Attorney-Verified Promissory Note Form for Ohio State

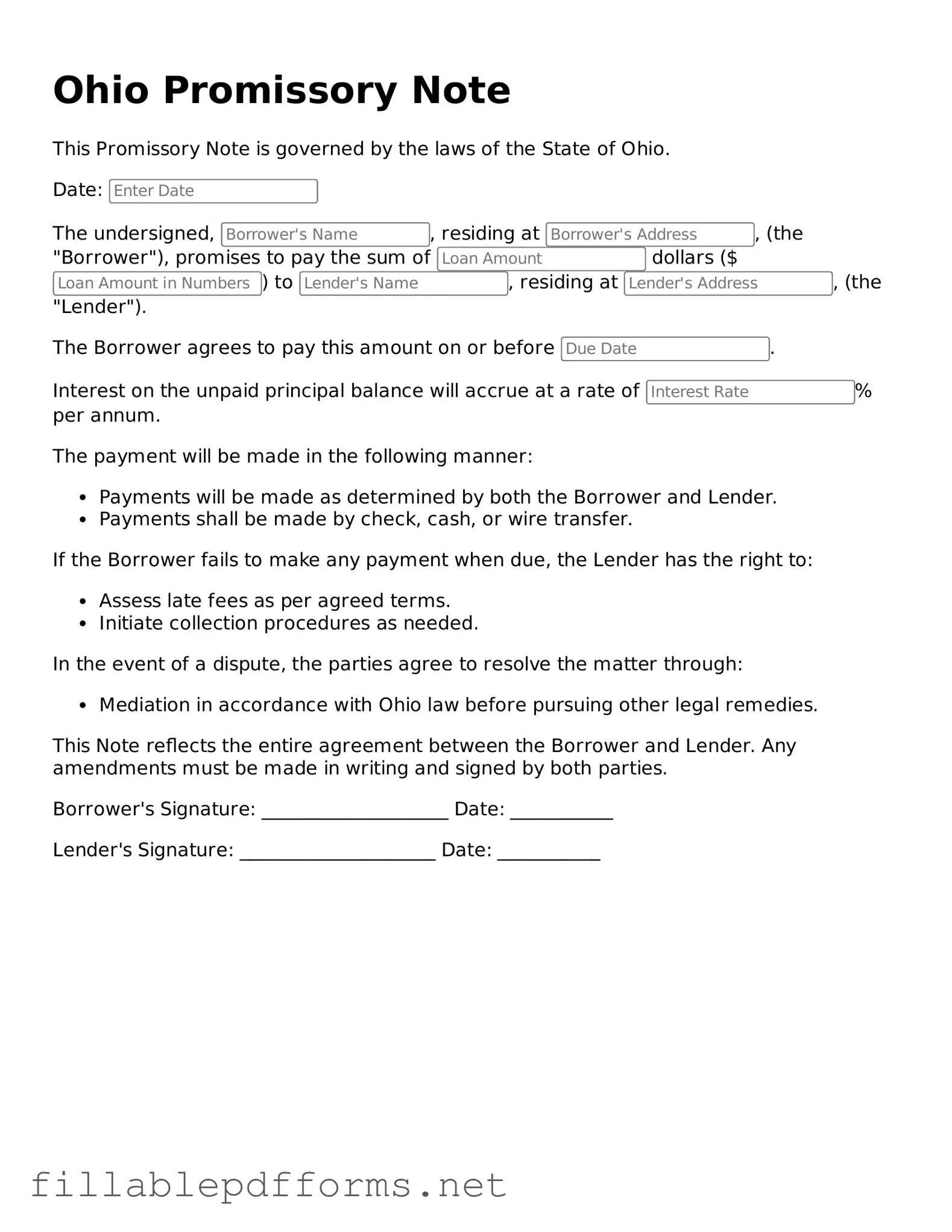

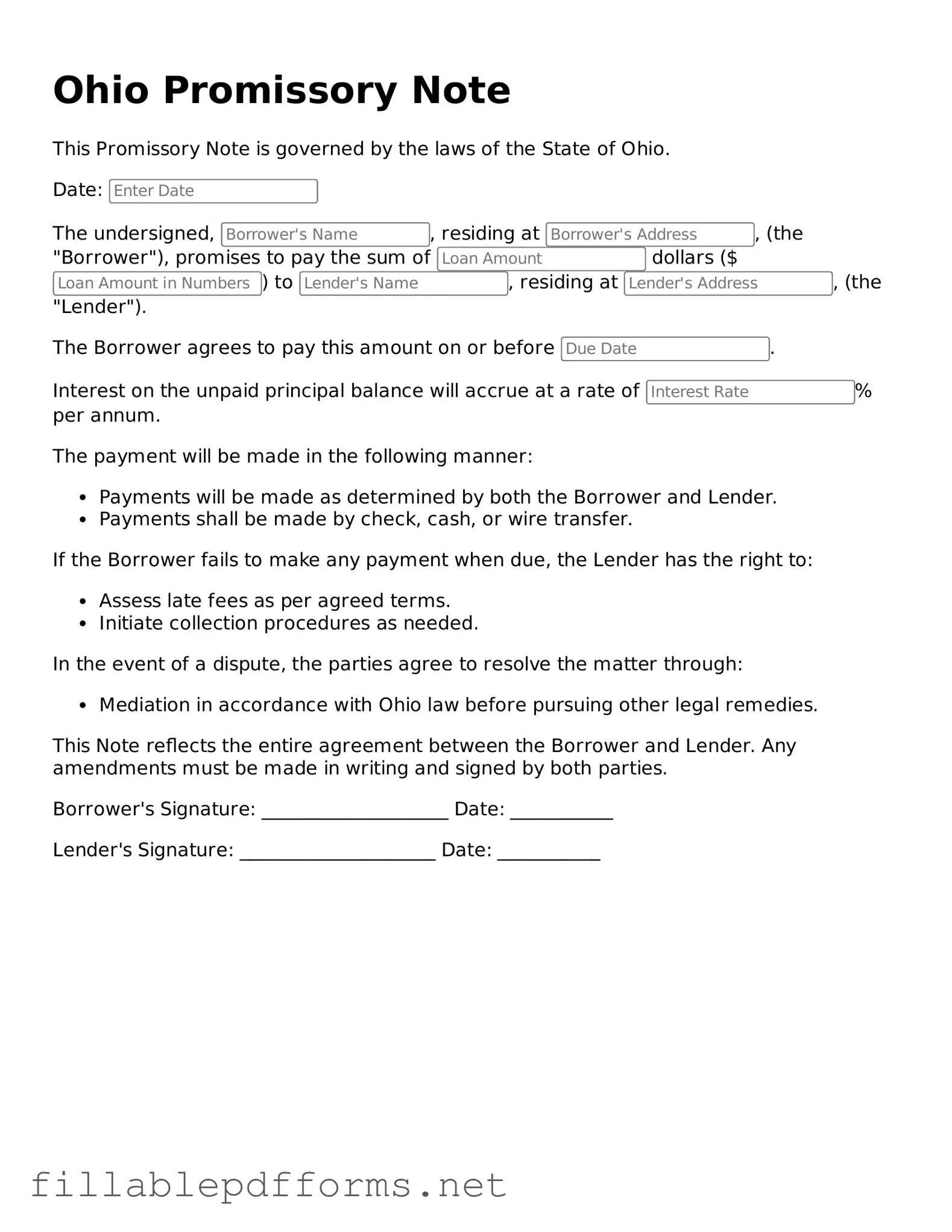

A Promissory Note is a written promise to pay a specified amount of money to a designated party at a determined time or on demand. In Ohio, this legal document serves as a critical tool for both lenders and borrowers, outlining the terms of the loan and the obligations of each party. Understanding the nuances of the Ohio Promissory Note form is essential for anyone entering into a lending agreement in the state.

Launch Editor Here

Attorney-Verified Promissory Note Form for Ohio State

Launch Editor Here

Launch Editor Here

or

▼ Promissory Note PDF

Almost there — finish the form

Complete Promissory Note online fast — no printing, no scanning.