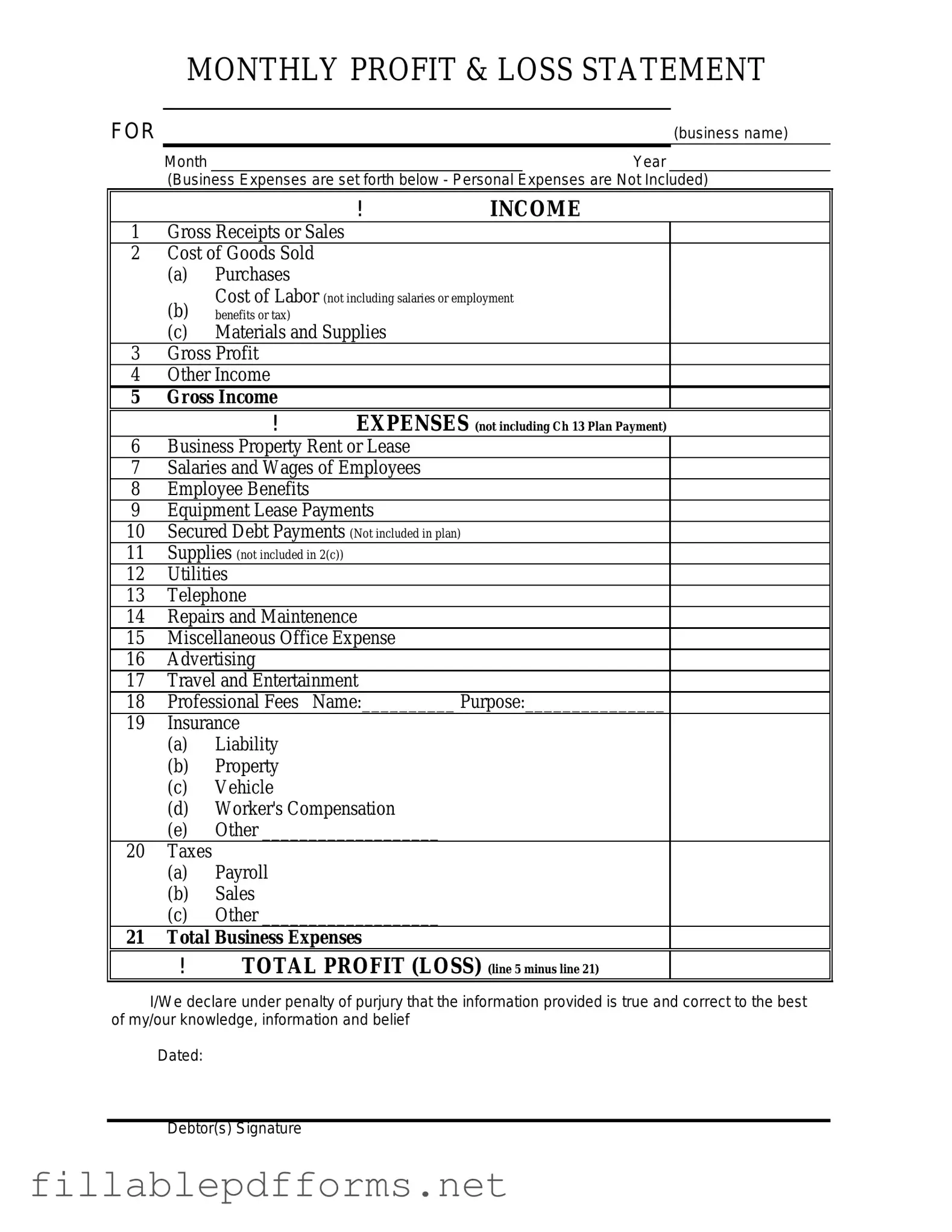

Profit And Loss PDF Template

The Profit and Loss form, often referred to as an income statement, is a financial document that summarizes revenues, costs, and expenses incurred during a specific period. This essential tool provides businesses with a clear view of their financial performance, helping them understand profitability and make informed decisions. By analyzing this form, stakeholders can assess operational efficiency and identify areas for improvement.

Launch Editor Here

Profit And Loss PDF Template

Launch Editor Here

Launch Editor Here

or

▼ Profit And Loss PDF

Almost there — finish the form

Complete Profit And Loss online fast — no printing, no scanning.