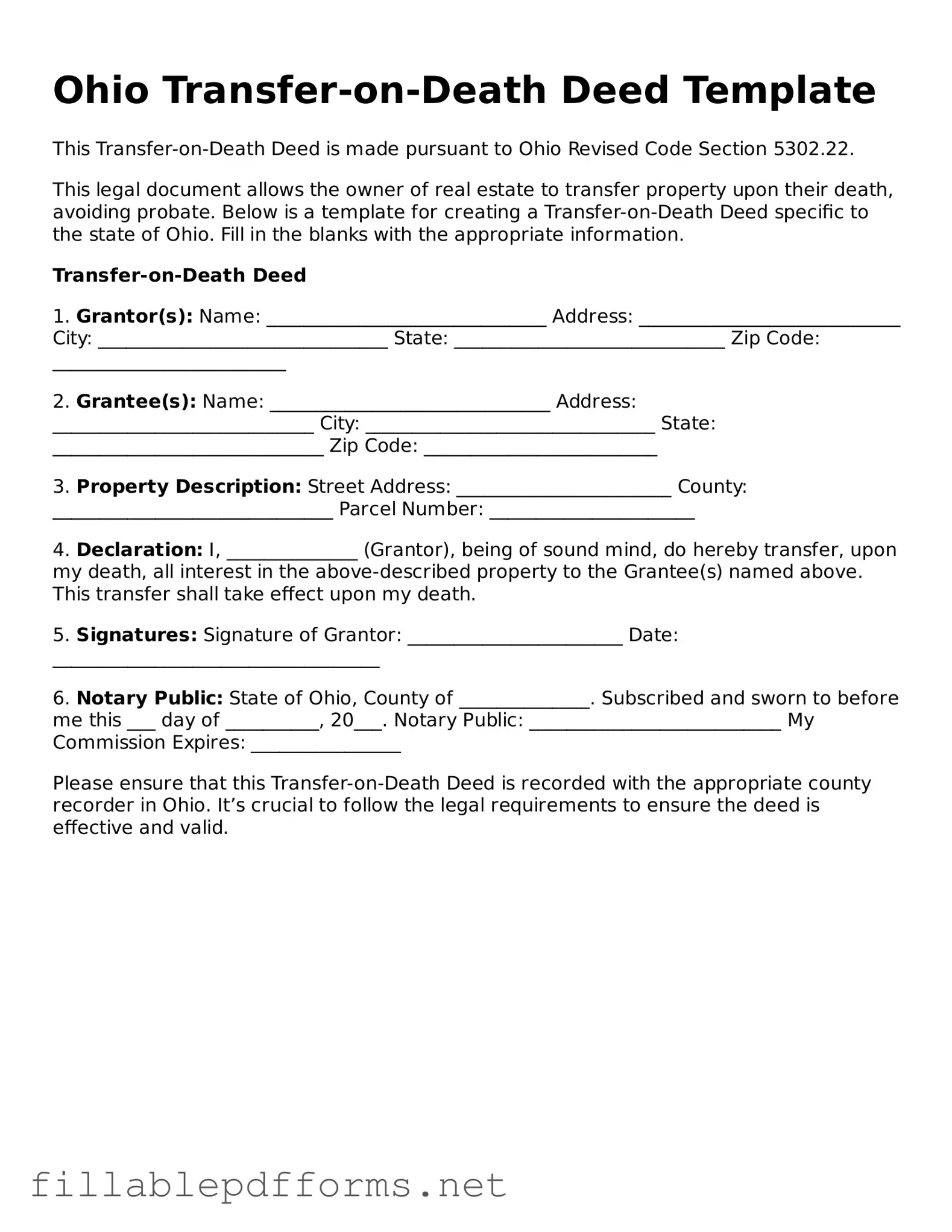

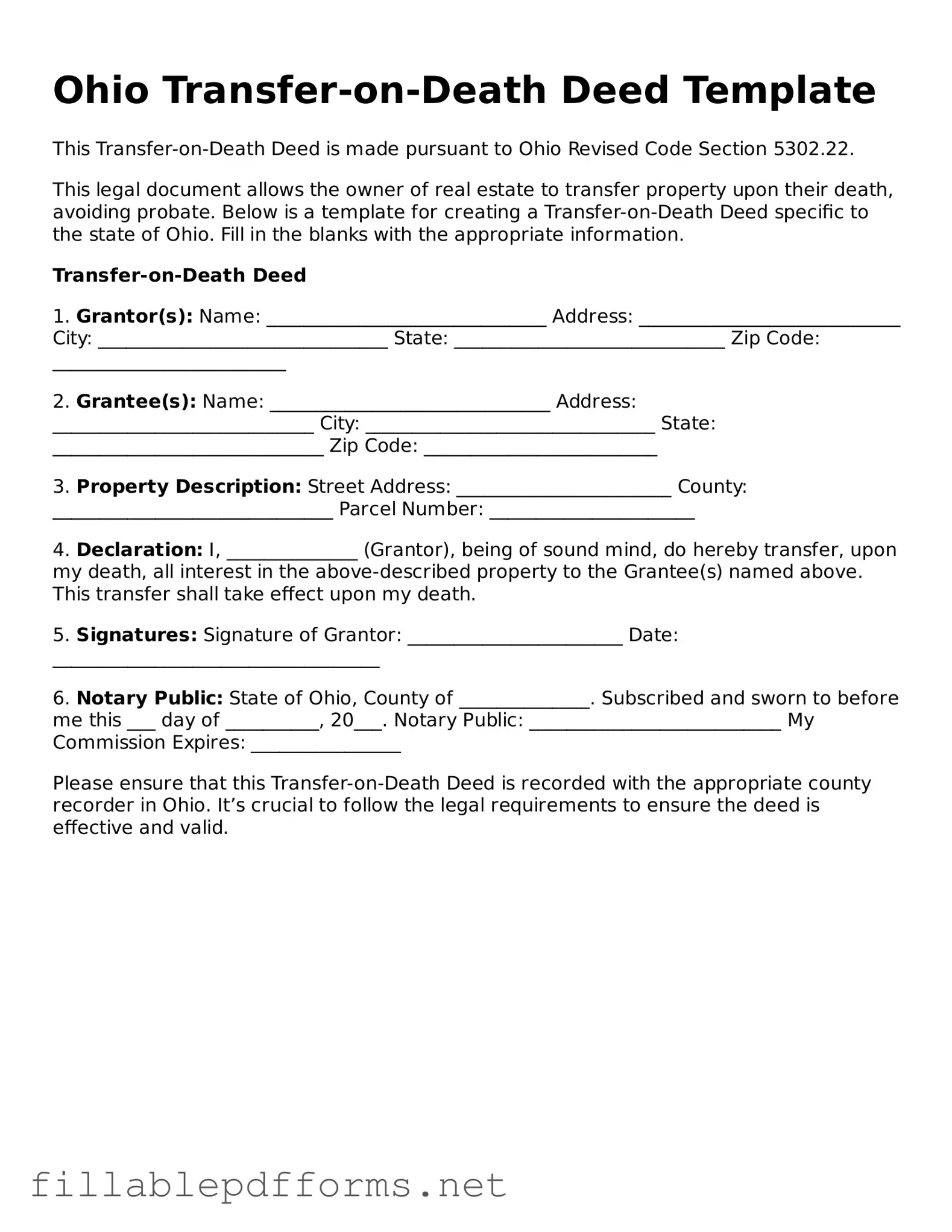

Attorney-Verified Transfer-on-Death Deed Form for Ohio State

The Transfer-on-Death Deed form in Ohio is a legal document that allows property owners to transfer their real estate to designated beneficiaries upon their death, without the need for probate. This form simplifies the process of passing on property, ensuring that it goes directly to the intended recipients. Understanding how to properly complete and file this deed can help individuals secure their estate planning goals.

Launch Editor Here

Attorney-Verified Transfer-on-Death Deed Form for Ohio State

Launch Editor Here

Launch Editor Here

or

▼ Transfer-on-Death Deed PDF

Almost there — finish the form

Complete Transfer-on-Death Deed online fast — no printing, no scanning.