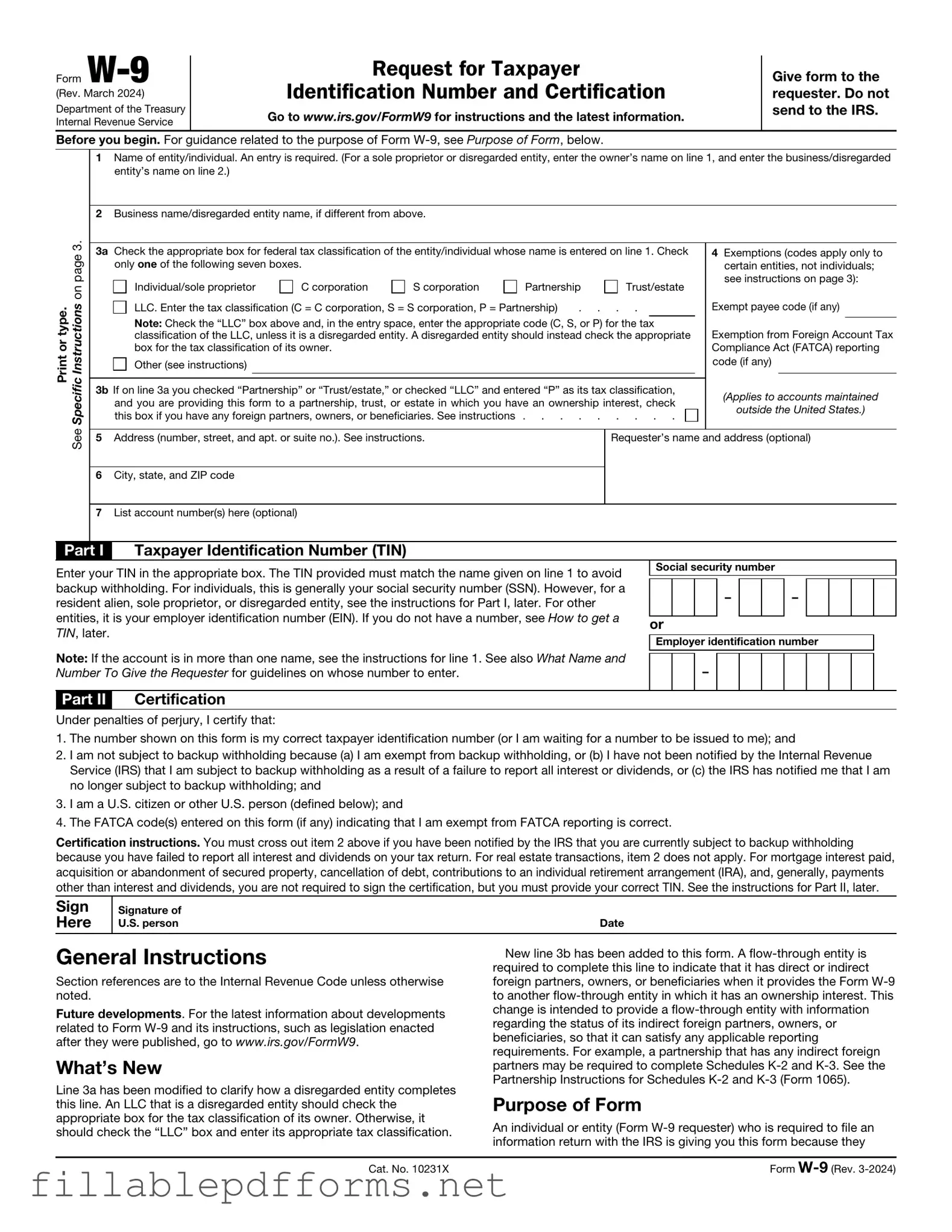

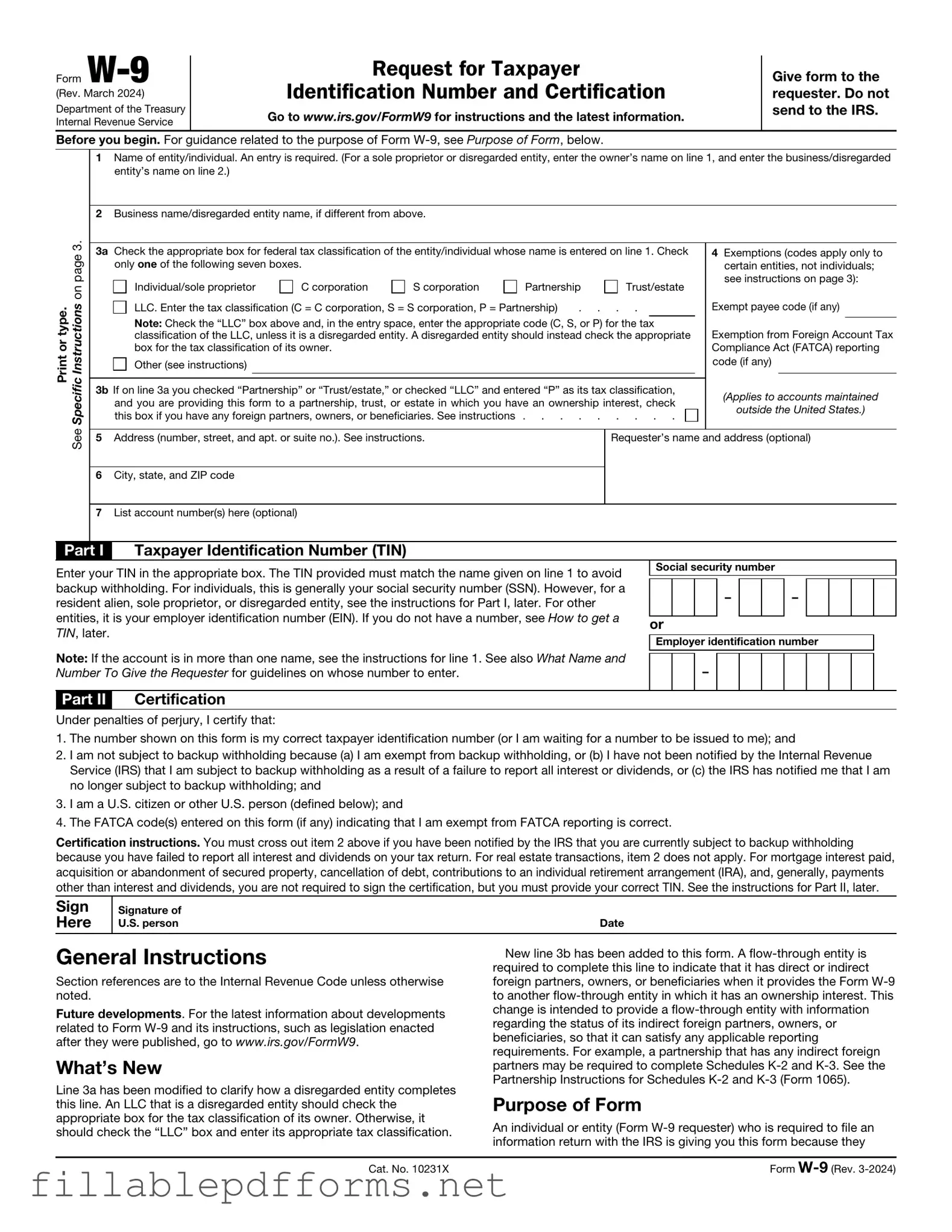

IRS W-9 PDF Template

The IRS W-9 form is a document used by individuals and businesses to provide their taxpayer identification information to others, typically for tax reporting purposes. Completing this form accurately is essential to ensure proper reporting of income to the Internal Revenue Service. Understanding how to fill out the W-9 can help avoid potential tax issues down the line.

Launch Editor Here

IRS W-9 PDF Template

Launch Editor Here

Launch Editor Here

or

▼ IRS W-9 PDF

Almost there — finish the form

Complete IRS W-9 online fast — no printing, no scanning.