Attorney-Verified Promissory Note Form for North Carolina State

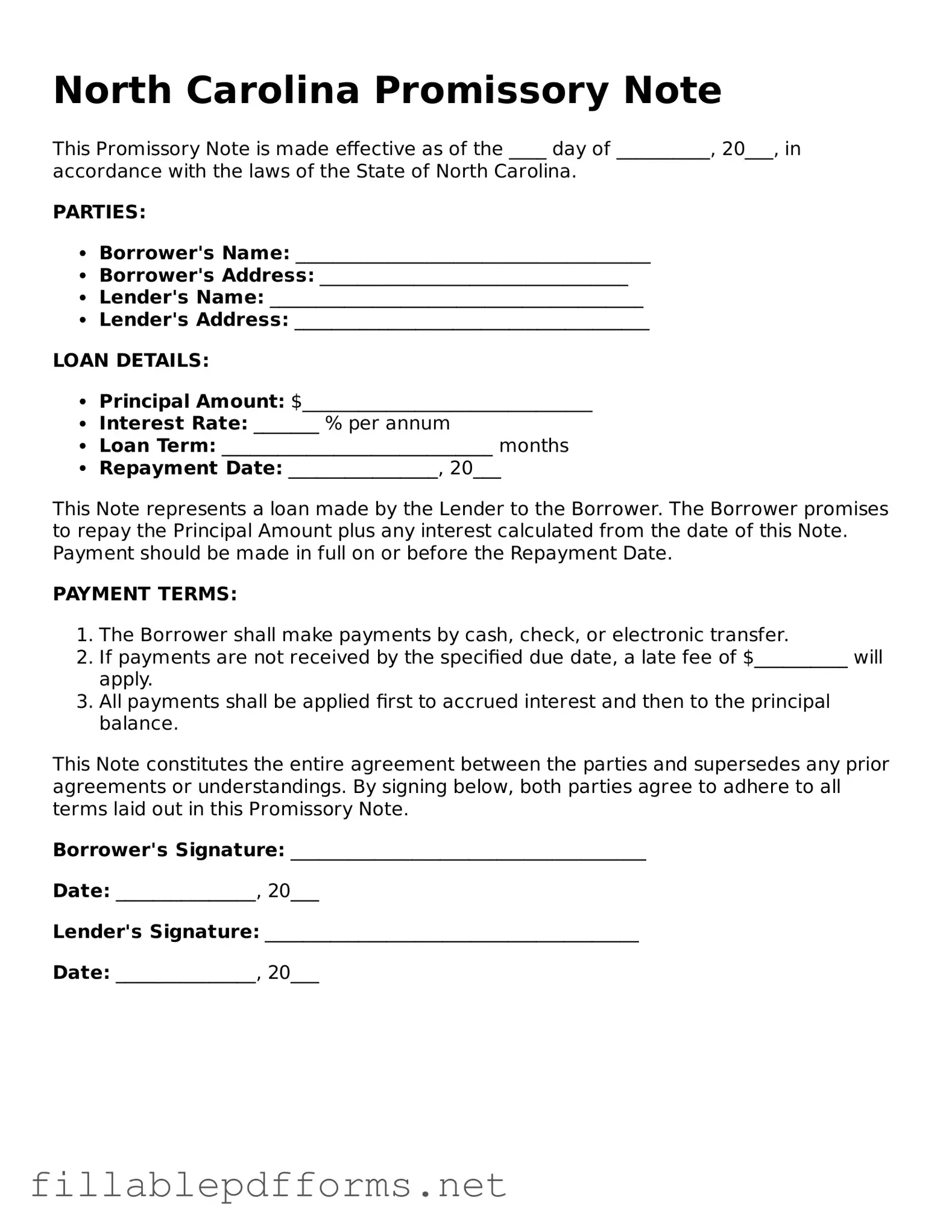

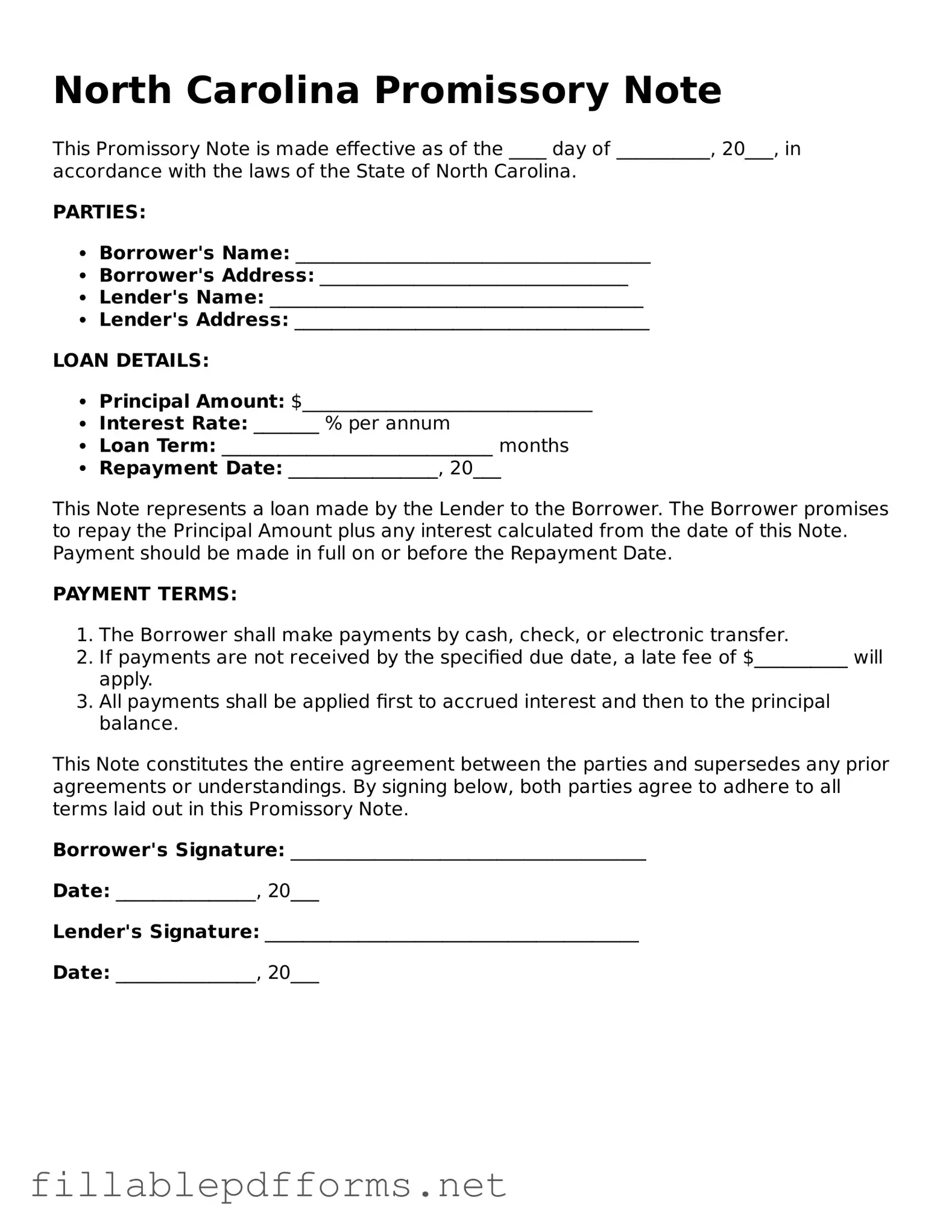

A North Carolina Promissory Note is a legal document that outlines a borrower's promise to repay a specified amount of money to a lender under agreed-upon terms. This form serves as a crucial tool for both parties, ensuring clarity and accountability in financial transactions. Understanding its components and implications can help individuals navigate lending and borrowing situations more effectively.

Launch Editor Here

Attorney-Verified Promissory Note Form for North Carolina State

Launch Editor Here

Launch Editor Here

or

▼ Promissory Note PDF

Almost there — finish the form

Complete Promissory Note online fast — no printing, no scanning.