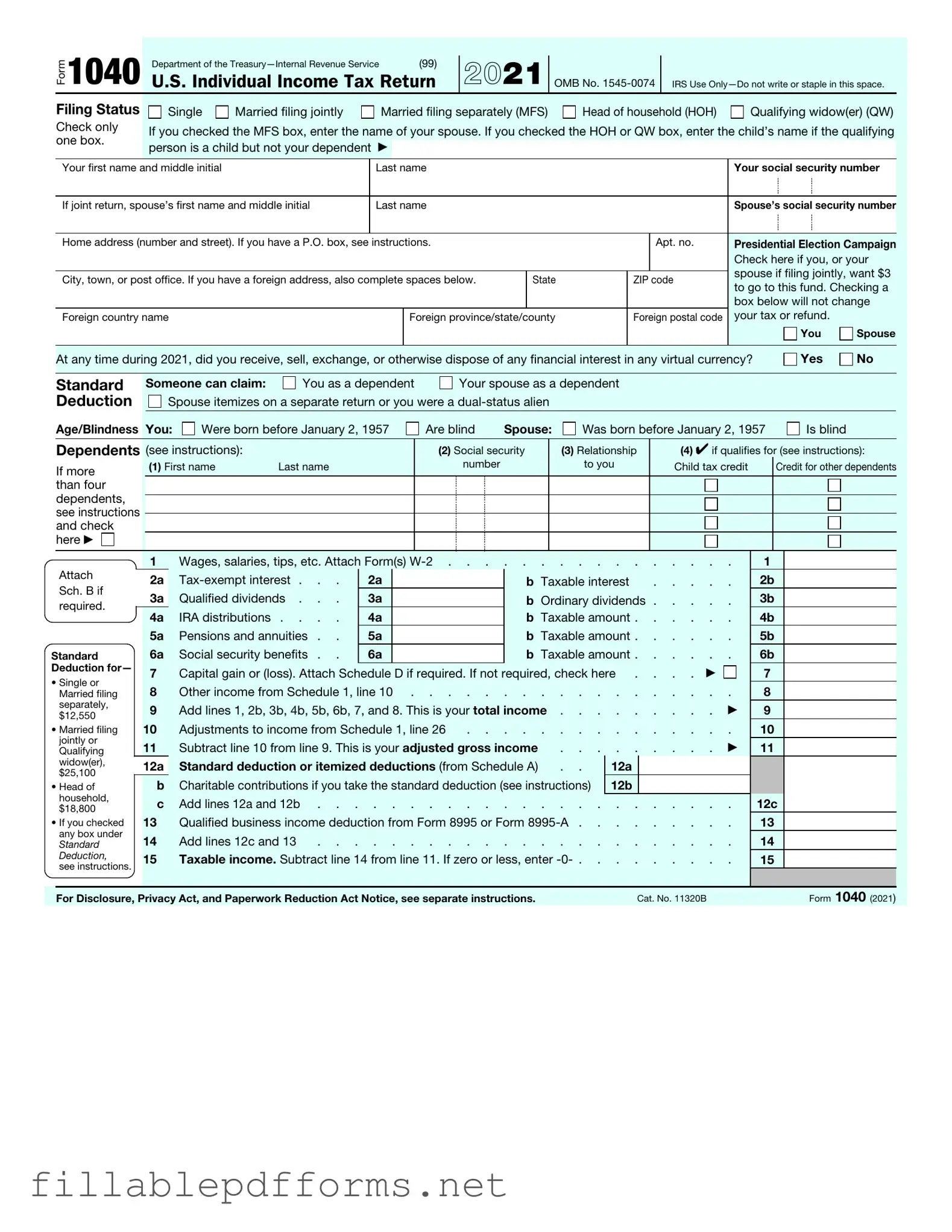

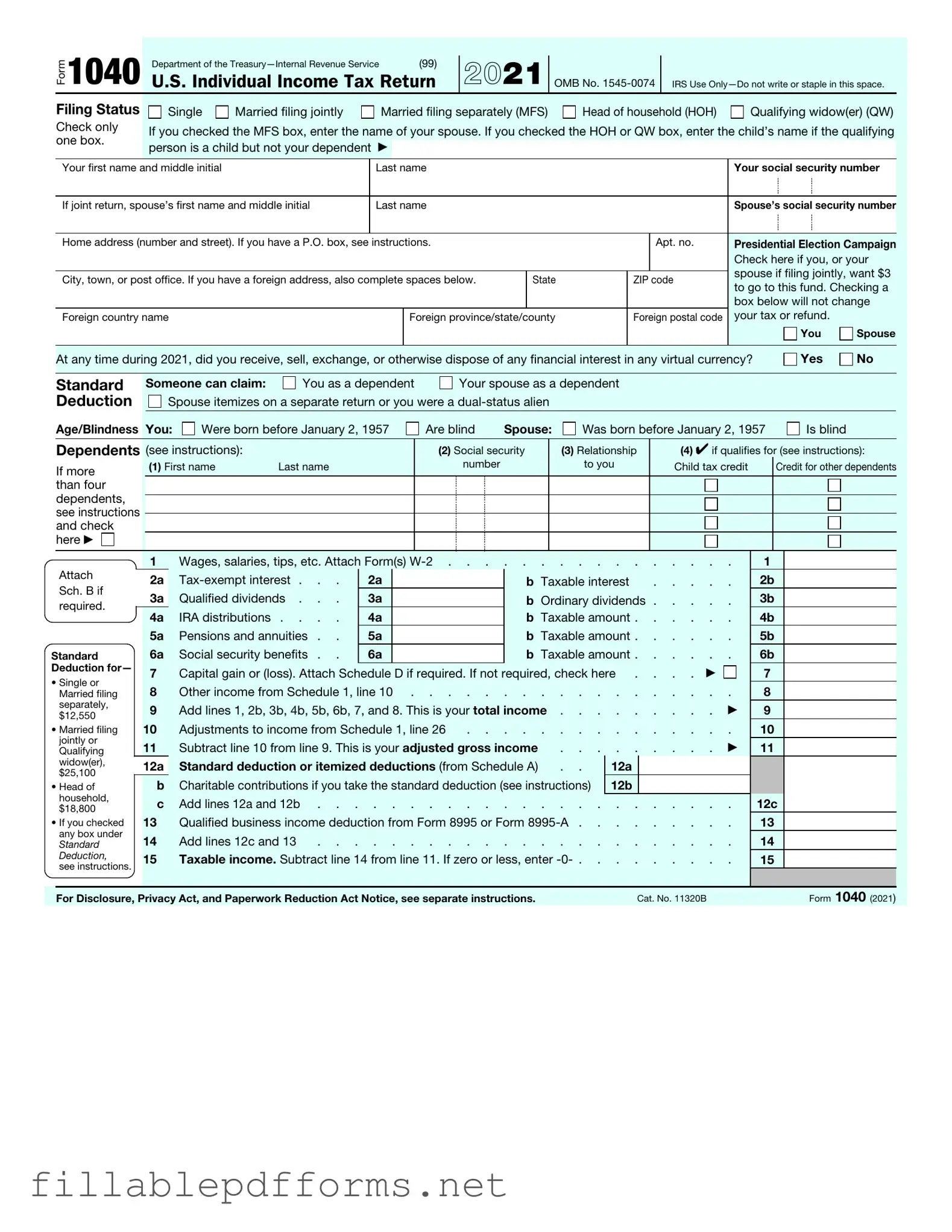

IRS 1040 PDF Template

The IRS 1040 form is the standard individual income tax return used by U.S. taxpayers to report their annual income and calculate their tax liability. This form allows individuals to detail their earnings, claim deductions, and determine any tax refunds or payments owed. Understanding the 1040 form is essential for accurate tax filing and compliance with federal tax laws.

Launch Editor Here

IRS 1040 PDF Template

Launch Editor Here

Launch Editor Here

or

▼ IRS 1040 PDF

Almost there — finish the form

Complete IRS 1040 online fast — no printing, no scanning.