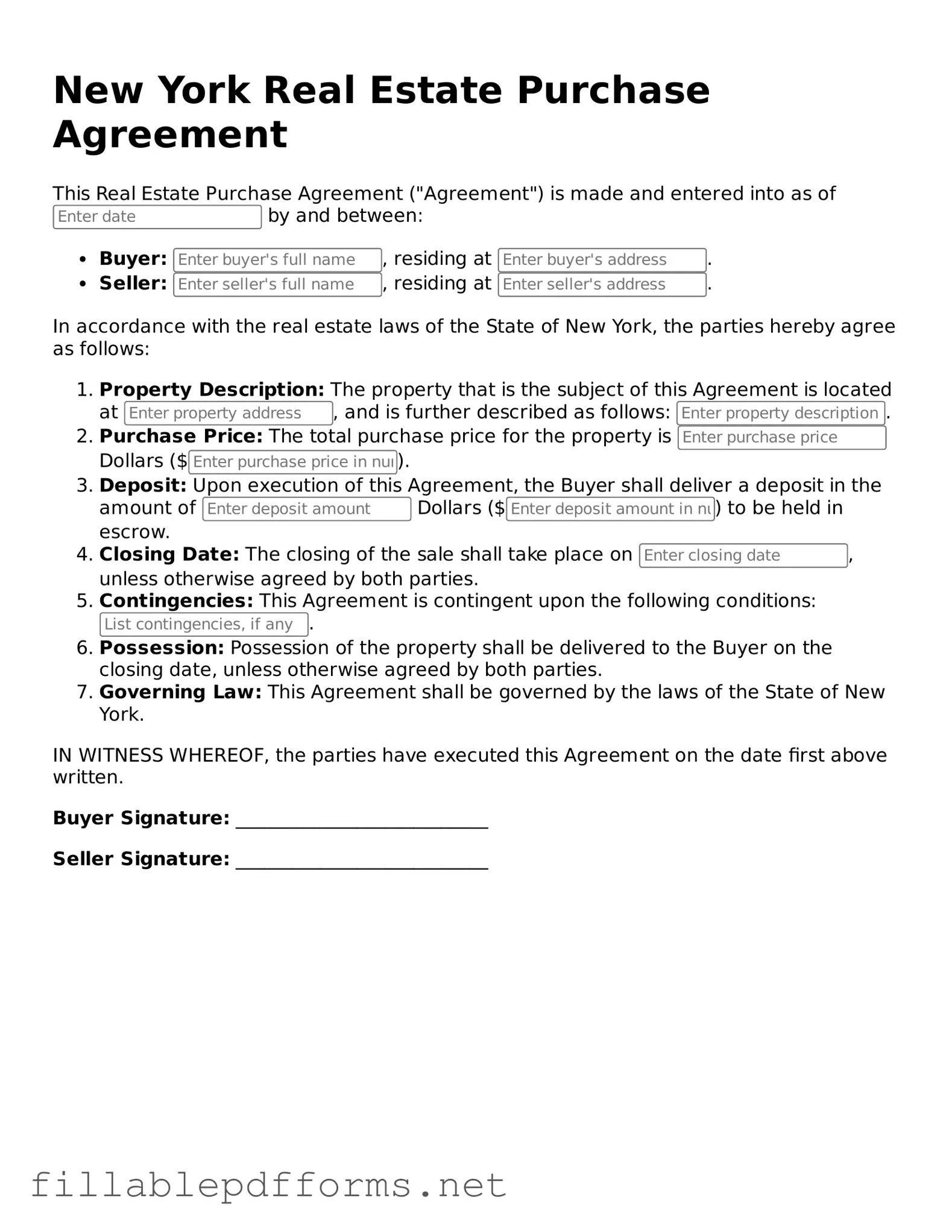

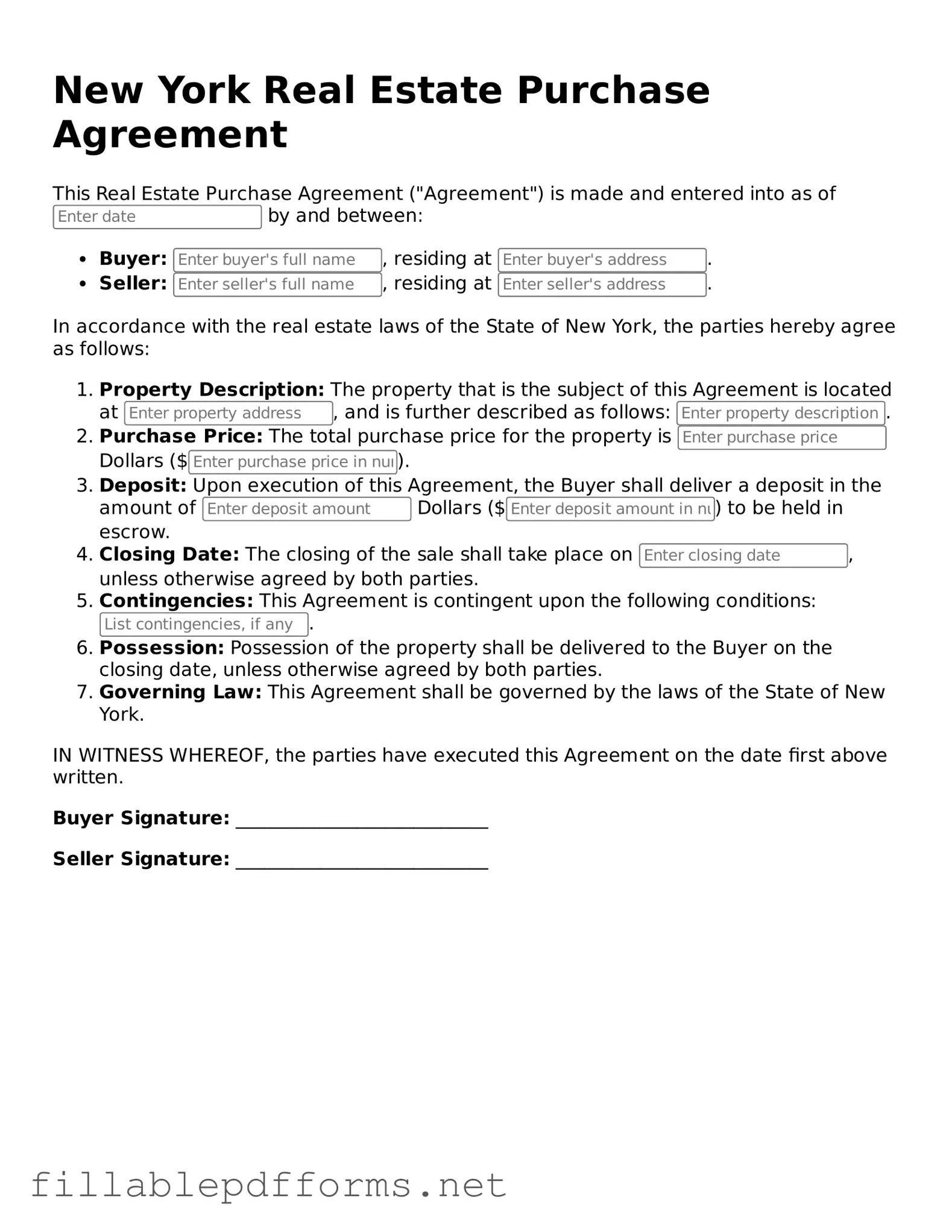

Attorney-Verified Real Estate Purchase Agreement Form for New York State

The New York Real Estate Purchase Agreement is a legal document that outlines the terms and conditions under which a buyer agrees to purchase a property from a seller. This agreement serves as a crucial framework for the transaction, detailing essential elements such as the purchase price, contingencies, and closing date. Understanding this form is vital for both buyers and sellers to ensure a smooth and successful real estate transaction.

Launch Editor Here

Attorney-Verified Real Estate Purchase Agreement Form for New York State

Launch Editor Here

Launch Editor Here

or

▼ Real Estate Purchase Agreement PDF

Almost there — finish the form

Complete Real Estate Purchase Agreement online fast — no printing, no scanning.