Attorney-Verified Articles of Incorporation Form for Ohio State

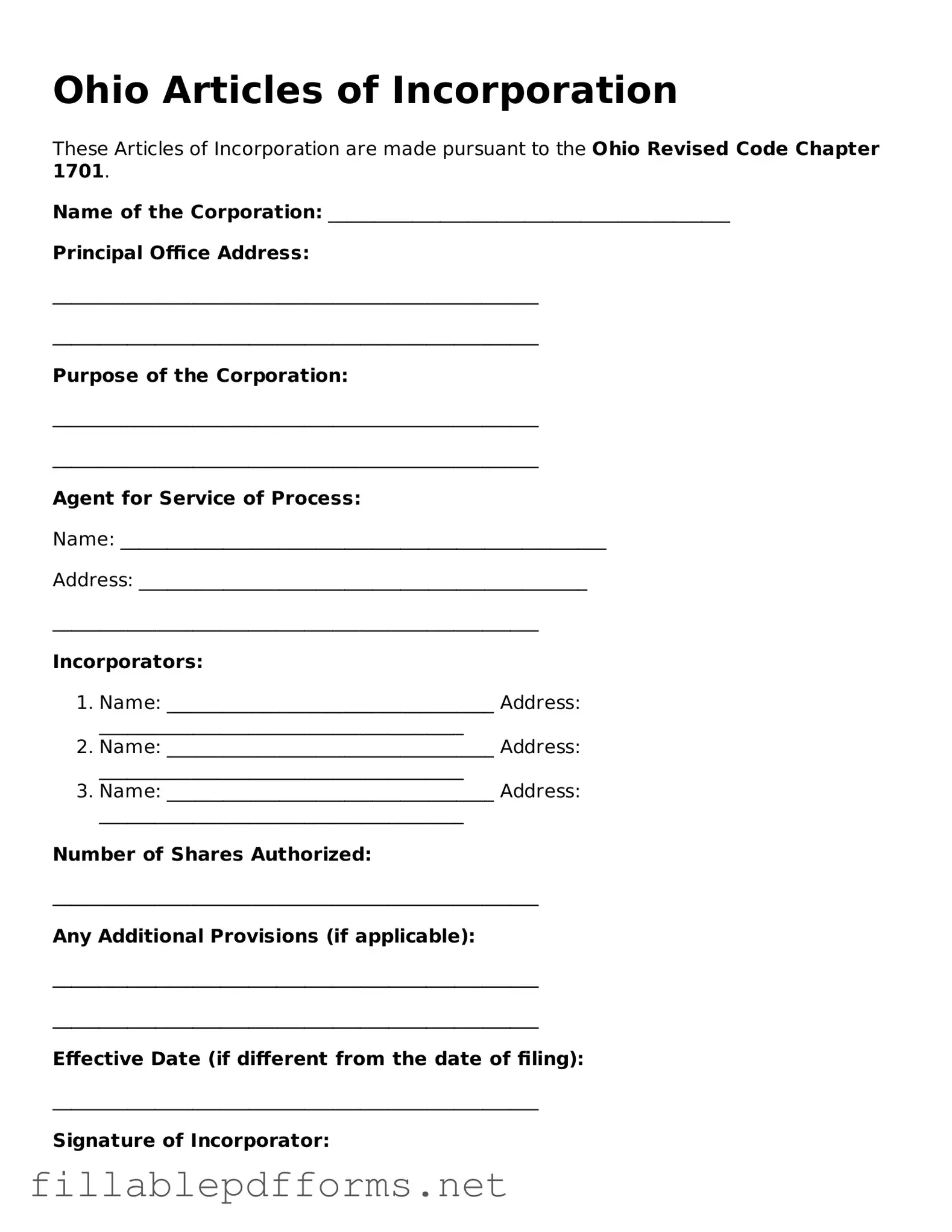

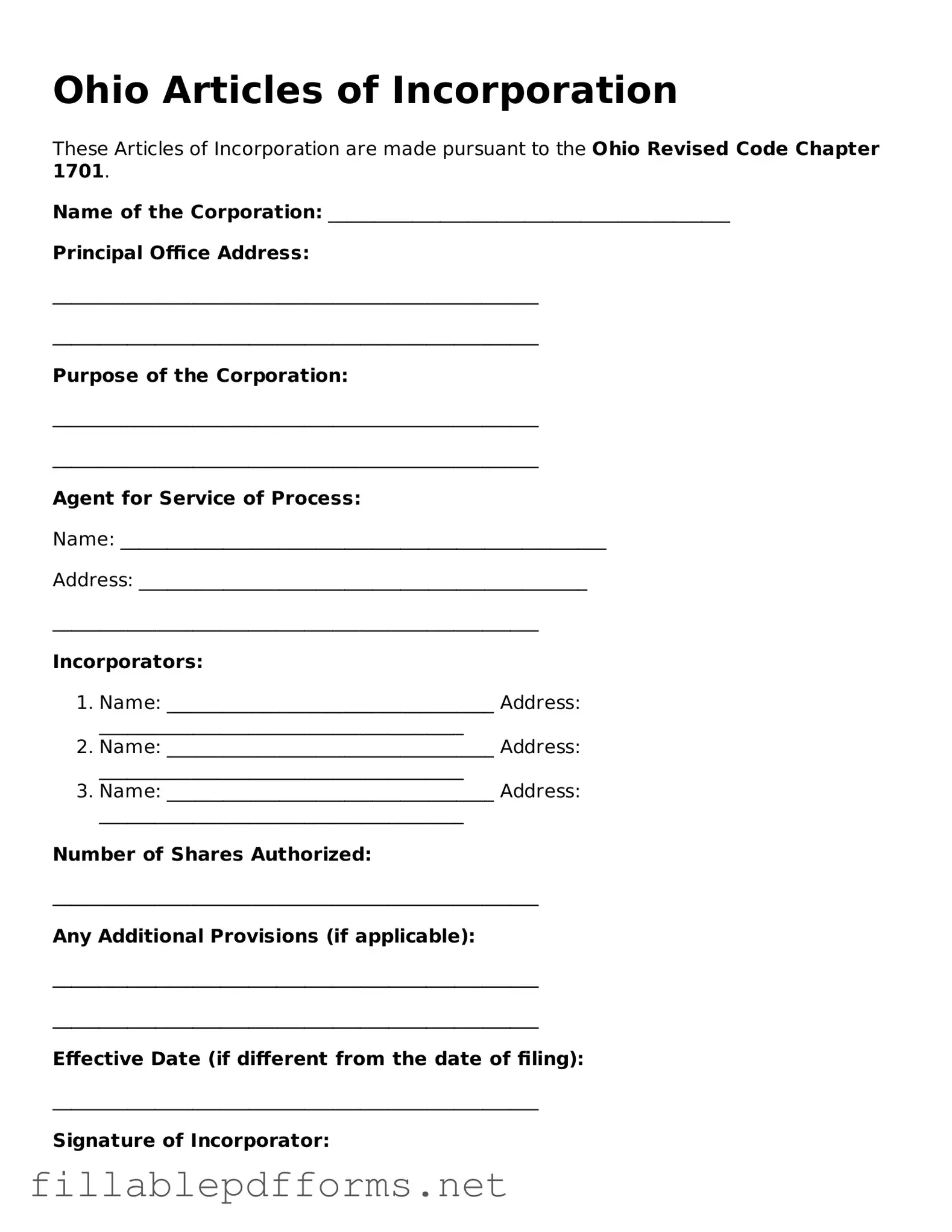

The Ohio Articles of Incorporation form is a legal document that establishes a corporation in the state of Ohio. This form outlines essential information about the corporation, including its name, purpose, and structure. Filing this document is a crucial step for anyone looking to create a legally recognized business entity in Ohio.

Launch Editor Here

Attorney-Verified Articles of Incorporation Form for Ohio State

Launch Editor Here

Launch Editor Here

or

▼ Articles of Incorporation PDF

Almost there — finish the form

Complete Articles of Incorporation online fast — no printing, no scanning.