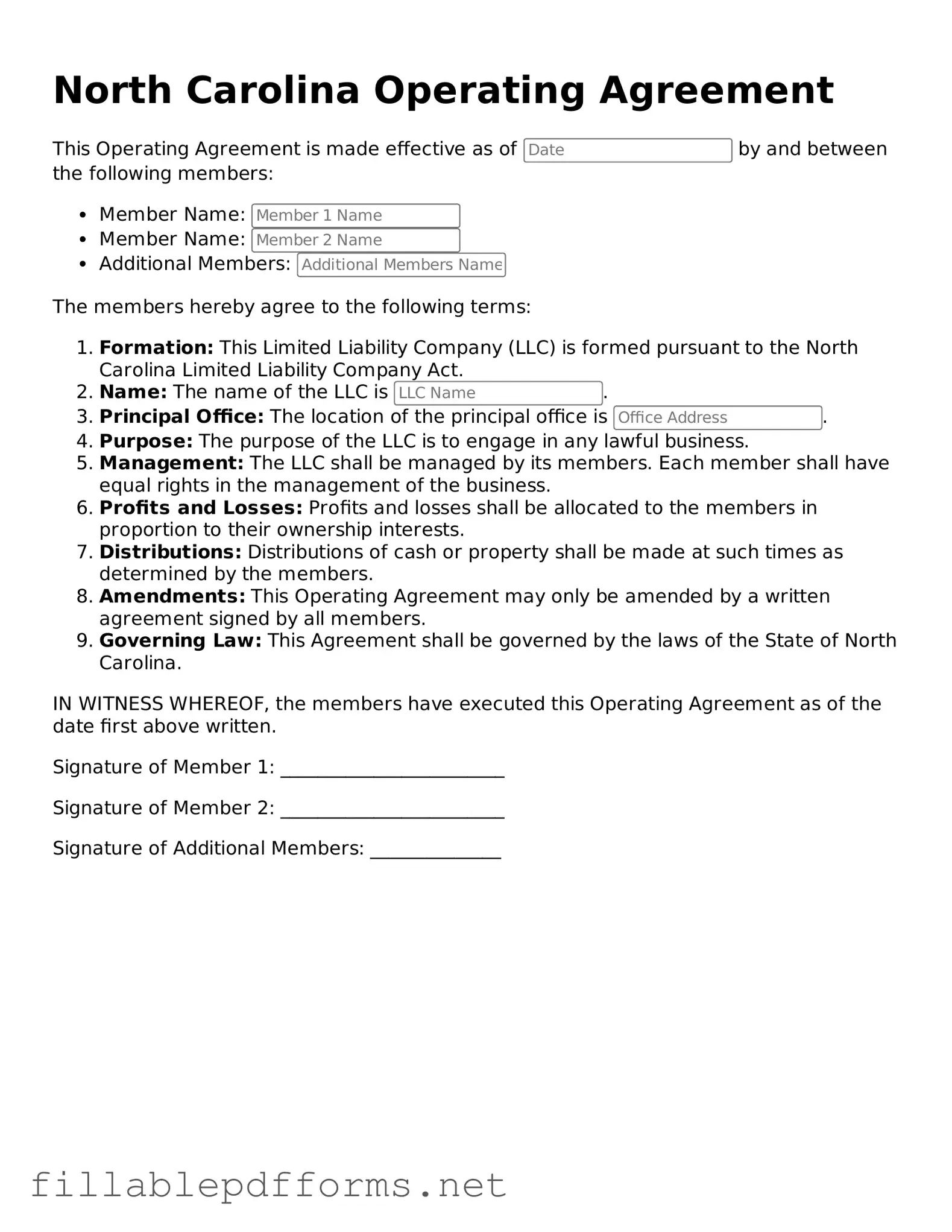

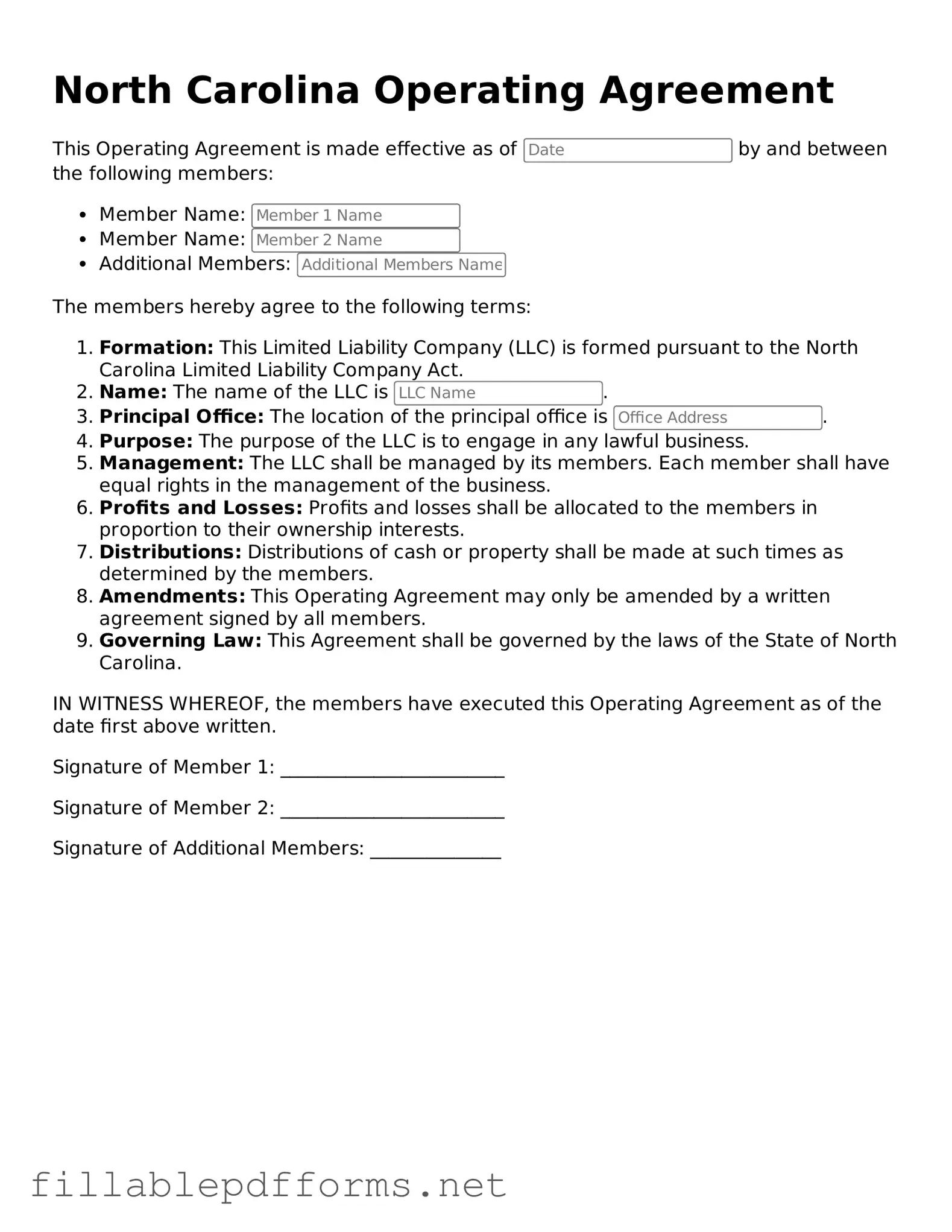

Attorney-Verified Operating Agreement Form for North Carolina State

The North Carolina Operating Agreement form is a crucial document for limited liability companies (LLCs) in the state. It outlines the management structure, responsibilities of members, and operational procedures of the business. Having a well-crafted operating agreement helps ensure that all members are on the same page and can prevent potential disputes in the future.

Launch Editor Here

Attorney-Verified Operating Agreement Form for North Carolina State

Launch Editor Here

Launch Editor Here

or

▼ Operating Agreement PDF

Almost there — finish the form

Complete Operating Agreement online fast — no printing, no scanning.