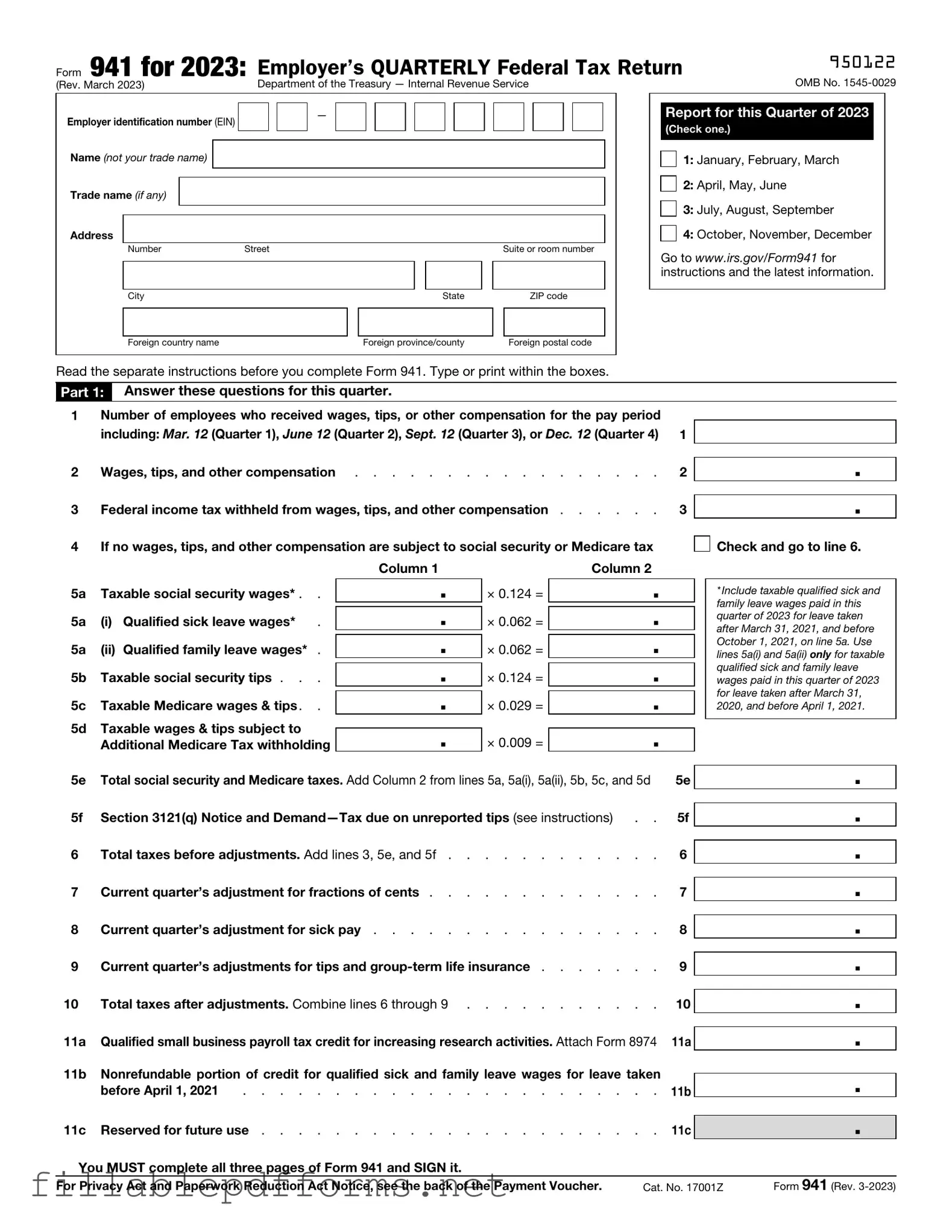

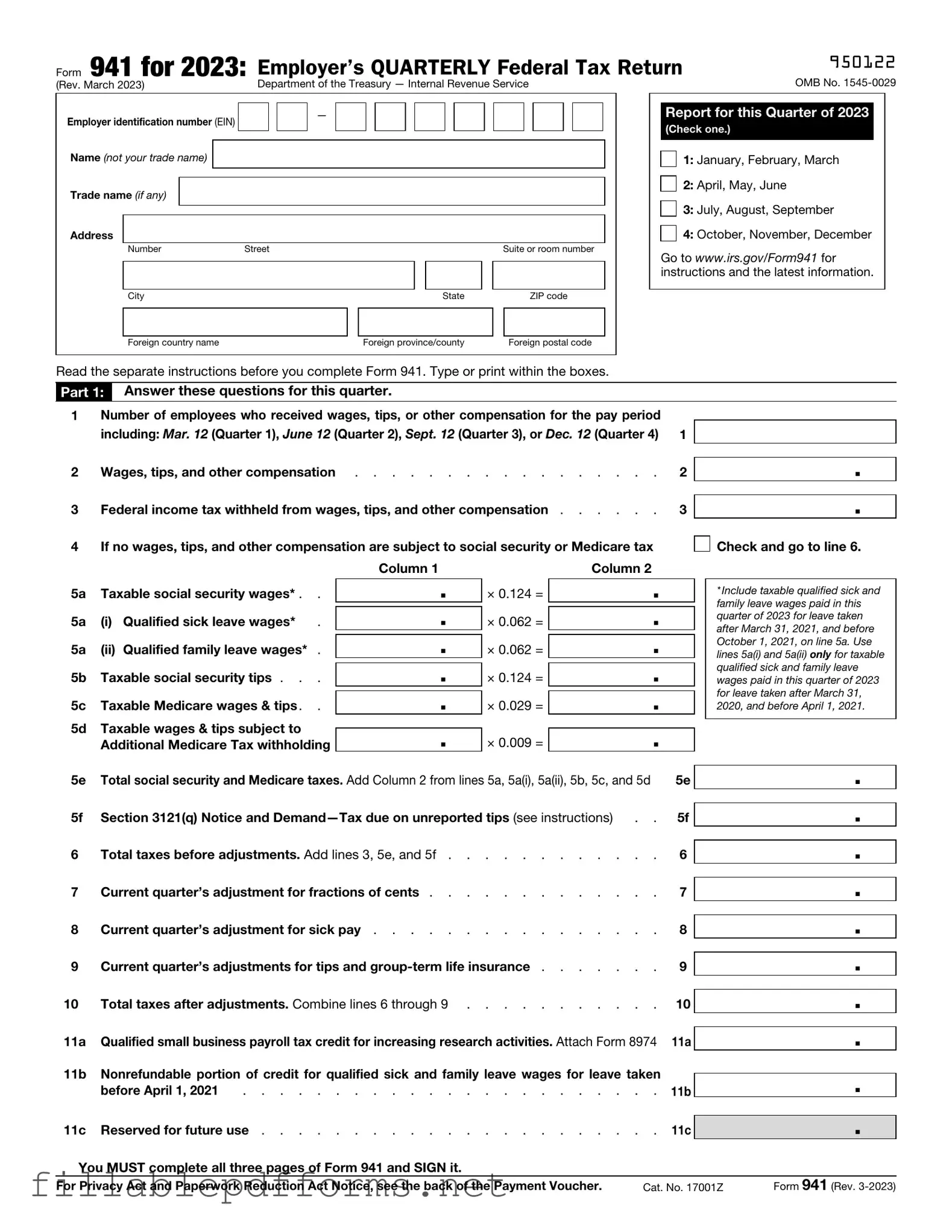

IRS 941 PDF Template

The IRS Form 941 is a quarterly tax form that employers use to report income taxes, Social Security tax, and Medicare tax withheld from employee wages. This form also helps employers calculate their share of Social Security and Medicare taxes. Understanding how to complete and file Form 941 is essential for compliance with federal tax obligations.

Launch Editor Here

IRS 941 PDF Template

Launch Editor Here

Launch Editor Here

or

▼ IRS 941 PDF

Almost there — finish the form

Complete IRS 941 online fast — no printing, no scanning.