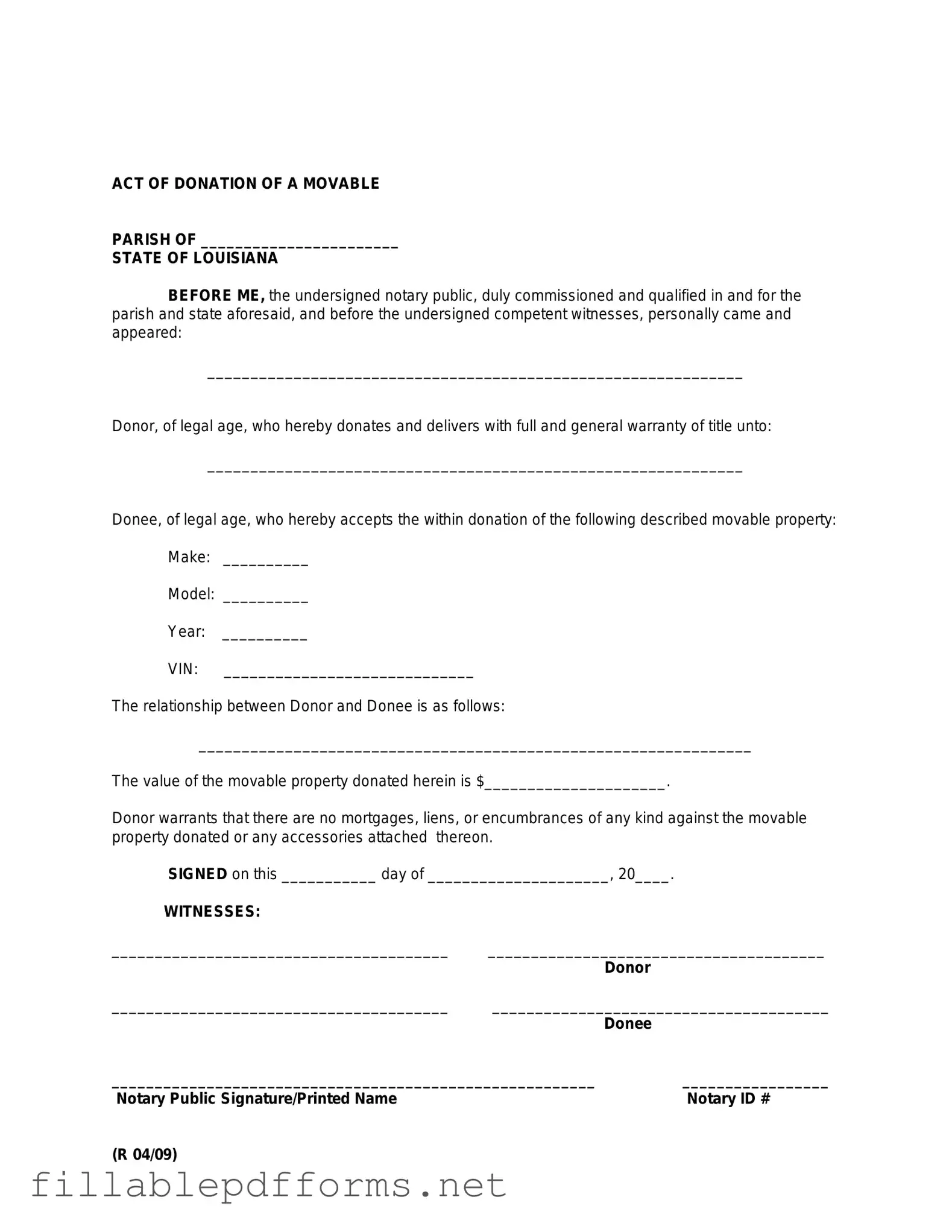

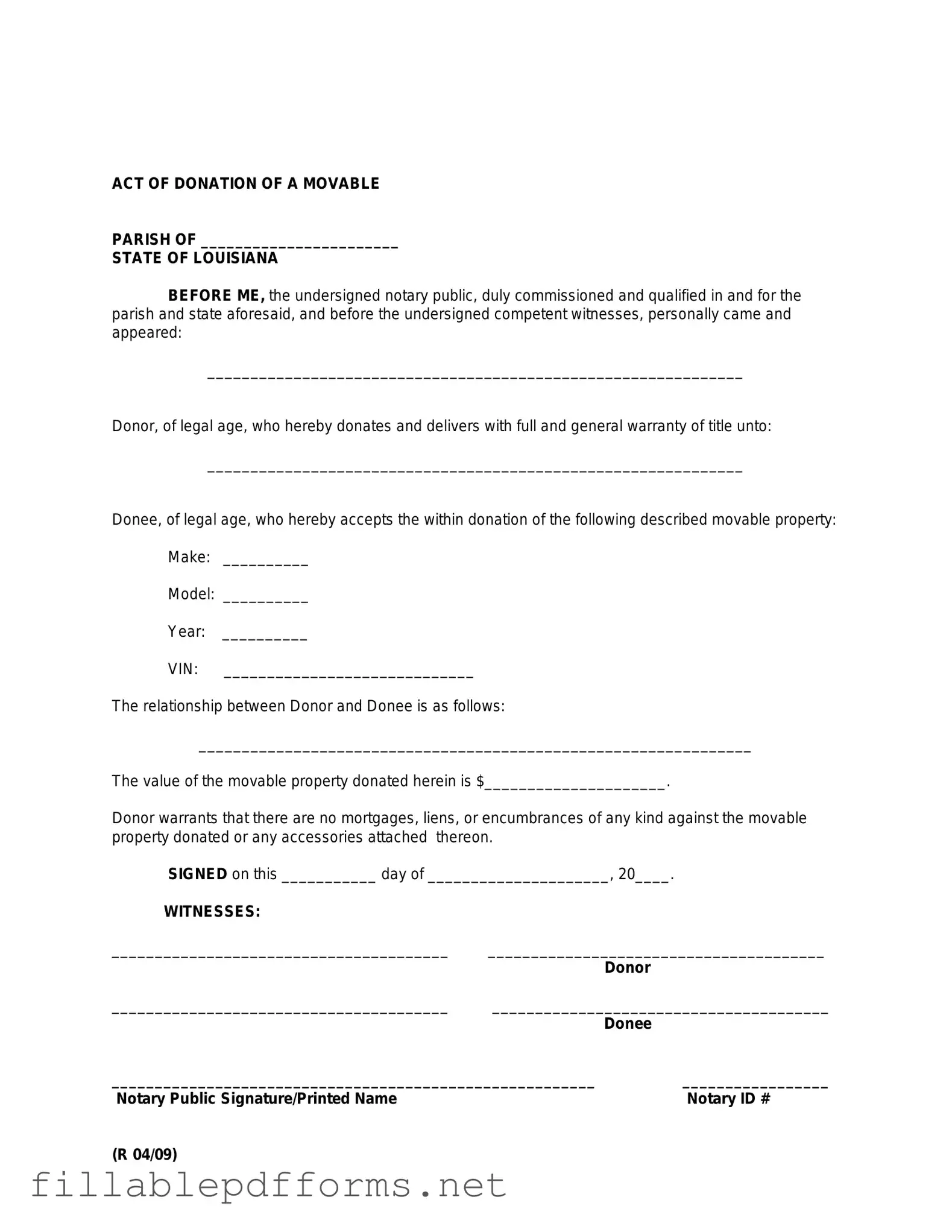

Louisiana act of donation PDF Template

The Louisiana act of donation form is a legal document used to formally transfer ownership of property or assets from one person to another without any exchange of money. This form serves as a vital tool for individuals looking to make gifts of real estate, personal property, or other valuable items. Understanding its significance can help ensure that your intentions are clearly communicated and legally recognized.

Launch Editor Here

Louisiana act of donation PDF Template

Launch Editor Here

Launch Editor Here

or

▼ Louisiana act of donation PDF

Almost there — finish the form

Complete Louisiana act of donation online fast — no printing, no scanning.