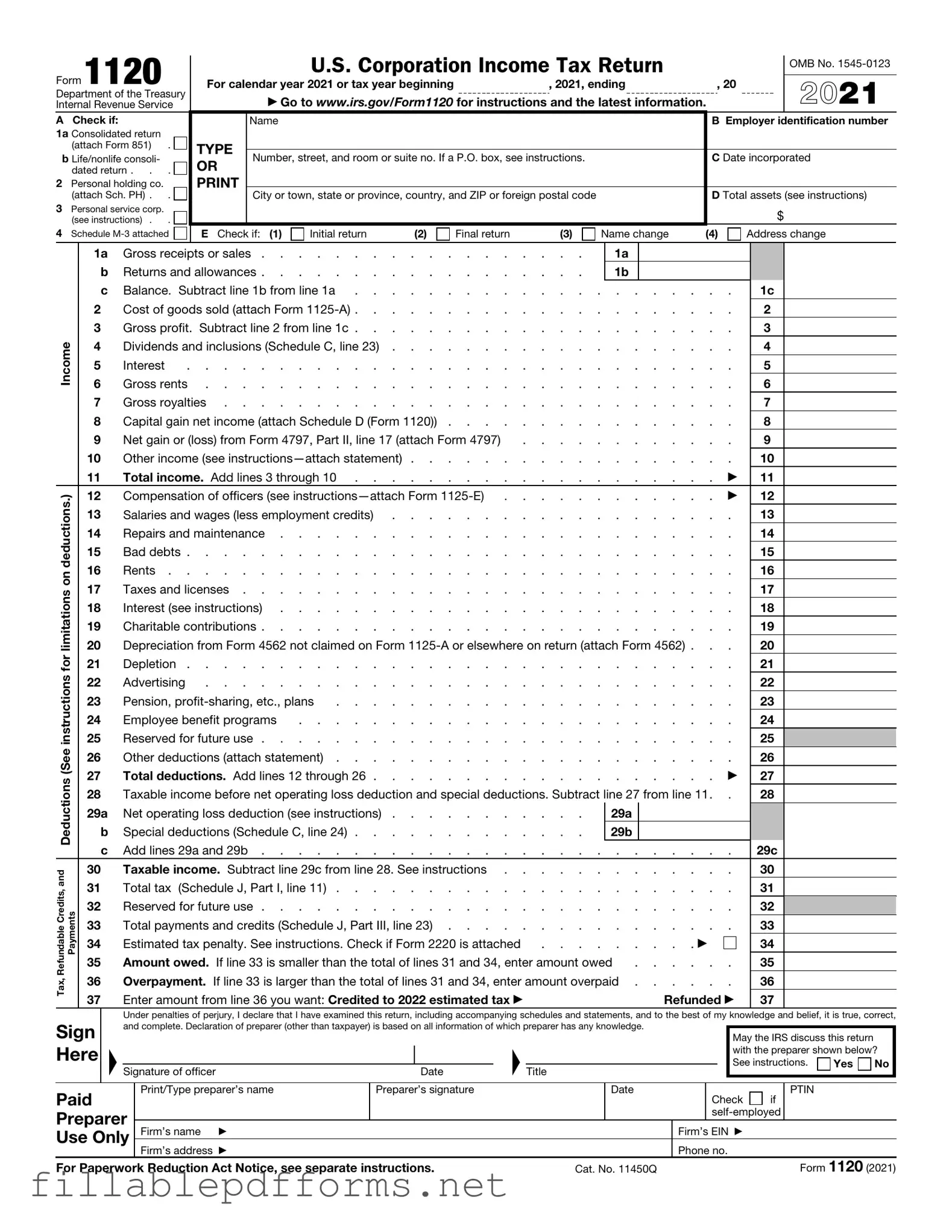

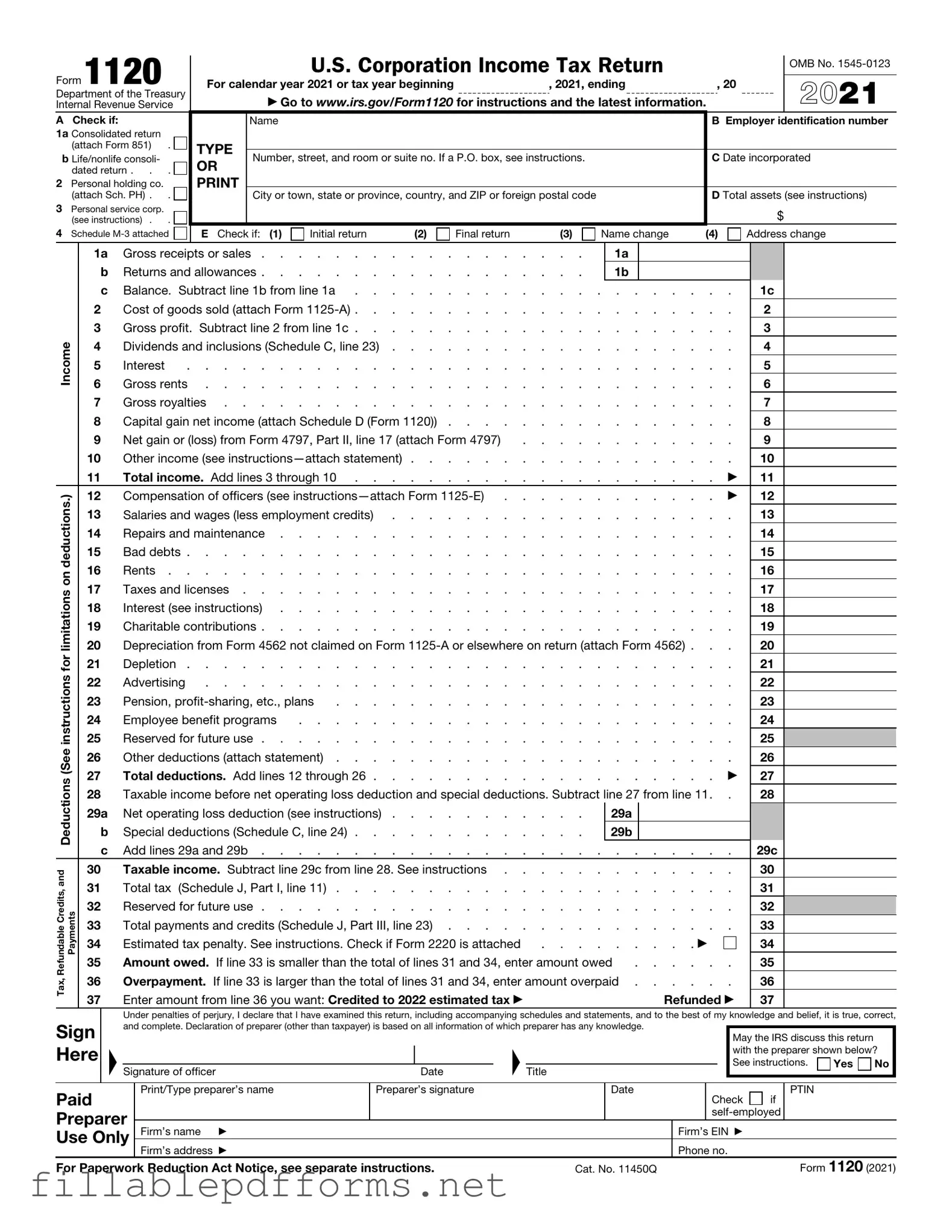

IRS 1120 PDF Template

The IRS 1120 form is a tax return used by corporations to report their income, gains, losses, deductions, and credits. This form plays a crucial role in determining a corporation's tax liability. Understanding how to properly complete and file the 1120 form can help businesses navigate their tax obligations effectively.

Launch Editor Here

IRS 1120 PDF Template

Launch Editor Here

Launch Editor Here

or

▼ IRS 1120 PDF

Almost there — finish the form

Complete IRS 1120 online fast — no printing, no scanning.