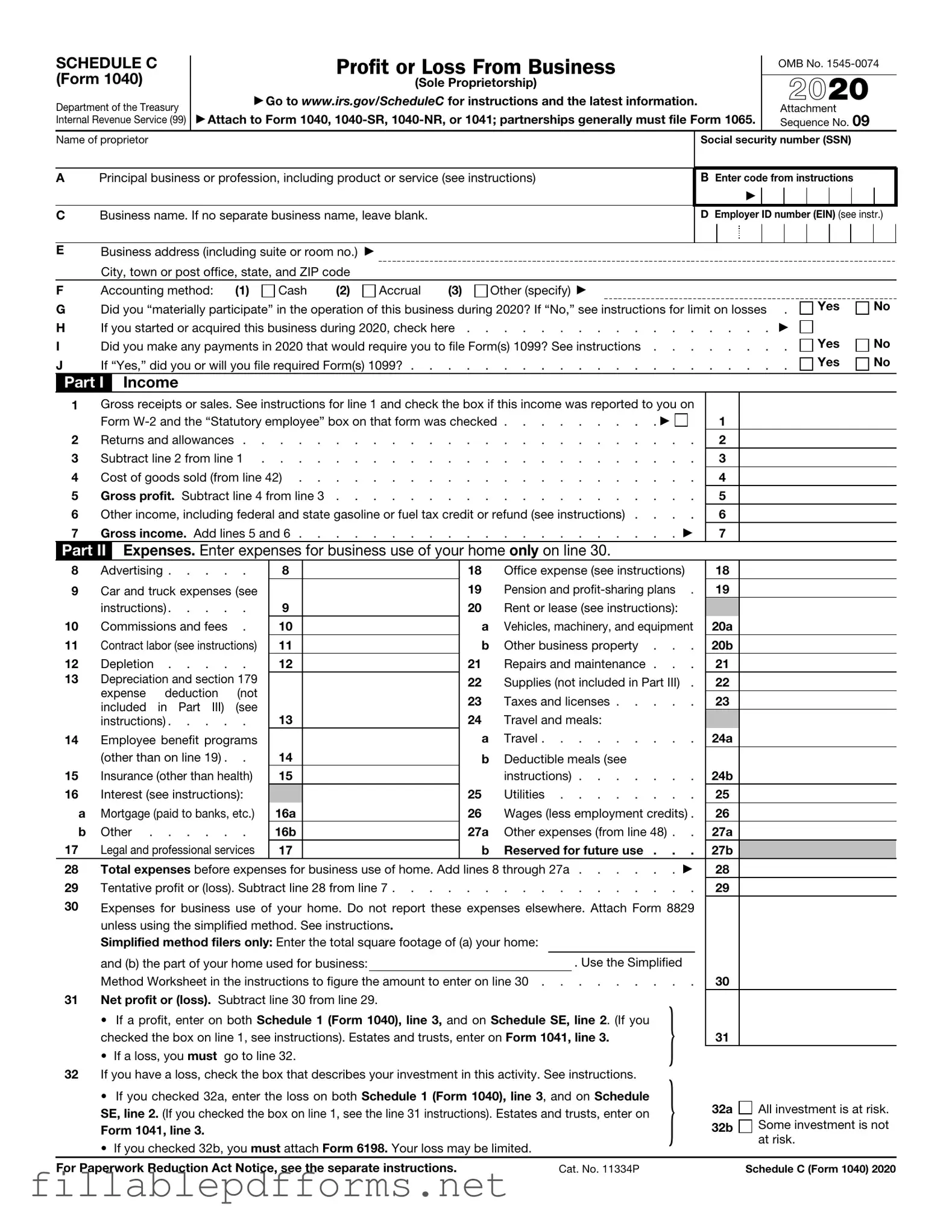

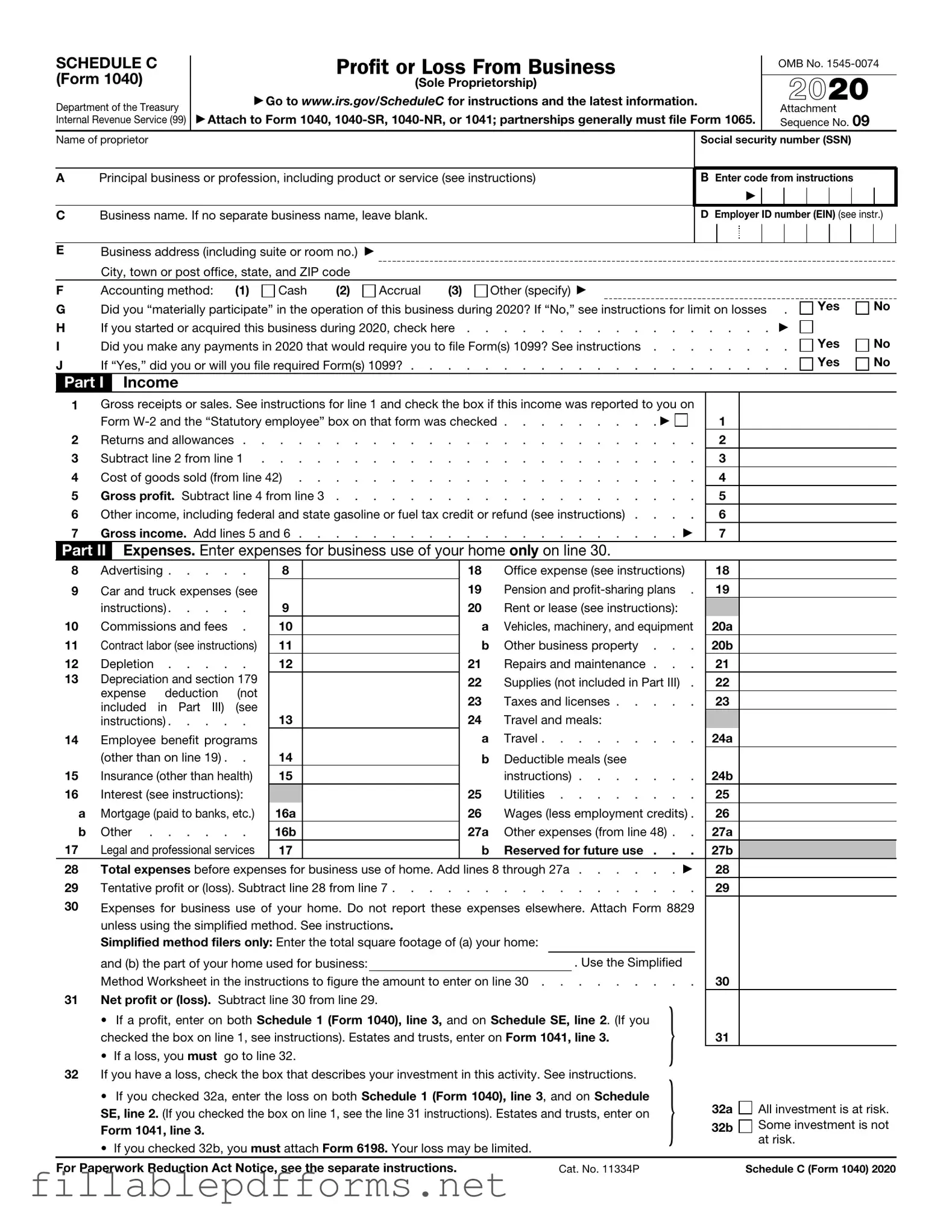

IRS Schedule C 1040 PDF Template

The IRS Schedule C (Form 1040) is a tax form used by sole proprietors to report income or loss from their business activities. This form allows individuals to detail their earnings and expenses, providing a clear picture of their business's financial health. Understanding how to accurately complete Schedule C is essential for ensuring compliance with tax obligations and maximizing potential deductions.

Launch Editor Here

IRS Schedule C 1040 PDF Template

Launch Editor Here

Launch Editor Here

or

▼ IRS Schedule C 1040 PDF

Almost there — finish the form

Complete IRS Schedule C 1040 online fast — no printing, no scanning.