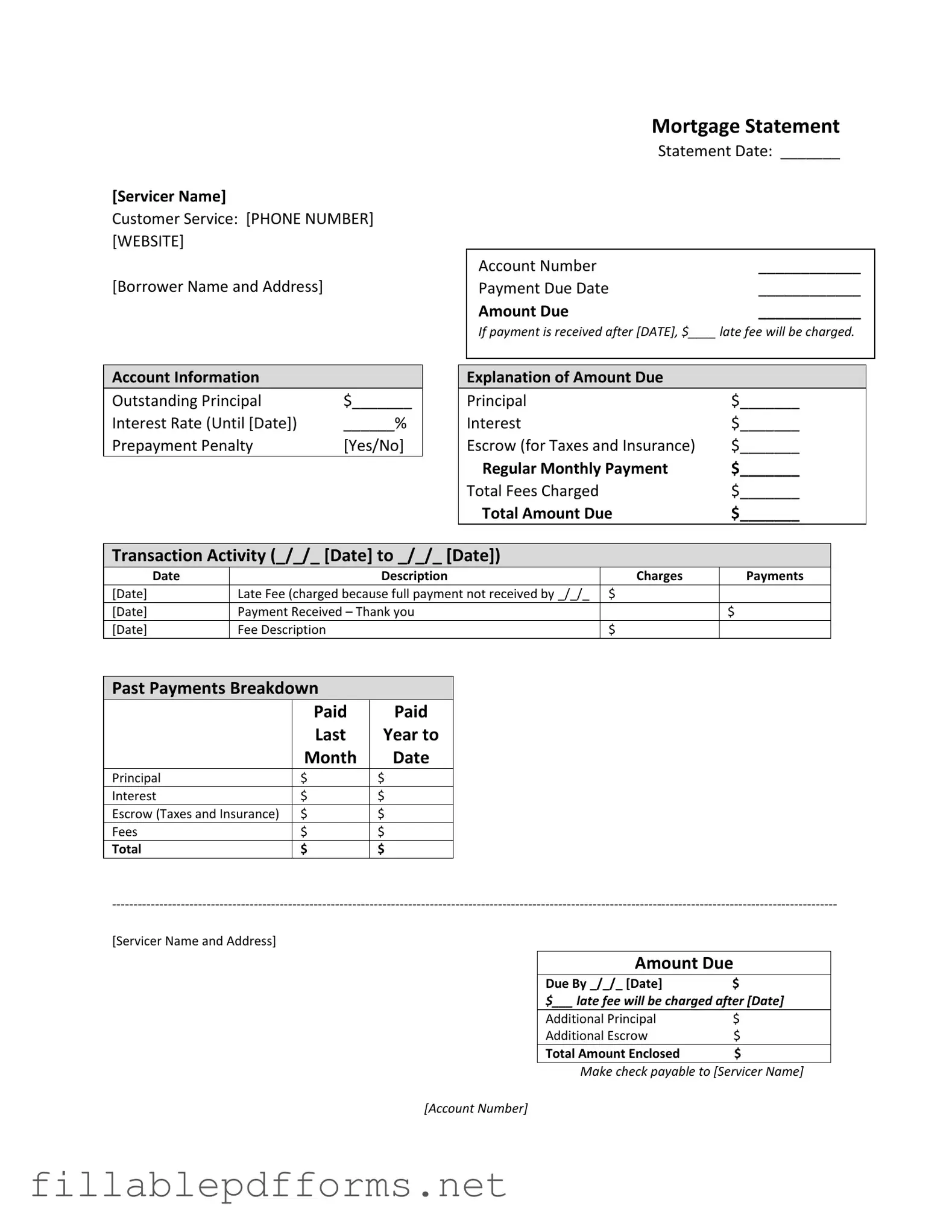

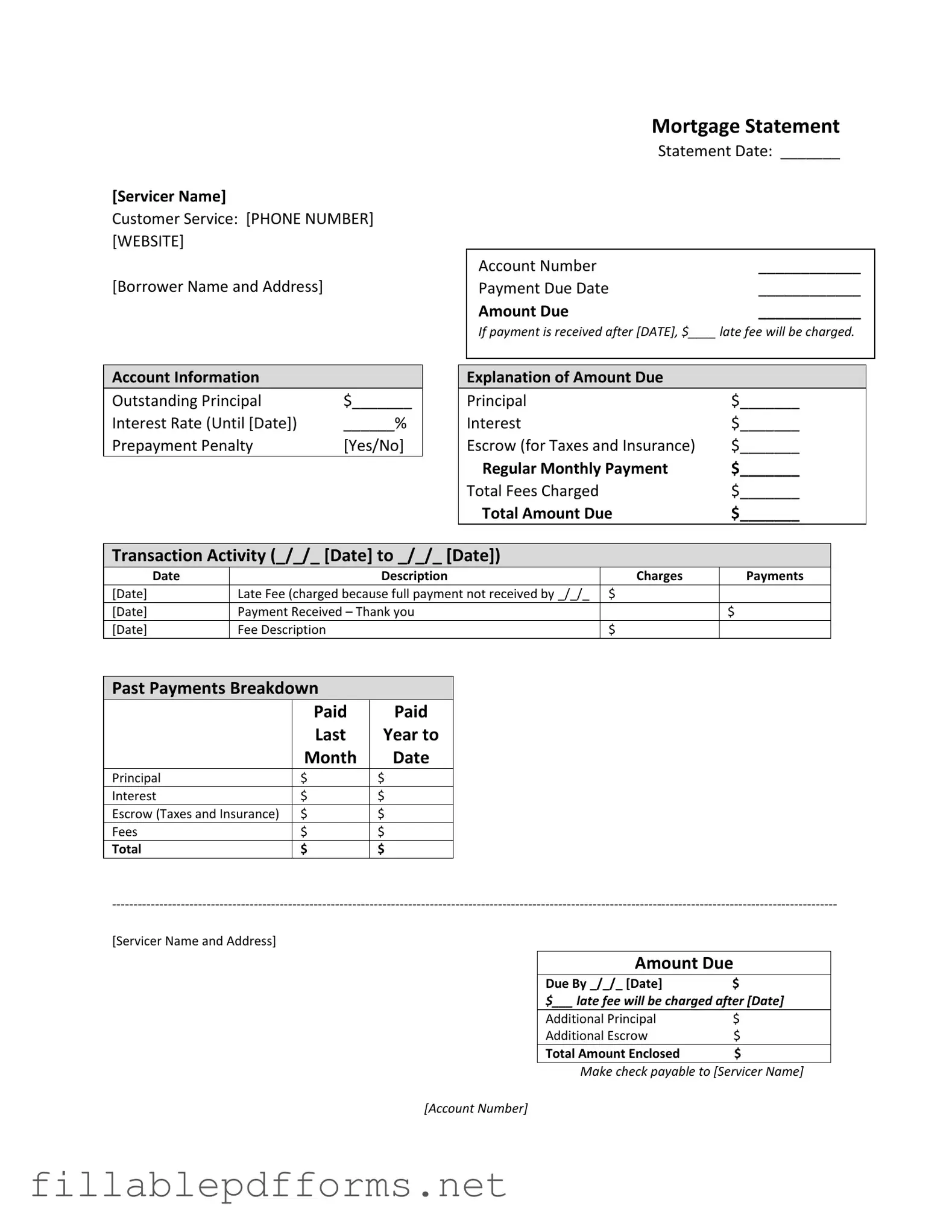

Mortgage Statement PDF Template

A Mortgage Statement is a crucial document that provides borrowers with detailed information about their mortgage loan. This form includes essential data such as the outstanding principal, interest rate, and payment history, helping homeowners understand their financial obligations. By reviewing their mortgage statement regularly, borrowers can stay informed about their account status and avoid potential pitfalls like late fees or foreclosure.

Launch Editor Here

Mortgage Statement PDF Template

Launch Editor Here

Launch Editor Here

or

▼ Mortgage Statement PDF

Almost there — finish the form

Complete Mortgage Statement online fast — no printing, no scanning.