Generic Direct Deposit PDF Template

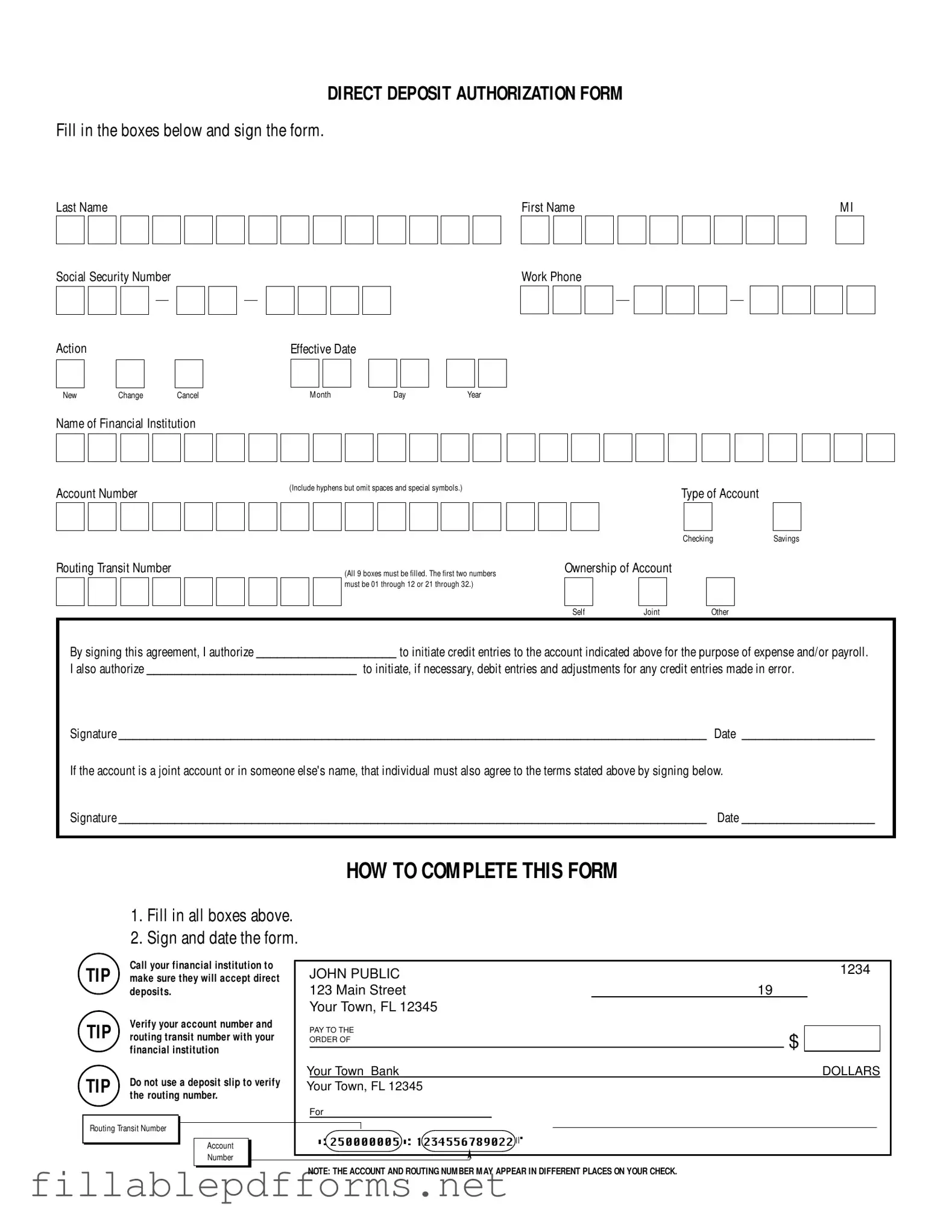

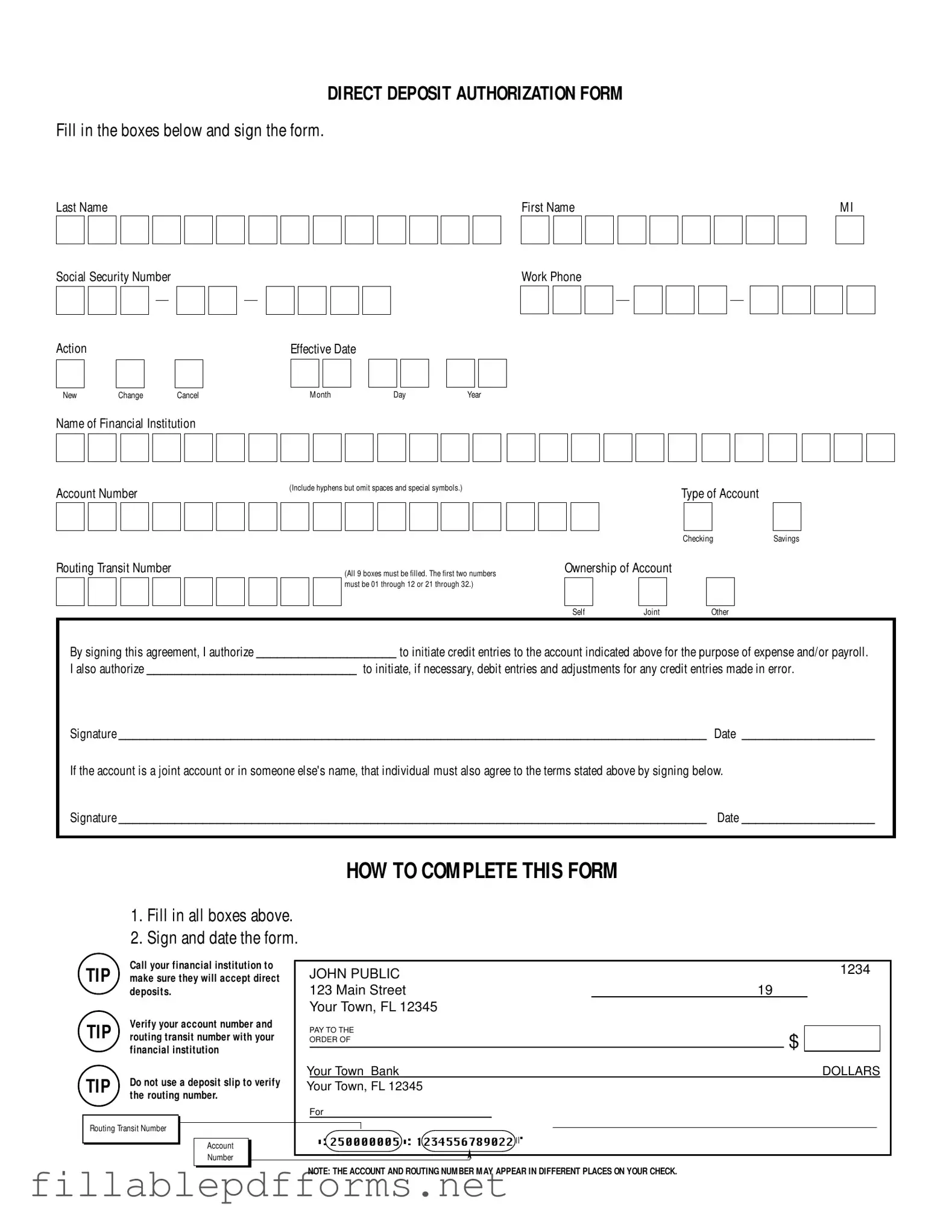

The Generic Direct Deposit Authorization Form is a document that allows individuals to authorize their employer or another entity to deposit funds directly into their bank account. Completing this form ensures timely payments, whether for payroll or other expenses, while providing a secure and convenient way to manage finances. Properly filling out this form is essential to avoid delays in receiving funds.

Launch Editor Here

Generic Direct Deposit PDF Template

Launch Editor Here

Launch Editor Here

or

▼ Generic Direct Deposit PDF

Almost there — finish the form

Complete Generic Direct Deposit online fast — no printing, no scanning.