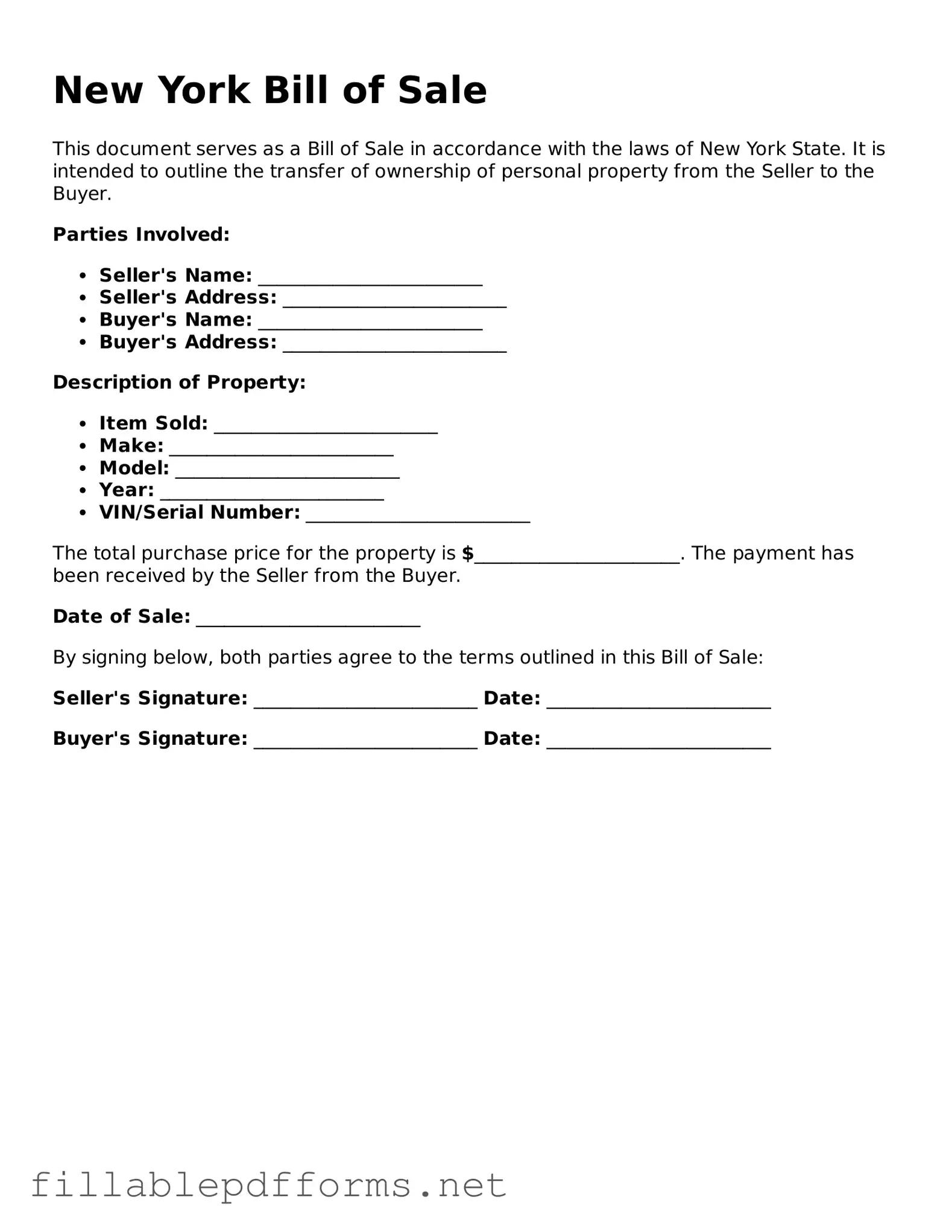

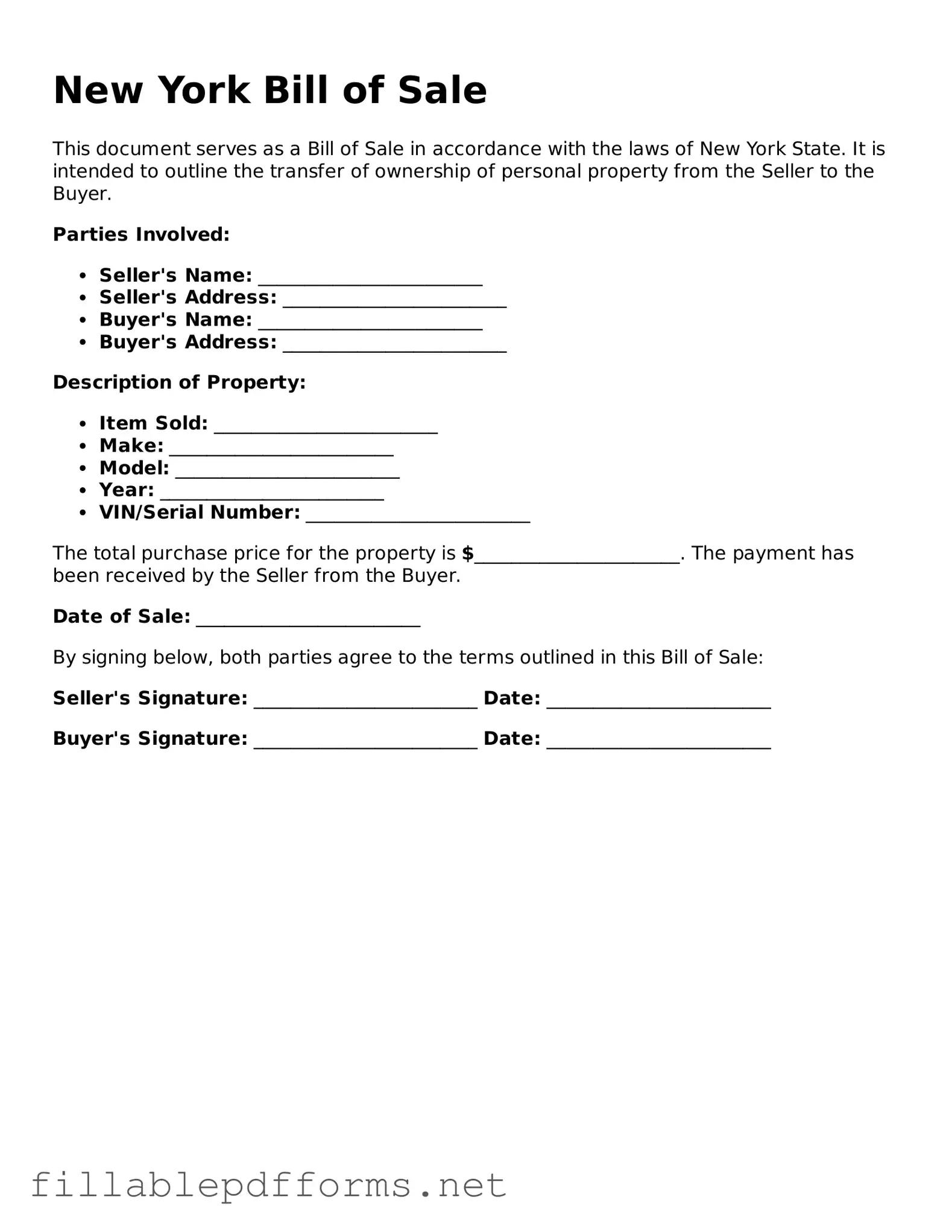

Attorney-Verified Bill of Sale Form for New York State

A Bill of Sale is a legal document that serves as proof of the transfer of ownership of personal property from one party to another. In New York, this form is essential for ensuring that both the buyer and seller have a clear record of the transaction, protecting their rights and interests. Understanding the intricacies of this document can help individuals navigate the sale process with confidence.

Launch Editor Here

Attorney-Verified Bill of Sale Form for New York State

Launch Editor Here

Launch Editor Here

or

▼ Bill of Sale PDF

Almost there — finish the form

Complete Bill of Sale online fast — no printing, no scanning.