Netspend Dispute PDF Template

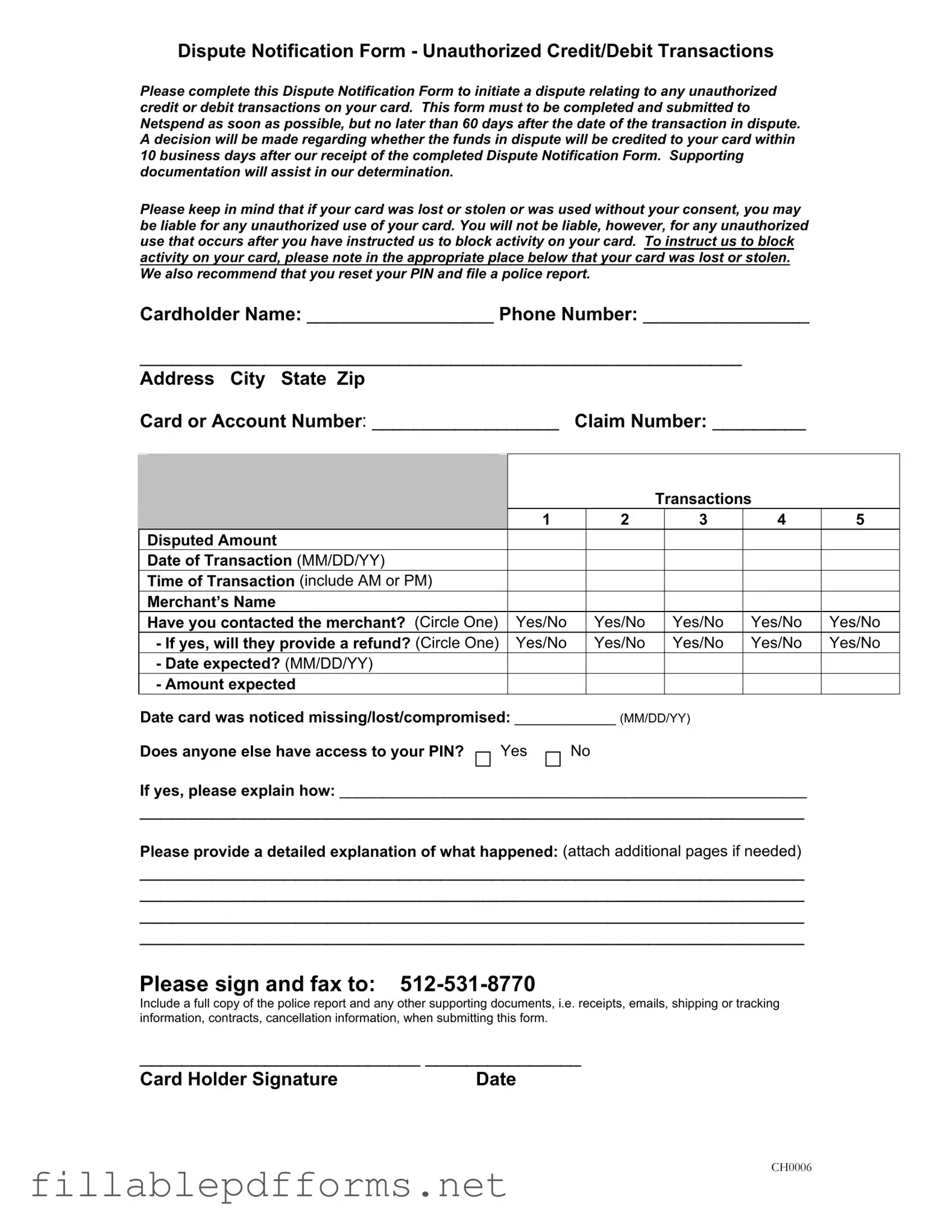

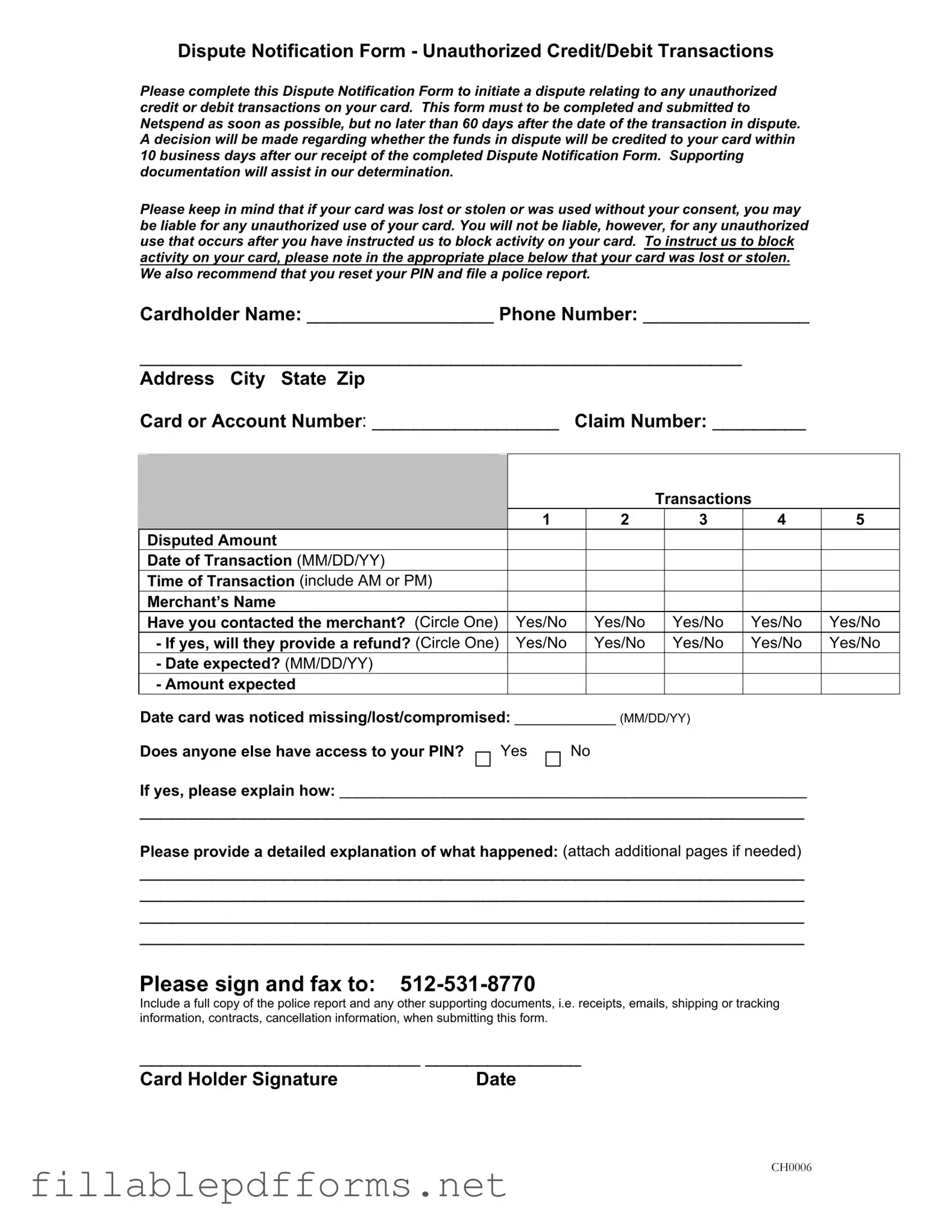

The Netspend Dispute Notification Form is a crucial document for cardholders who need to report unauthorized credit or debit transactions. By completing this form, individuals can initiate a dispute process with Netspend, ensuring that their concerns are addressed promptly. It is essential to submit the form within 60 days of the disputed transaction to facilitate a timely resolution.

Launch Editor Here

Netspend Dispute PDF Template

Launch Editor Here

Launch Editor Here

or

▼ Netspend Dispute PDF

Almost there — finish the form

Complete Netspend Dispute online fast — no printing, no scanning.