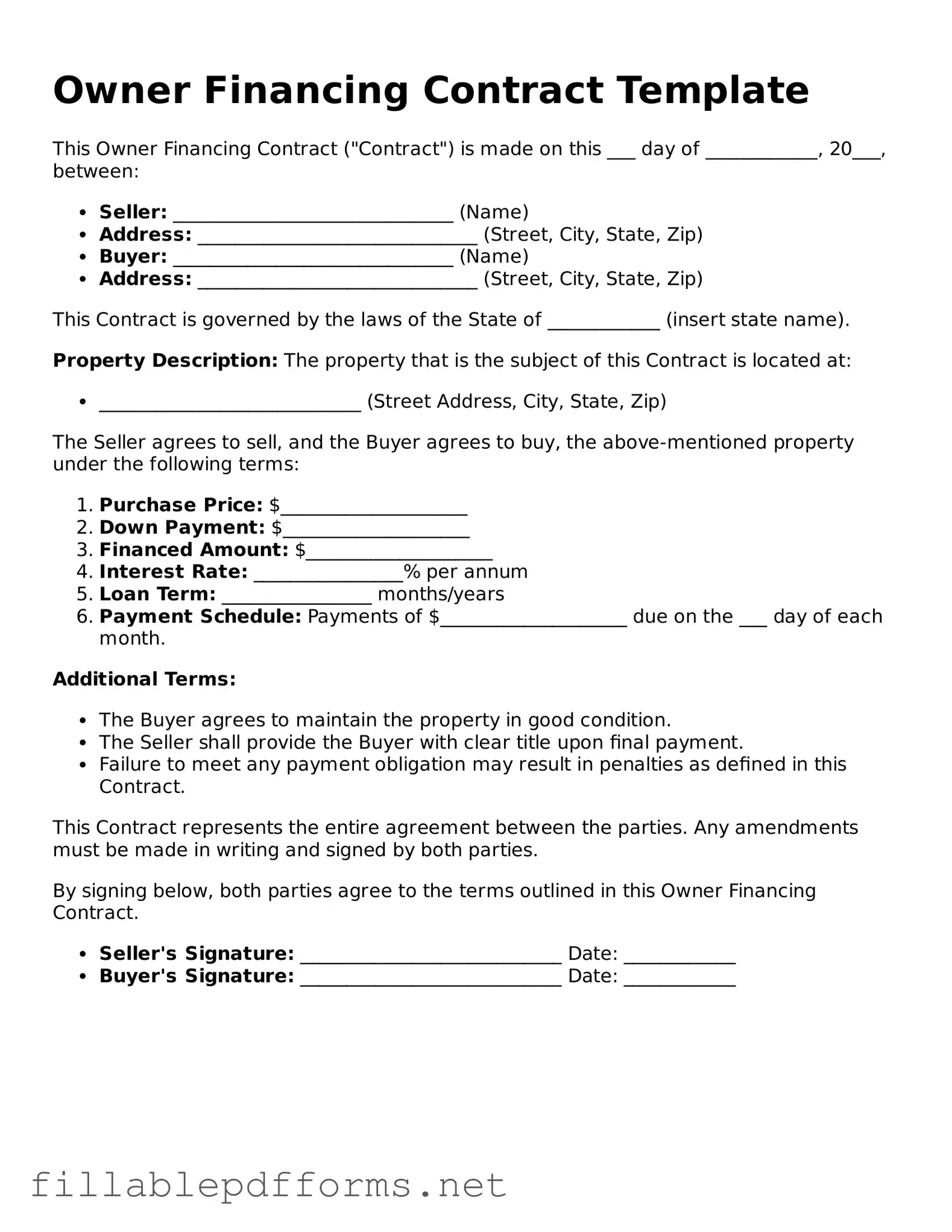

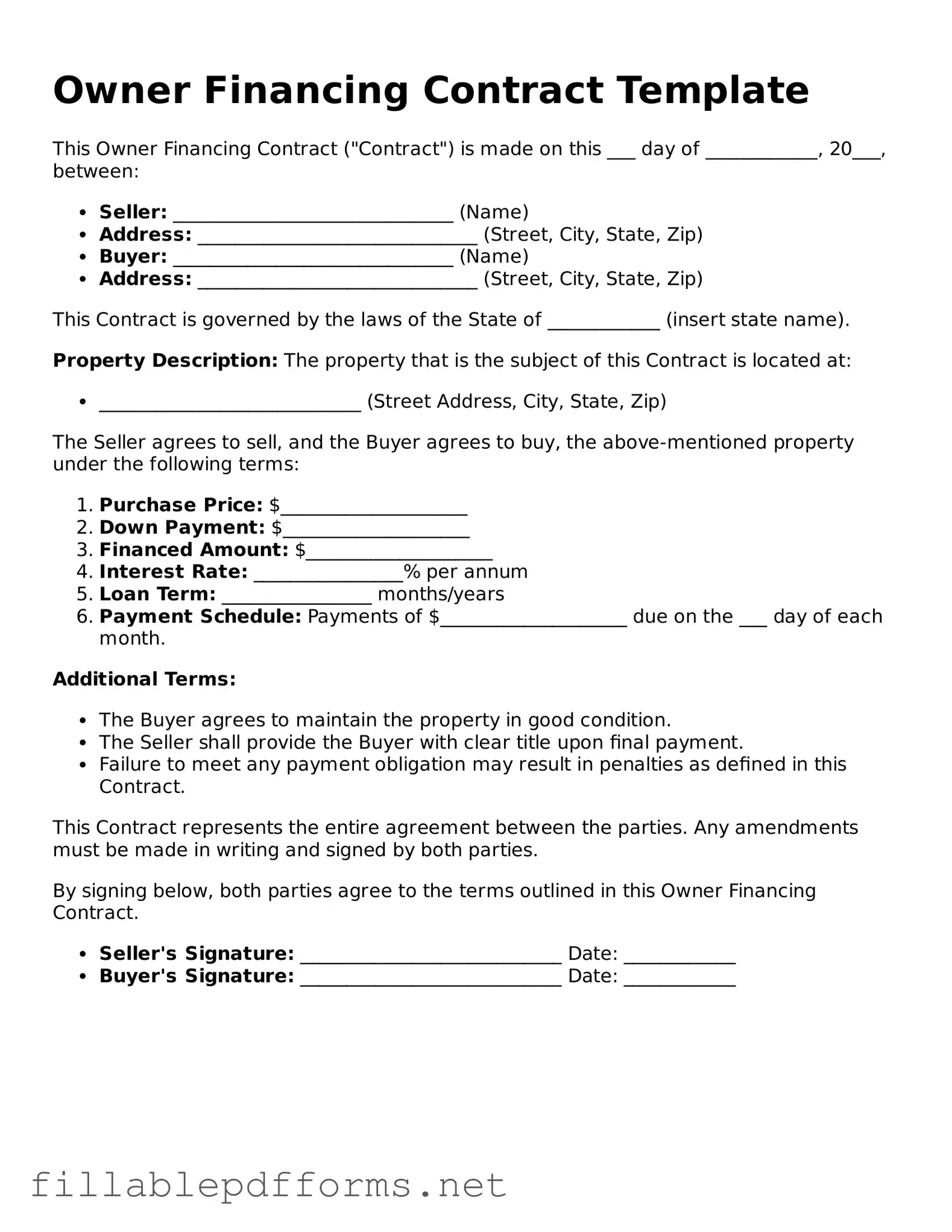

Blank Owner Financing Contract Template

An Owner Financing Contract is a legal document that outlines the terms under which a property seller provides financing to the buyer, allowing them to purchase the property without traditional bank financing. This type of agreement can benefit both parties by facilitating the sale and providing flexible payment options. Understanding the key components of this contract is essential for ensuring a smooth transaction.

Launch Editor Here

Blank Owner Financing Contract Template

Launch Editor Here

Launch Editor Here

or

▼ Owner Financing Contract PDF

Almost there — finish the form

Complete Owner Financing Contract online fast — no printing, no scanning.