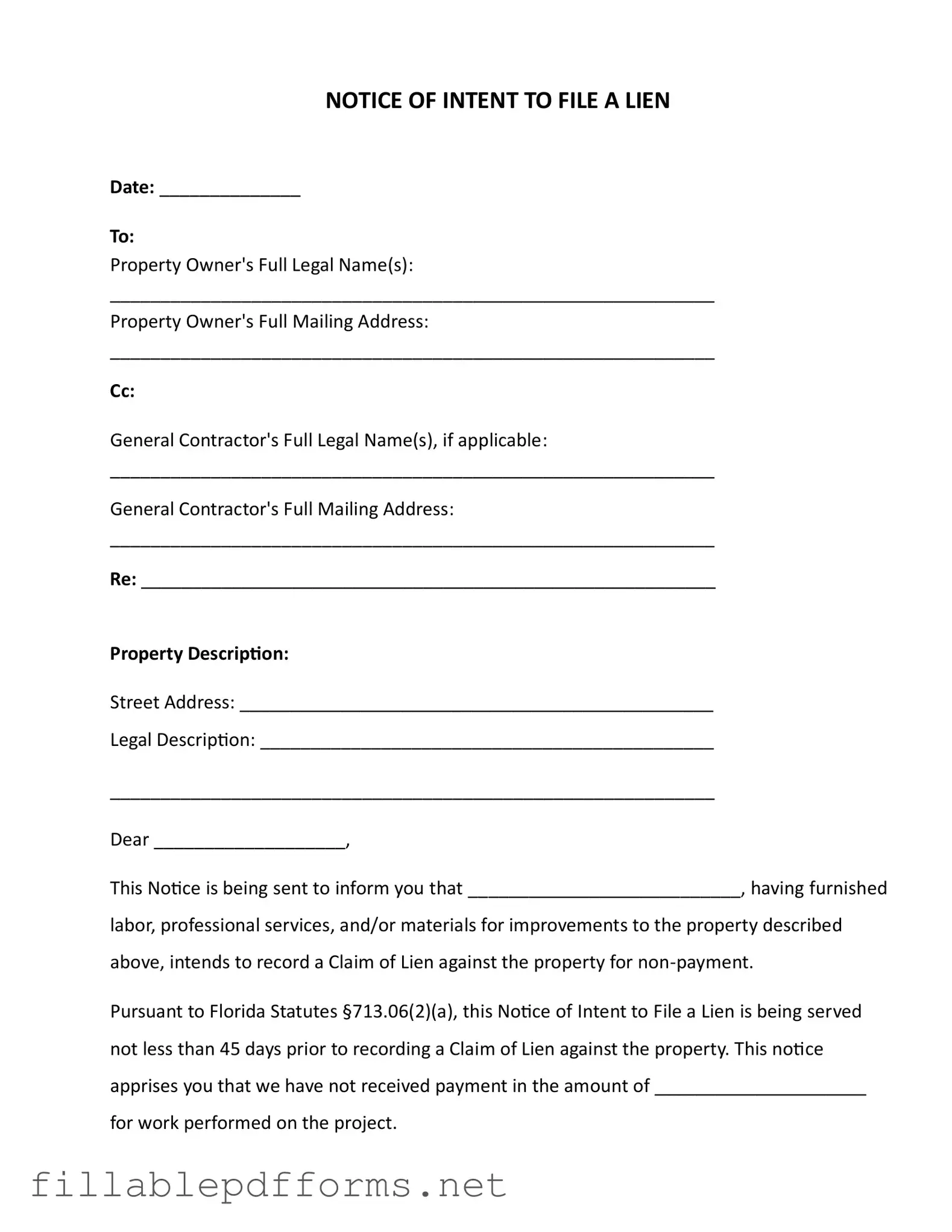

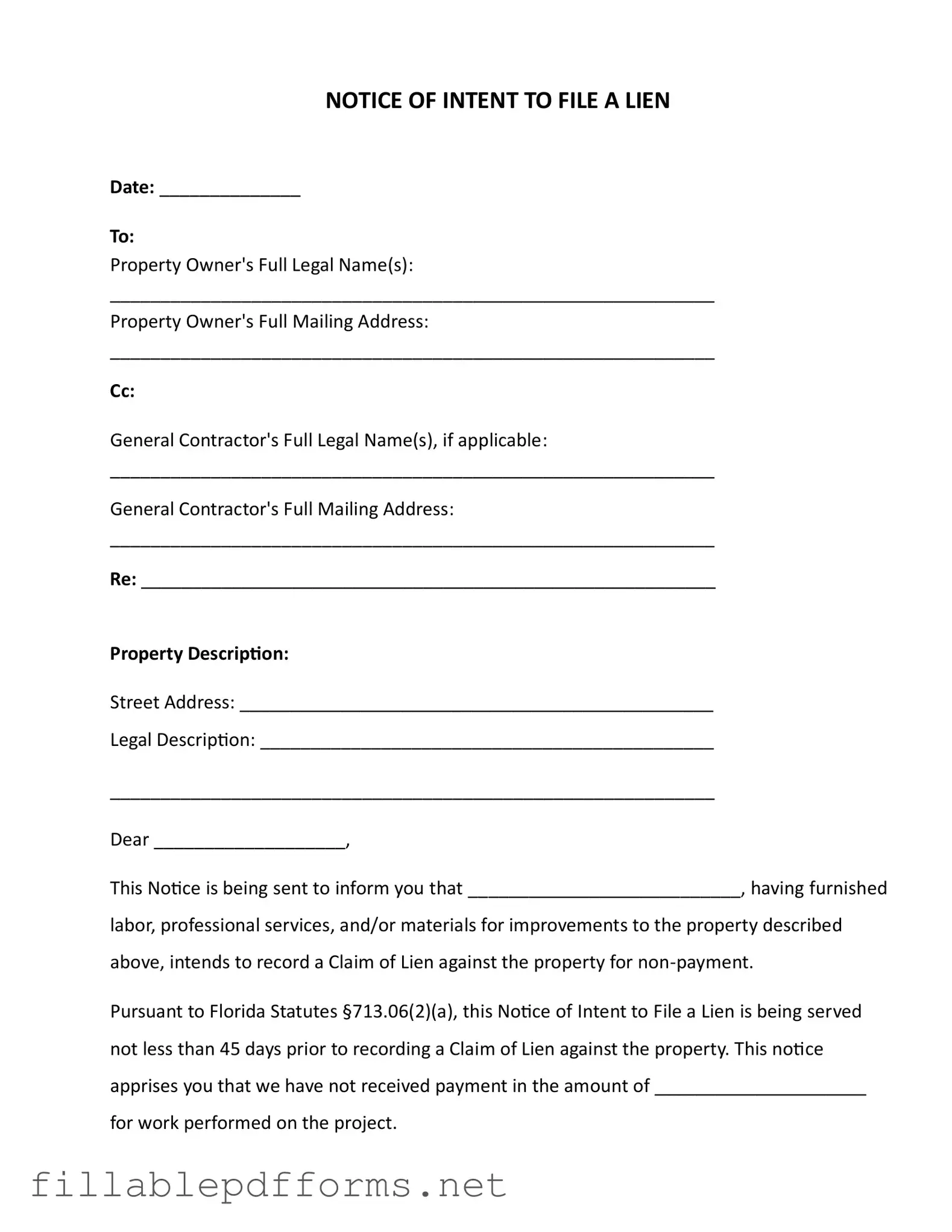

Intent To Lien Florida PDF Template

The Intent To Lien Florida form is a legal document used to notify property owners of an impending lien against their property due to non-payment for services rendered or materials supplied. This form serves as a formal warning, allowing property owners the opportunity to address outstanding payments before a lien is officially recorded. Understanding this process is crucial, as failure to respond appropriately can lead to serious financial consequences, including foreclosure proceedings.

Launch Editor Here

Intent To Lien Florida PDF Template

Launch Editor Here

Launch Editor Here

or

▼ Intent To Lien Florida PDF

Almost there — finish the form

Complete Intent To Lien Florida online fast — no printing, no scanning.