Attorney-Verified Tractor Bill of Sale Form for Ohio State

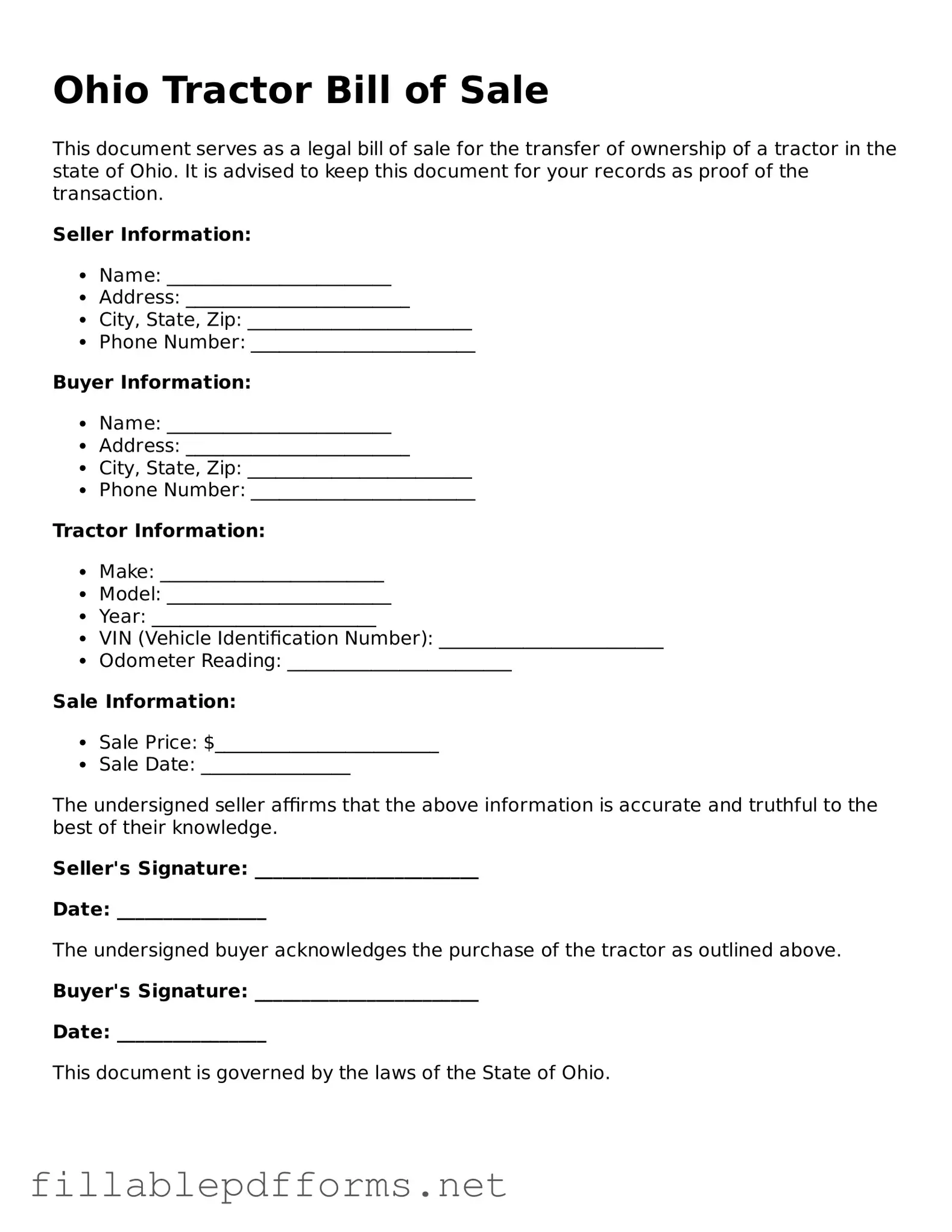

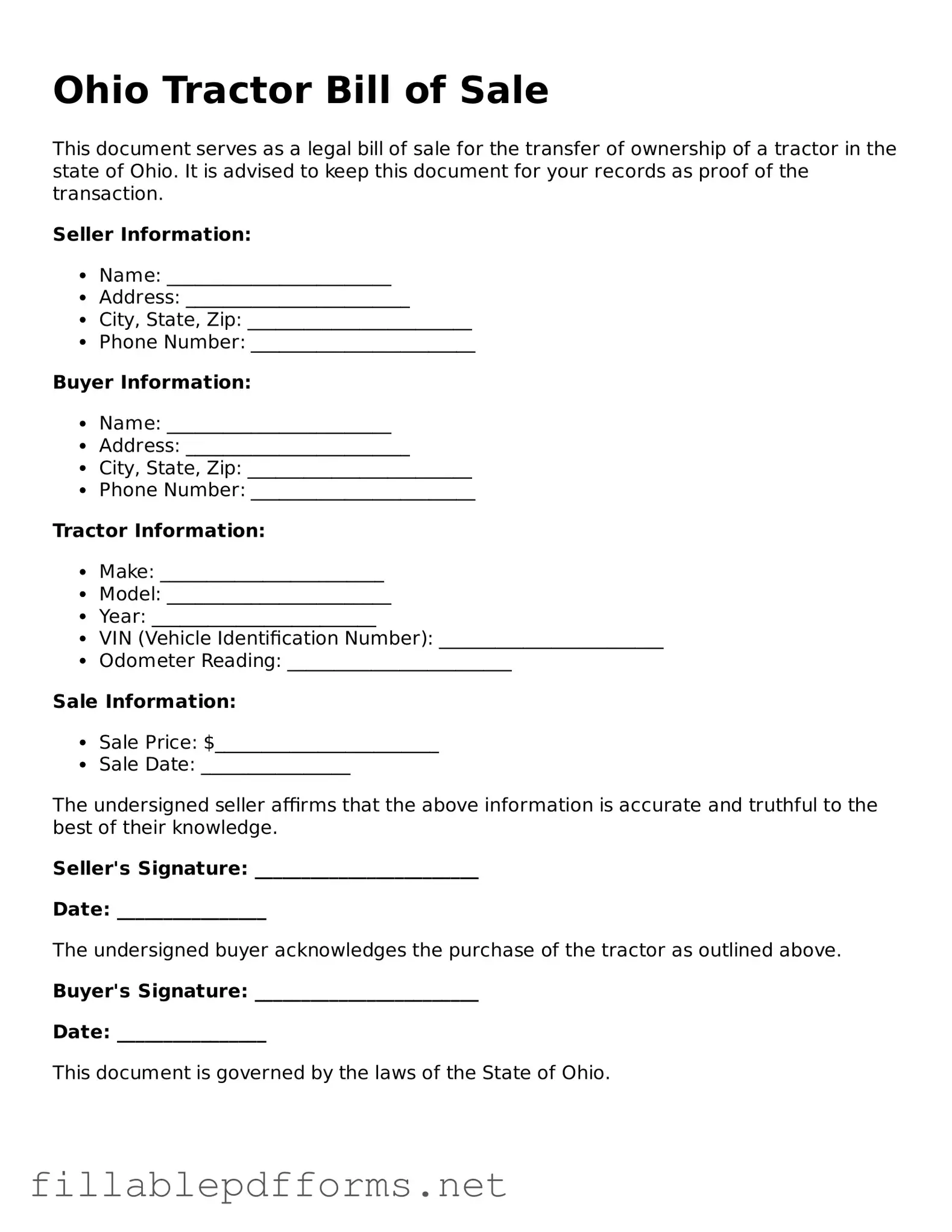

The Ohio Tractor Bill of Sale form is a legal document used to record the sale of a tractor in the state of Ohio. This form serves as proof of ownership transfer between the seller and the buyer, ensuring that both parties have a clear understanding of the transaction. Properly completing this form can help prevent disputes and protect the rights of both the buyer and seller.

Launch Editor Here

Attorney-Verified Tractor Bill of Sale Form for Ohio State

Launch Editor Here

Launch Editor Here

or

▼ Tractor Bill of Sale PDF

Almost there — finish the form

Complete Tractor Bill of Sale online fast — no printing, no scanning.