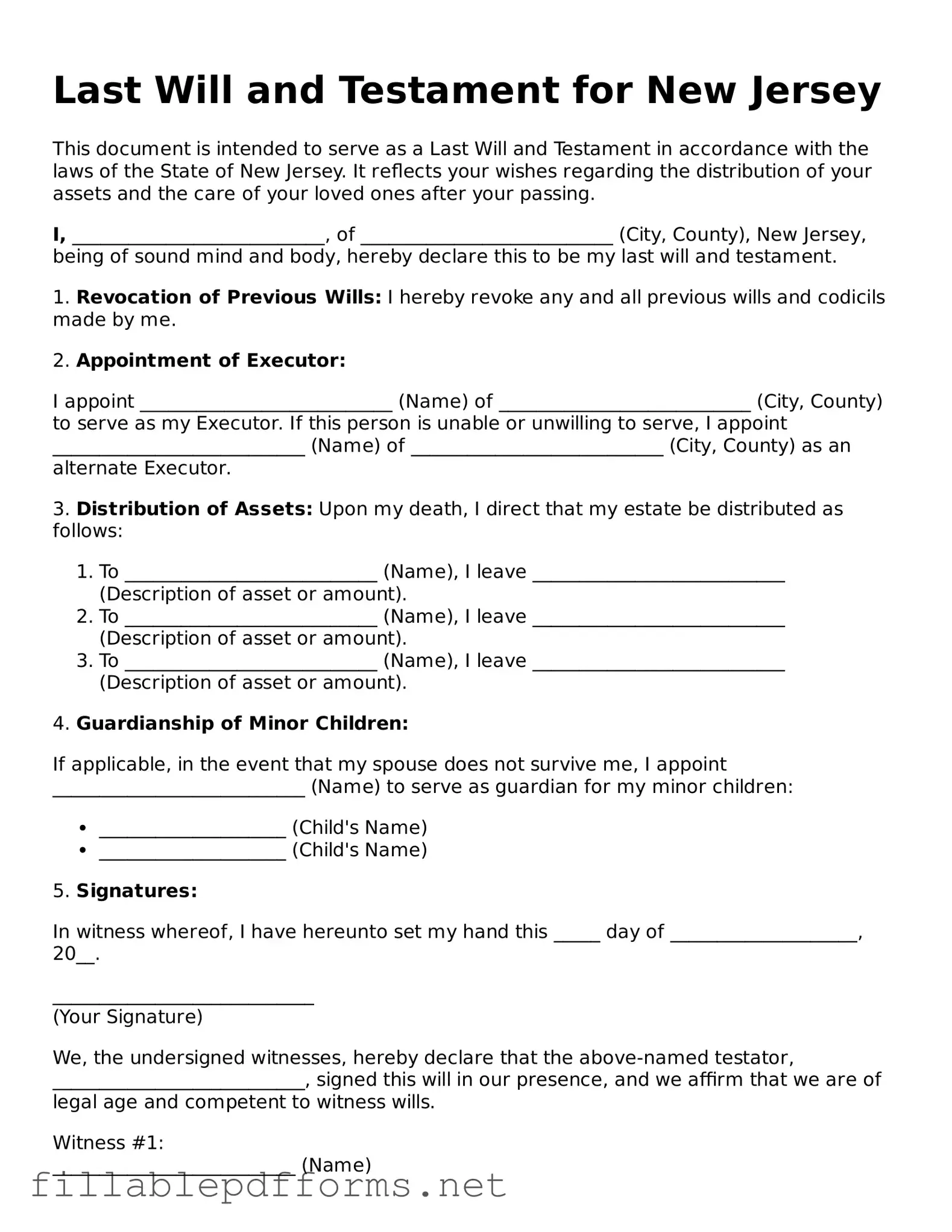

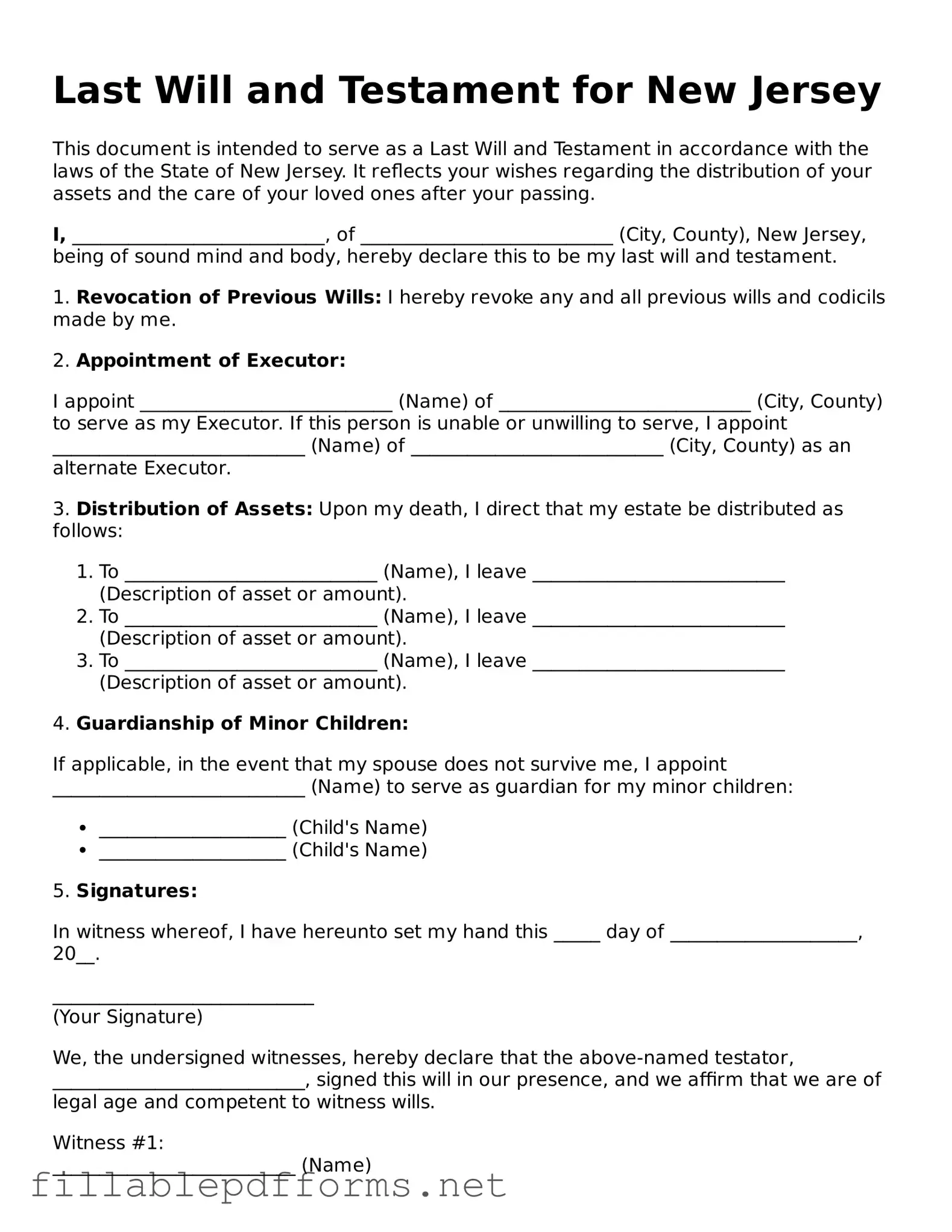

Attorney-Verified Last Will and Testament Form for New Jersey State

A Last Will and Testament is a legal document that outlines an individual's wishes regarding the distribution of their assets after death. In New Jersey, this form serves as a crucial tool for ensuring that a person's estate is managed according to their preferences. Understanding the specific requirements and provisions of the New Jersey Last Will and Testament form is essential for effective estate planning.

Launch Editor Here

Attorney-Verified Last Will and Testament Form for New Jersey State

Launch Editor Here

Launch Editor Here

or

▼ Last Will and Testament PDF

Almost there — finish the form

Complete Last Will and Testament online fast — no printing, no scanning.