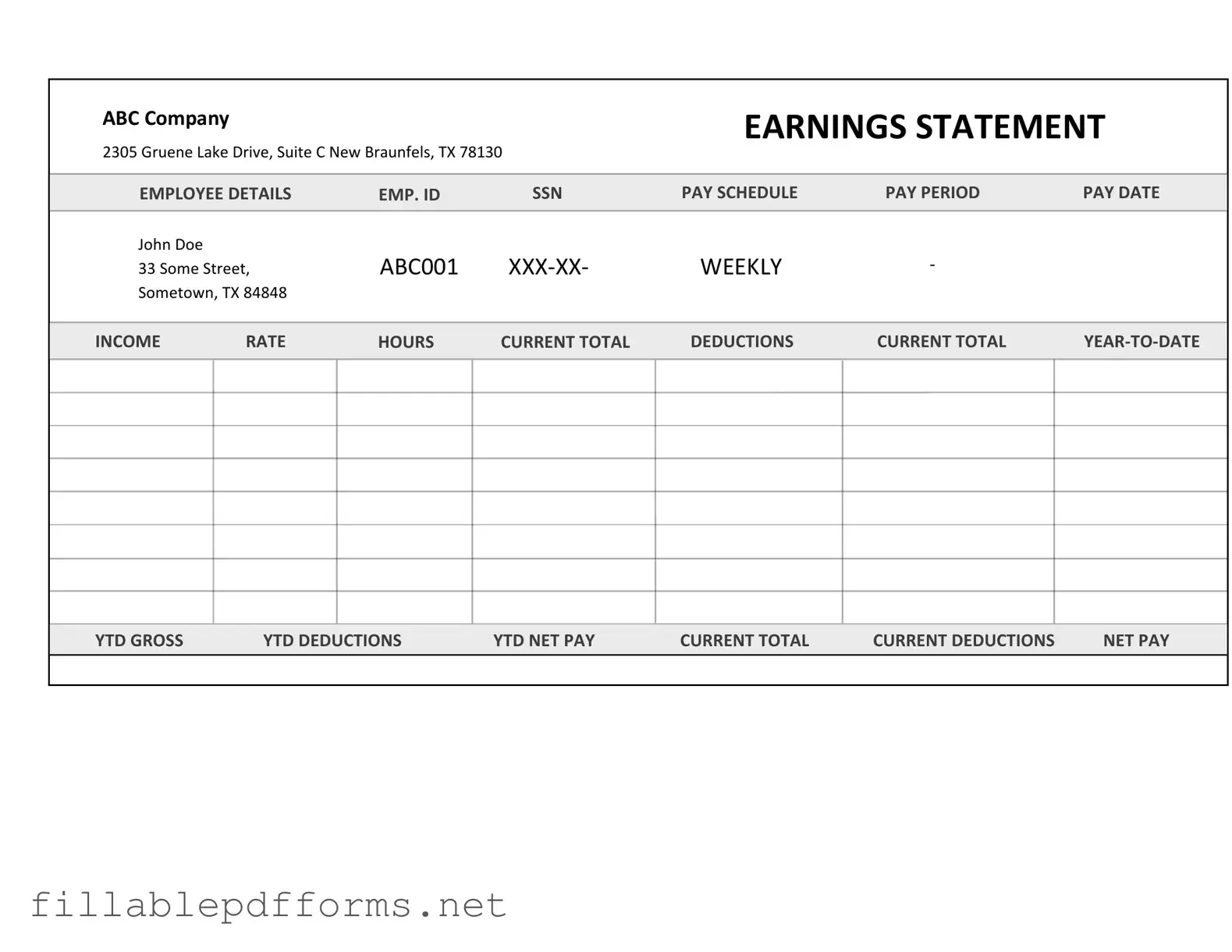

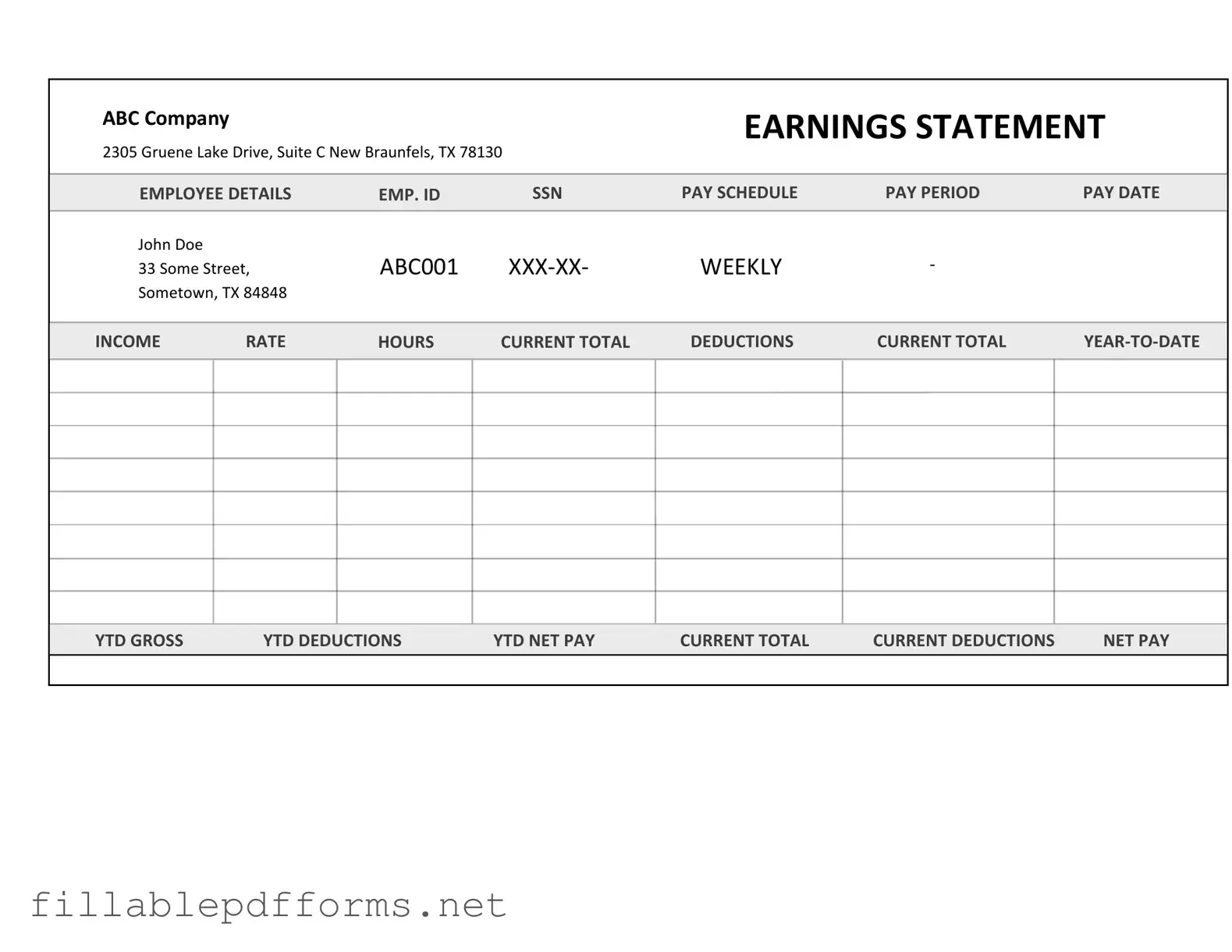

Independent Contractor Pay Stub PDF Template

The Independent Contractor Pay Stub form is a document that provides a detailed breakdown of payments made to independent contractors for their services. This form serves as a record of earnings, deductions, and any applicable taxes, ensuring transparency in financial transactions. Understanding this form is essential for both contractors and businesses to maintain accurate financial records and comply with tax regulations.

Launch Editor Here

Independent Contractor Pay Stub PDF Template

Launch Editor Here

Launch Editor Here

or

▼ Independent Contractor Pay Stub PDF

Almost there — finish the form

Complete Independent Contractor Pay Stub online fast — no printing, no scanning.