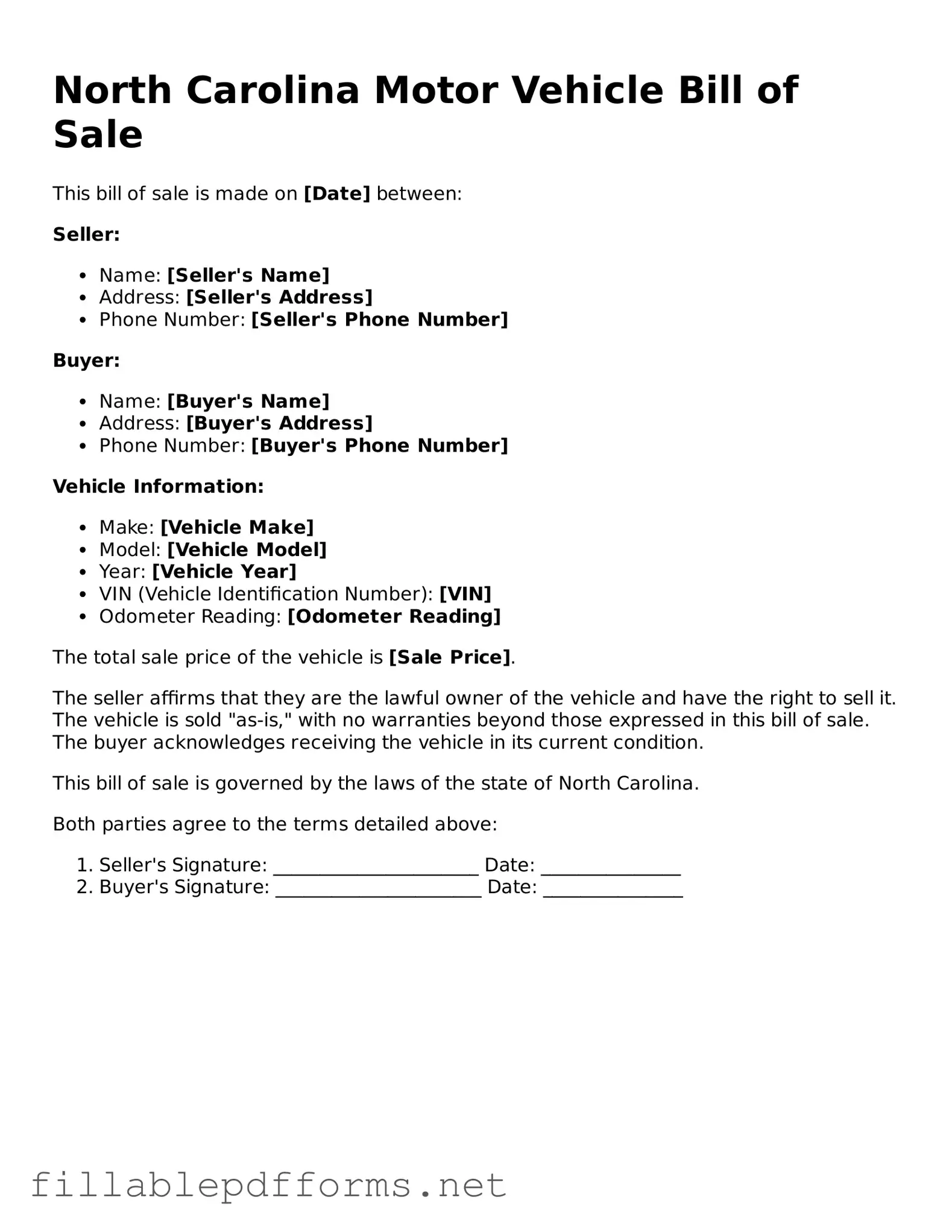

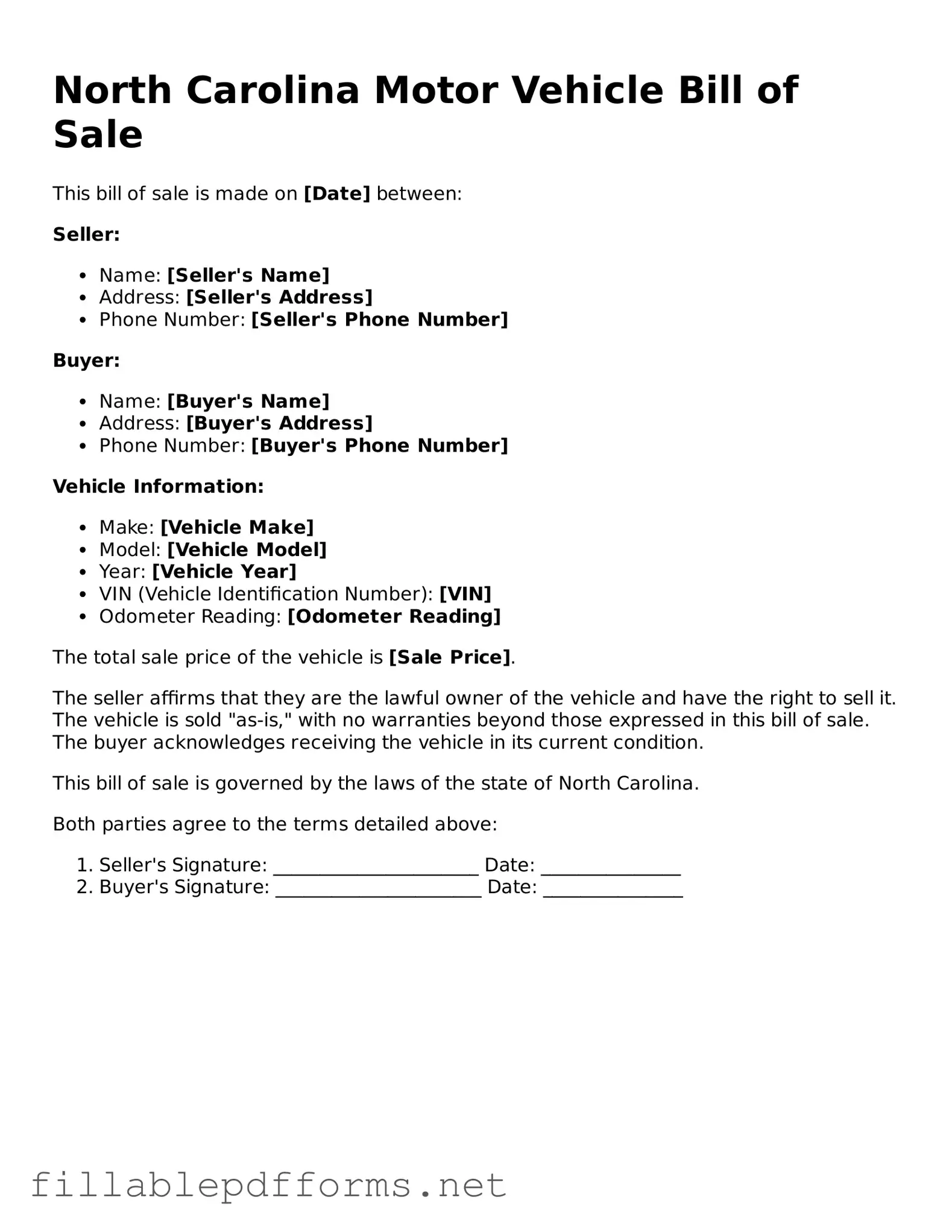

Attorney-Verified Motor Vehicle Bill of Sale Form for North Carolina State

The North Carolina Motor Vehicle Bill of Sale form is a crucial document that serves as proof of the sale and transfer of ownership of a motor vehicle. This form not only protects the interests of both the buyer and the seller but also ensures that the transaction is recorded properly with the state. Understanding its importance can simplify the process of buying or selling a vehicle in North Carolina.

Launch Editor Here

Attorney-Verified Motor Vehicle Bill of Sale Form for North Carolina State

Launch Editor Here

Launch Editor Here

or

▼ Motor Vehicle Bill of Sale PDF

Almost there — finish the form

Complete Motor Vehicle Bill of Sale online fast — no printing, no scanning.