Attorney-Verified Motor Vehicle Bill of Sale Form for New Jersey State

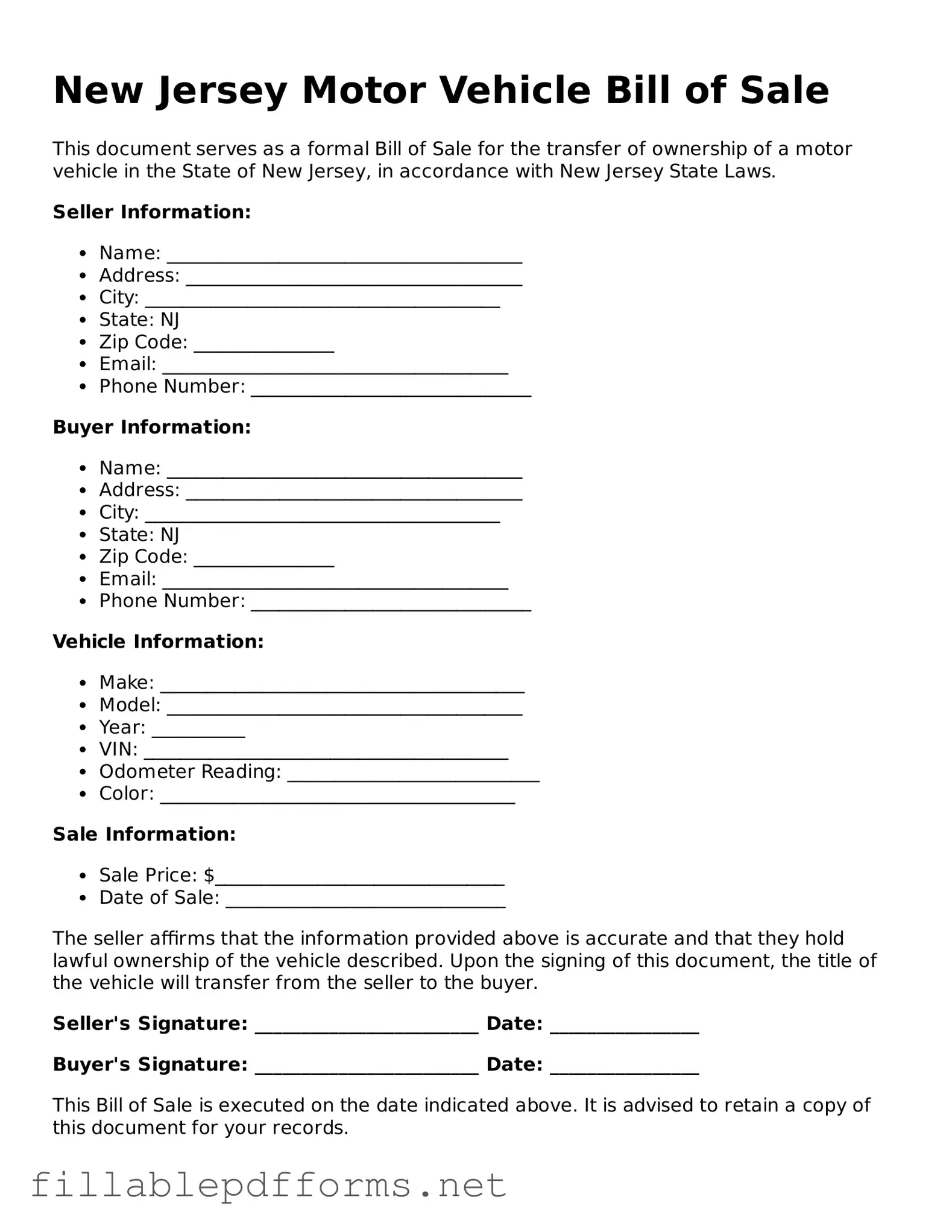

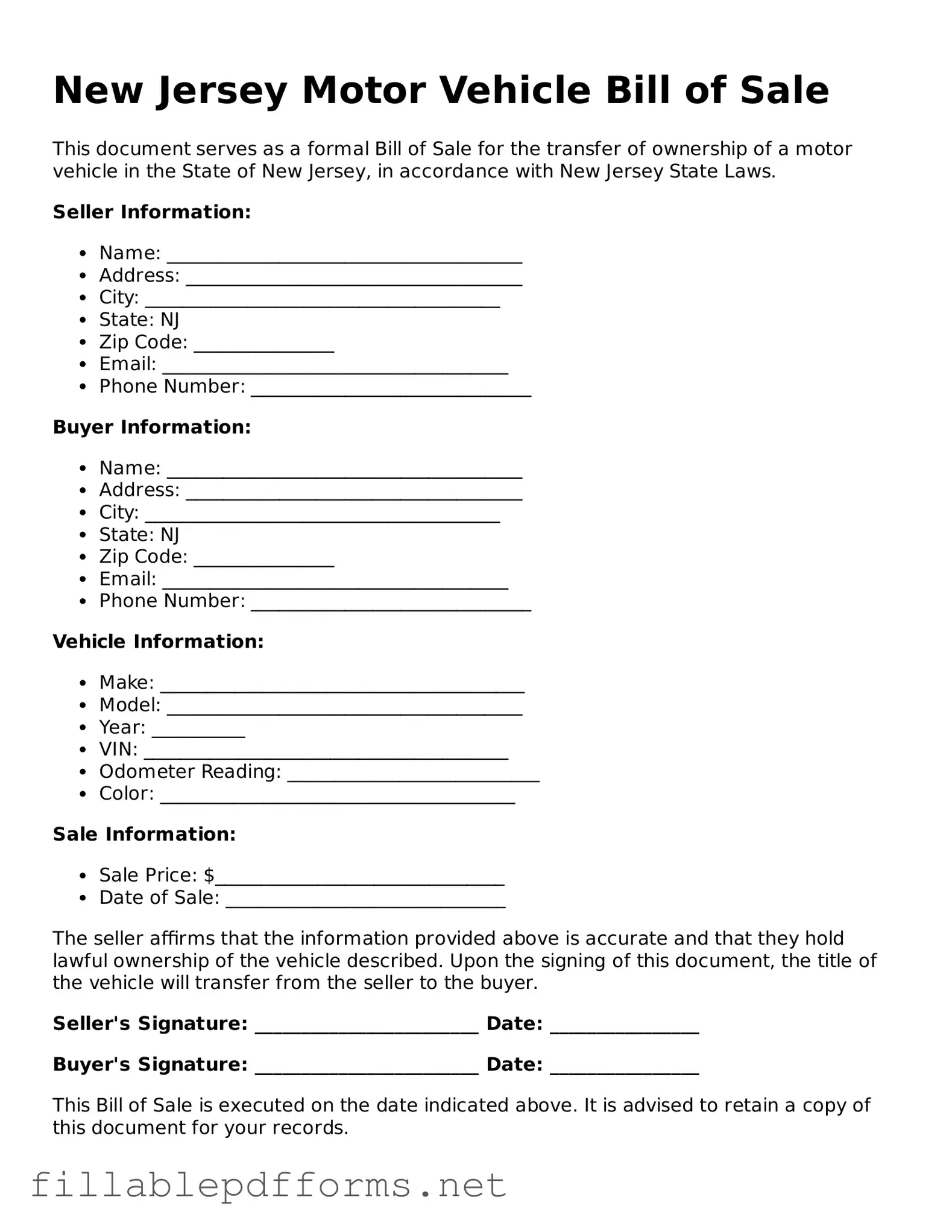

The New Jersey Motor Vehicle Bill of Sale form is a legal document that records the transfer of ownership of a motor vehicle from one party to another. This form serves as proof of the sale and outlines important details about the transaction. Understanding its significance can help ensure a smooth and compliant transfer process.

Launch Editor Here

Attorney-Verified Motor Vehicle Bill of Sale Form for New Jersey State

Launch Editor Here

Launch Editor Here

or

▼ Motor Vehicle Bill of Sale PDF

Almost there — finish the form

Complete Motor Vehicle Bill of Sale online fast — no printing, no scanning.