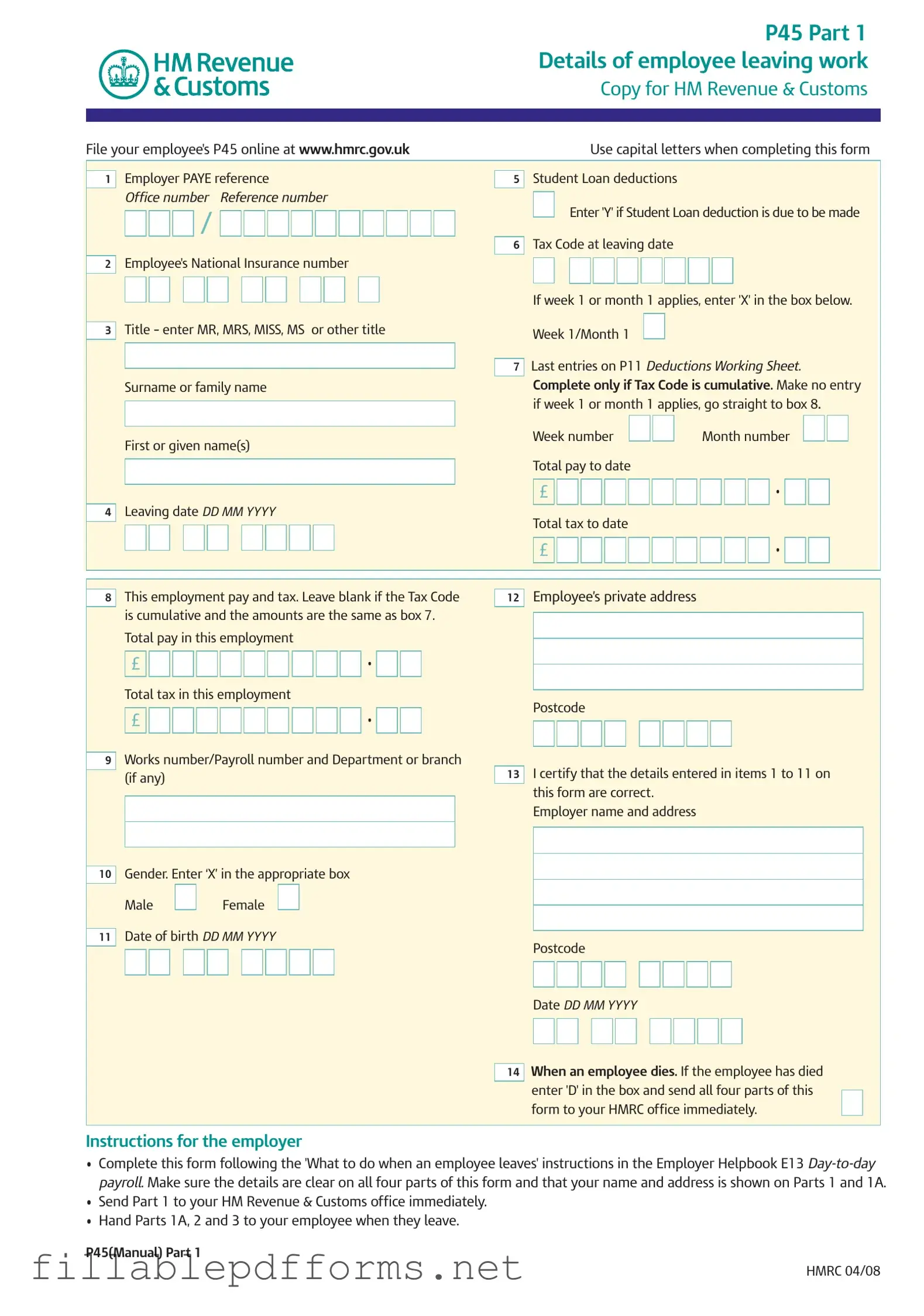

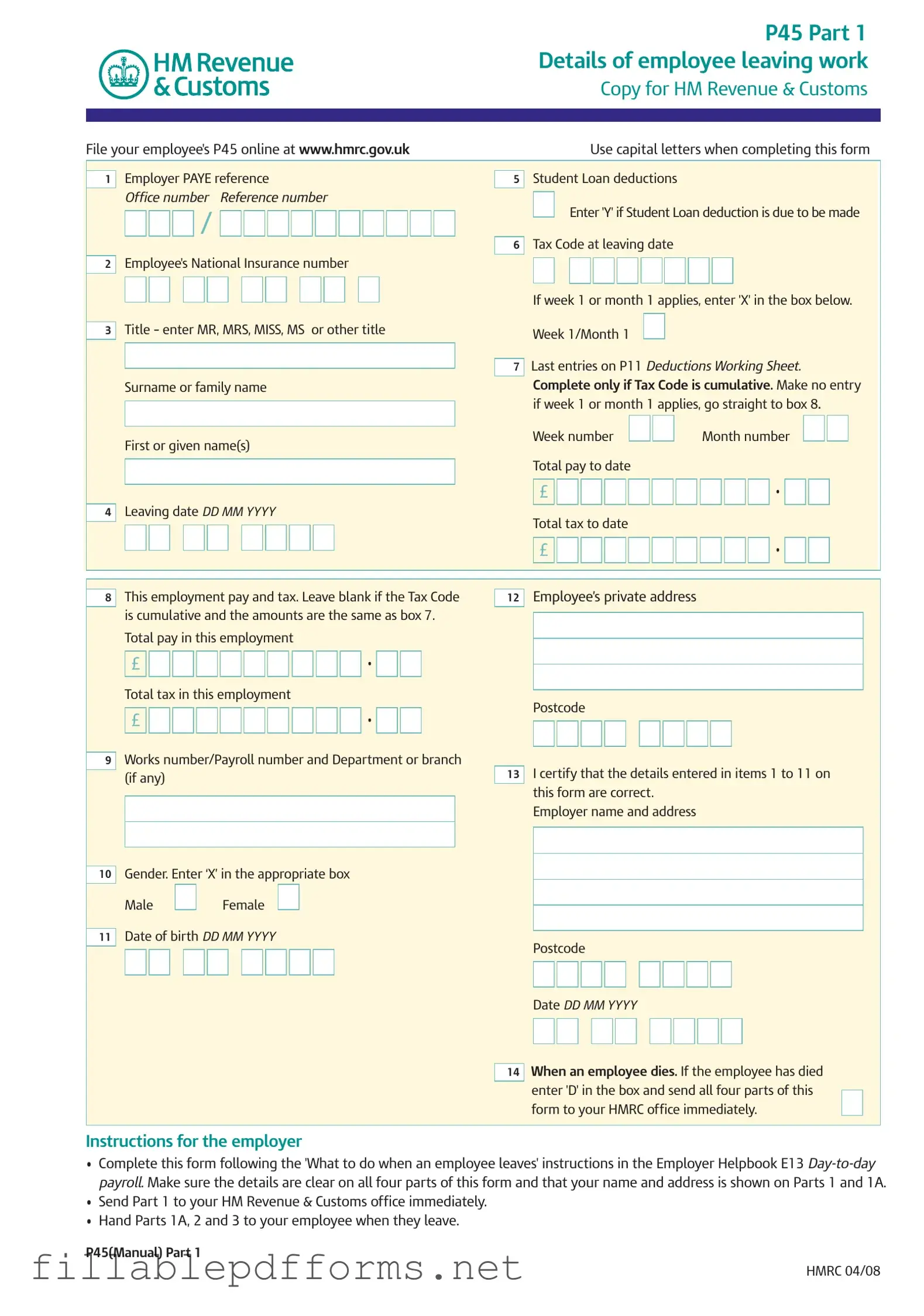

P 45 It PDF Template

The P45 It form is a document used in the United Kingdom to provide details about an employee who is leaving their job. This form is essential for both the employer and the employee, as it outlines the employee's tax information and earnings up to the date of departure. It consists of multiple parts, each serving different purposes for the employee and their new employer.

Launch Editor Here

P 45 It PDF Template

Launch Editor Here

Launch Editor Here

or

▼ P 45 It PDF

Almost there — finish the form

Complete P 45 It online fast — no printing, no scanning.