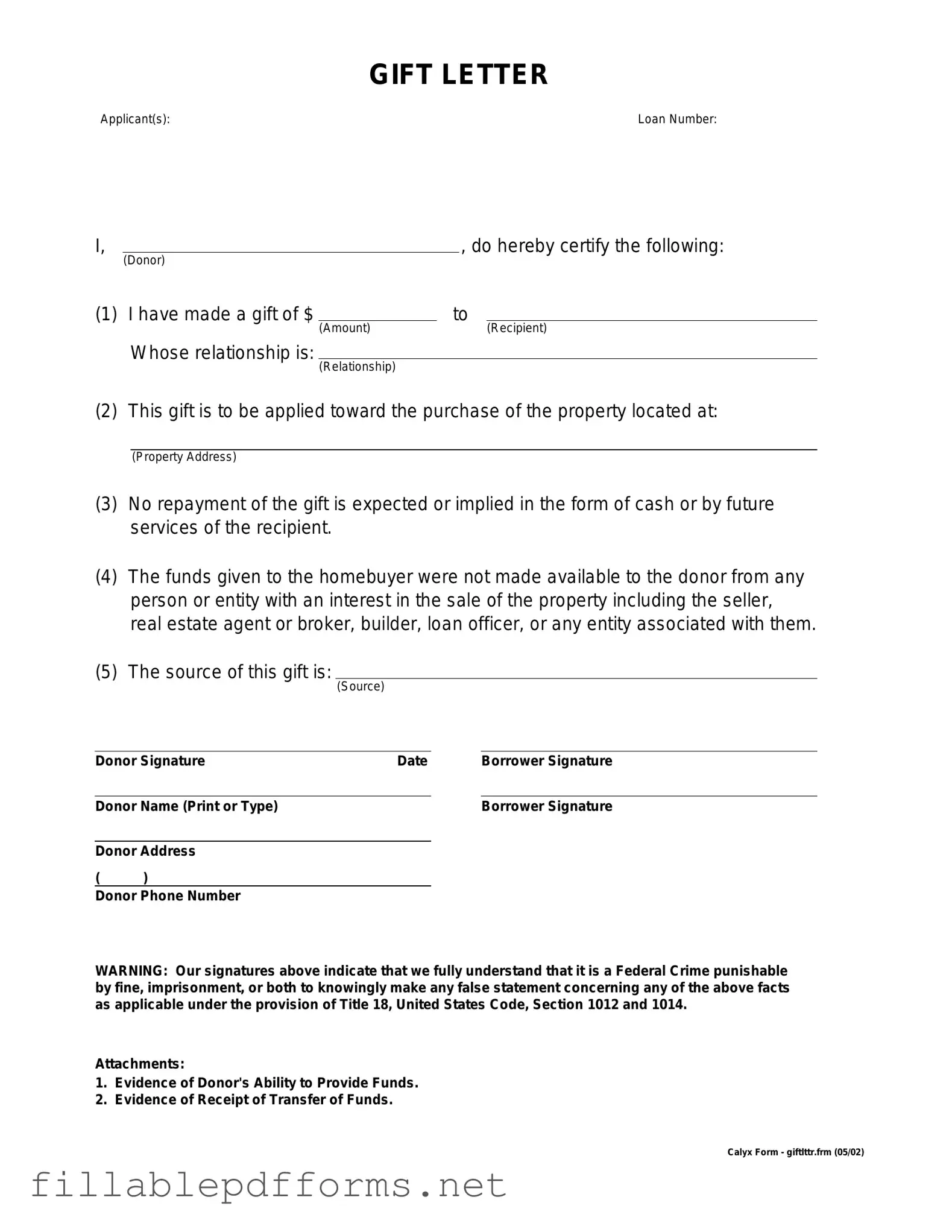

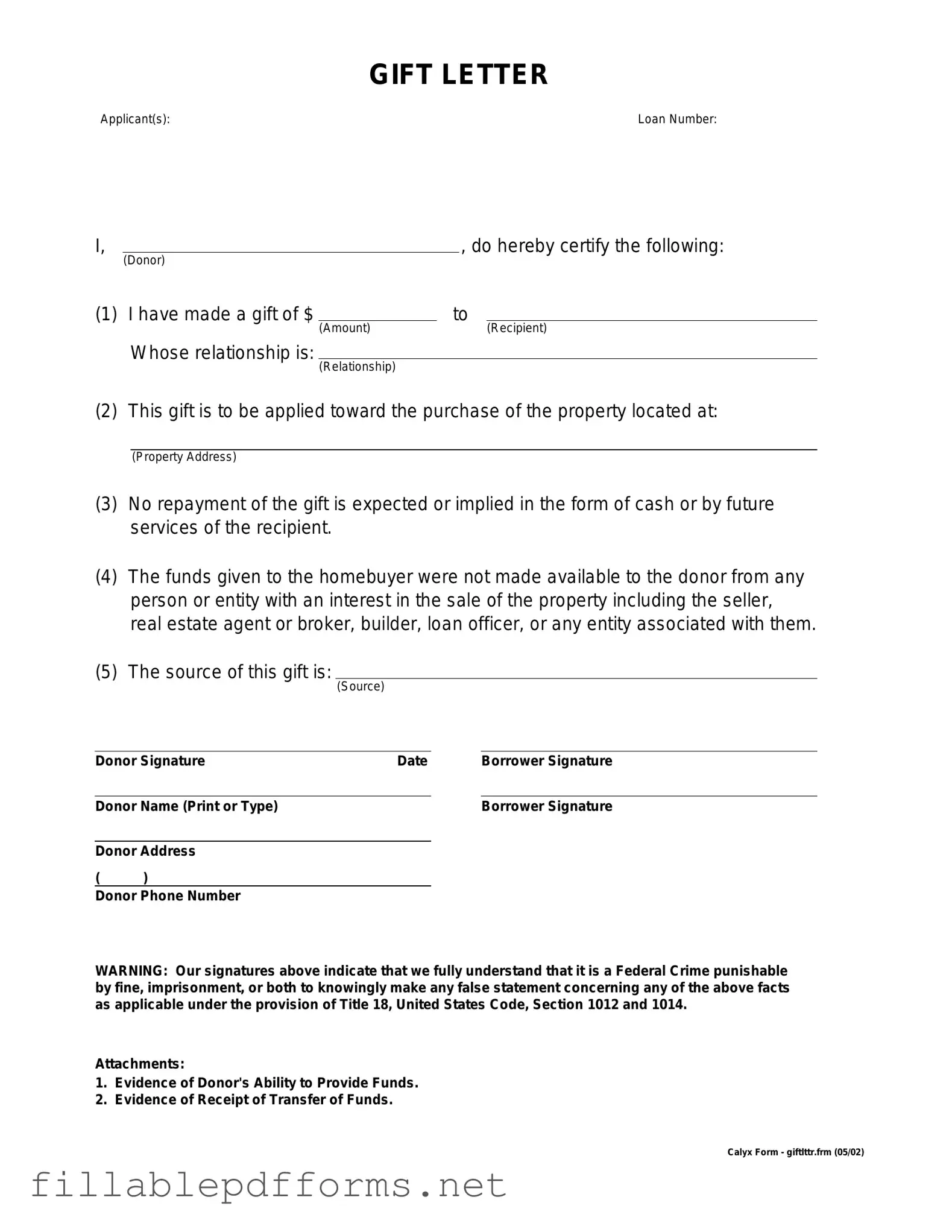

Gift Letter PDF Template

The Gift Letter form is a document used to confirm that a monetary gift has been given to an individual, often for purposes such as purchasing a home. This form serves as proof that the funds are indeed a gift and not a loan, which can be crucial when applying for a mortgage. Understanding its importance can help ensure a smooth transaction and avoid potential complications down the road.

Launch Editor Here

Gift Letter PDF Template

Launch Editor Here

Launch Editor Here

or

▼ Gift Letter PDF

Almost there — finish the form

Complete Gift Letter online fast — no printing, no scanning.