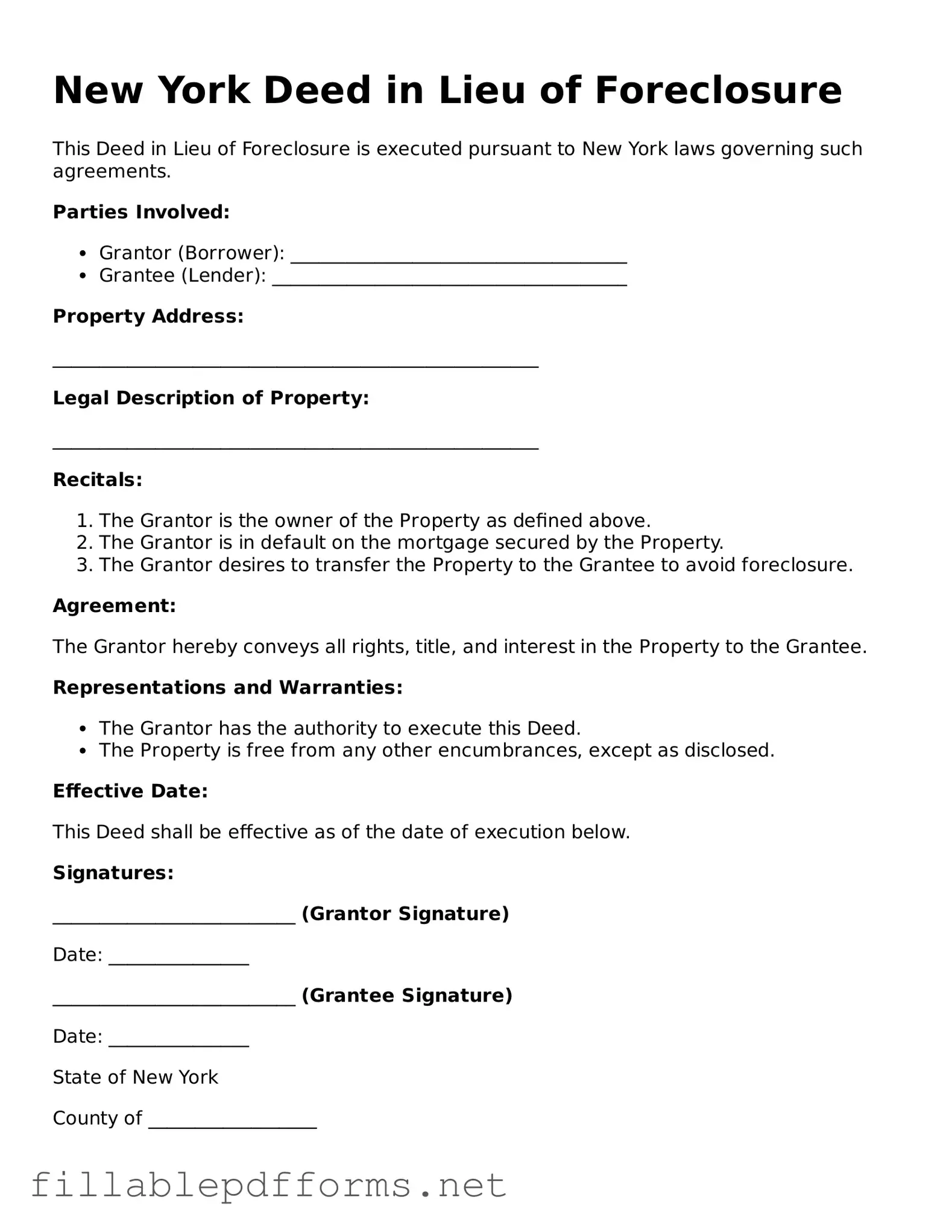

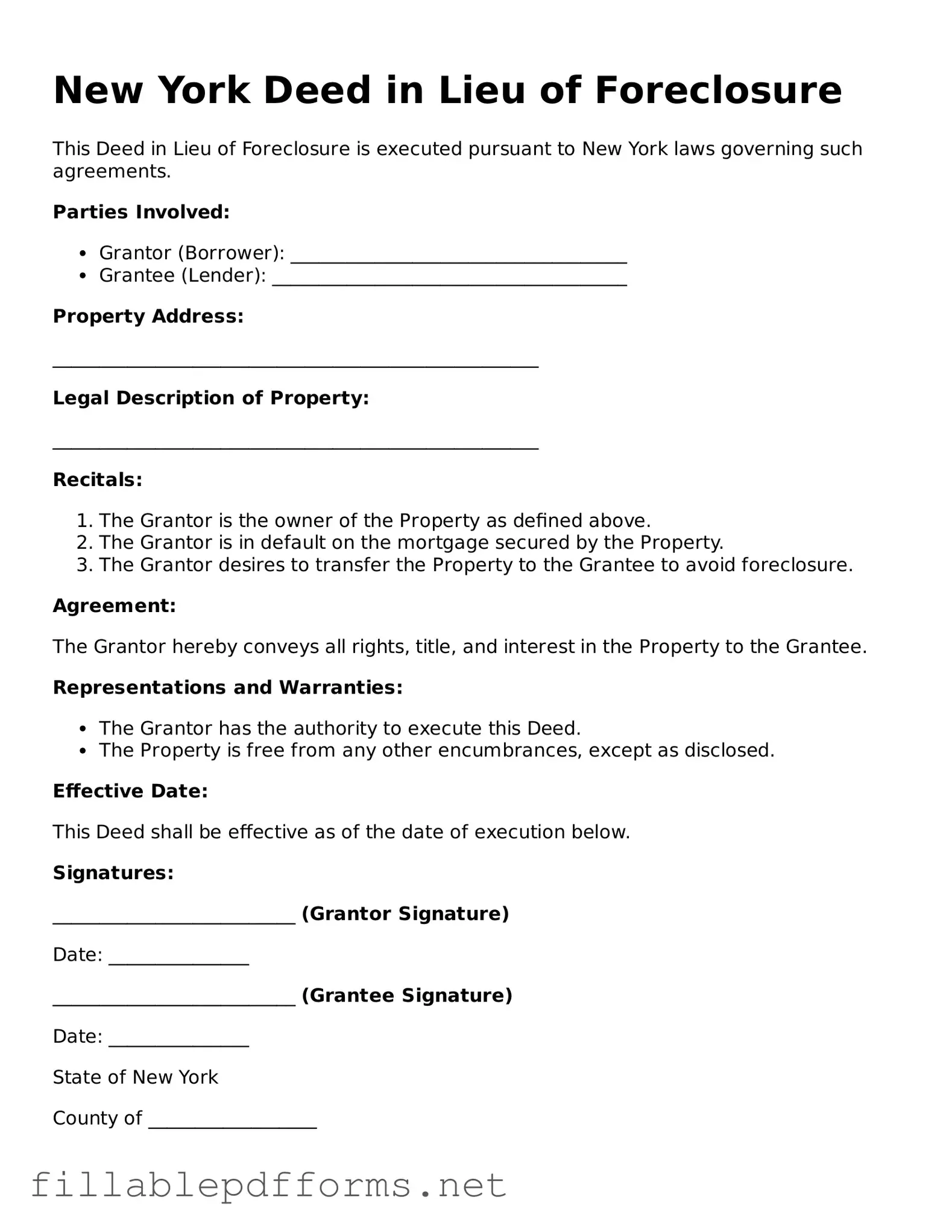

Attorney-Verified Deed in Lieu of Foreclosure Form for New York State

A Deed in Lieu of Foreclosure is a legal document that allows a homeowner to voluntarily transfer ownership of their property to the lender in order to avoid foreclosure. This process can provide a more streamlined resolution for both parties, often resulting in less financial strain and a quicker transition for the homeowner. Understanding the implications and requirements of this form is crucial for anyone facing potential foreclosure in New York.

Launch Editor Here

Attorney-Verified Deed in Lieu of Foreclosure Form for New York State

Launch Editor Here

Launch Editor Here

or

▼ Deed in Lieu of Foreclosure PDF

Almost there — finish the form

Complete Deed in Lieu of Foreclosure online fast — no printing, no scanning.