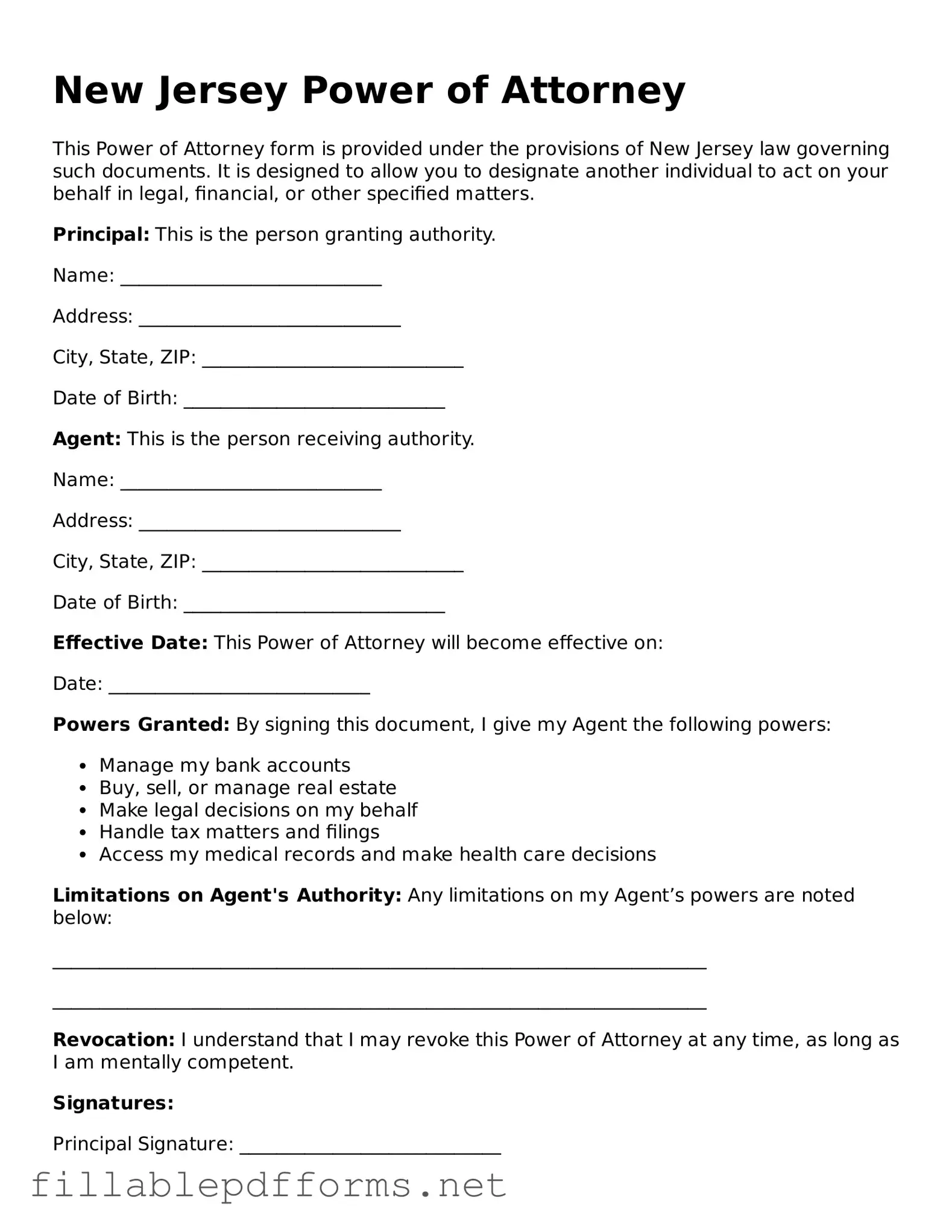

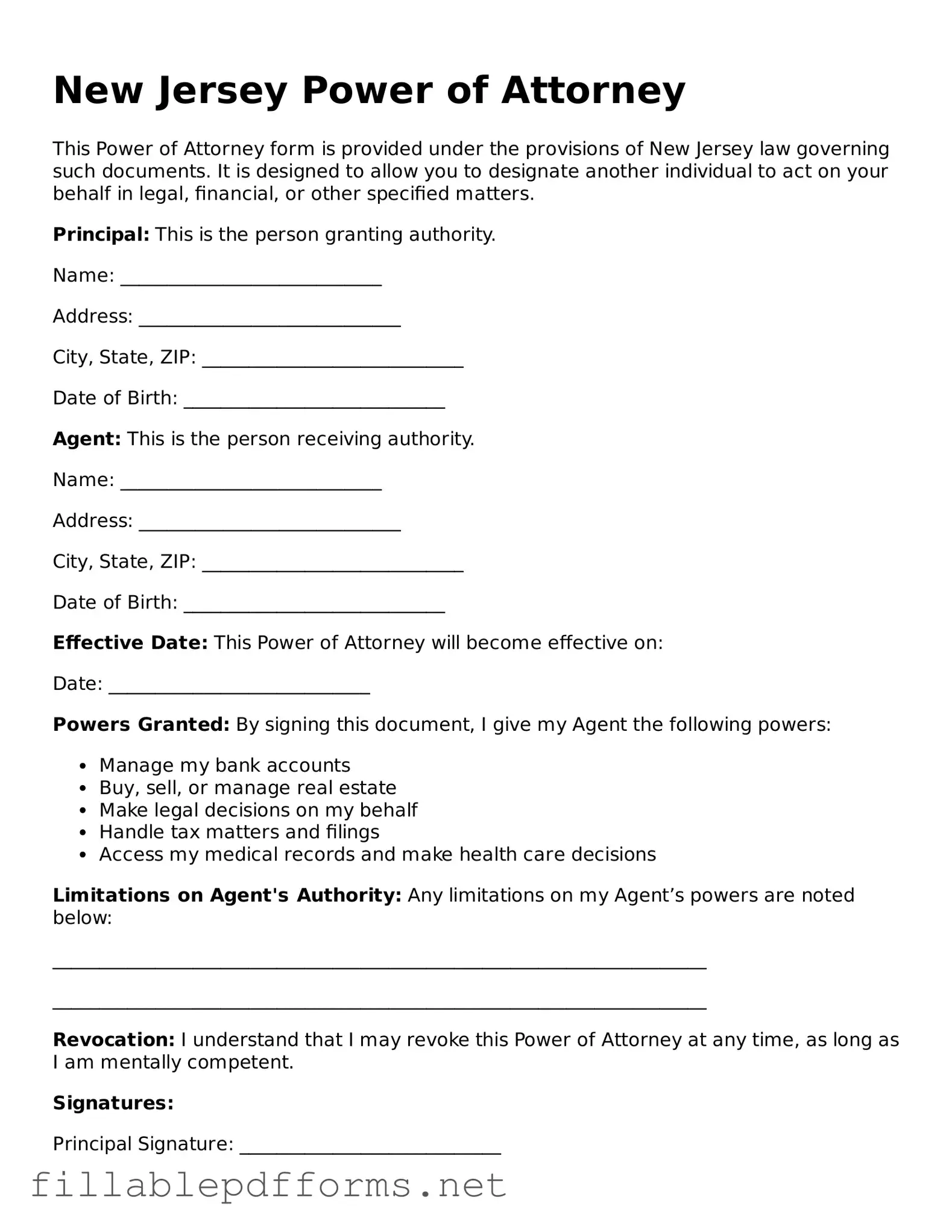

Attorney-Verified Power of Attorney Form for New Jersey State

The New Jersey Power of Attorney form is a legal document that allows an individual, known as the principal, to designate another person, called the agent, to make decisions on their behalf. This form is crucial for ensuring that your financial and personal matters are handled according to your wishes, especially in situations where you may be unable to act for yourself. Understanding the specifics of this form can provide peace of mind and clarity in planning for the future.

Launch Editor Here

Attorney-Verified Power of Attorney Form for New Jersey State

Launch Editor Here

Launch Editor Here

or

▼ Power of Attorney PDF

Almost there — finish the form

Complete Power of Attorney online fast — no printing, no scanning.