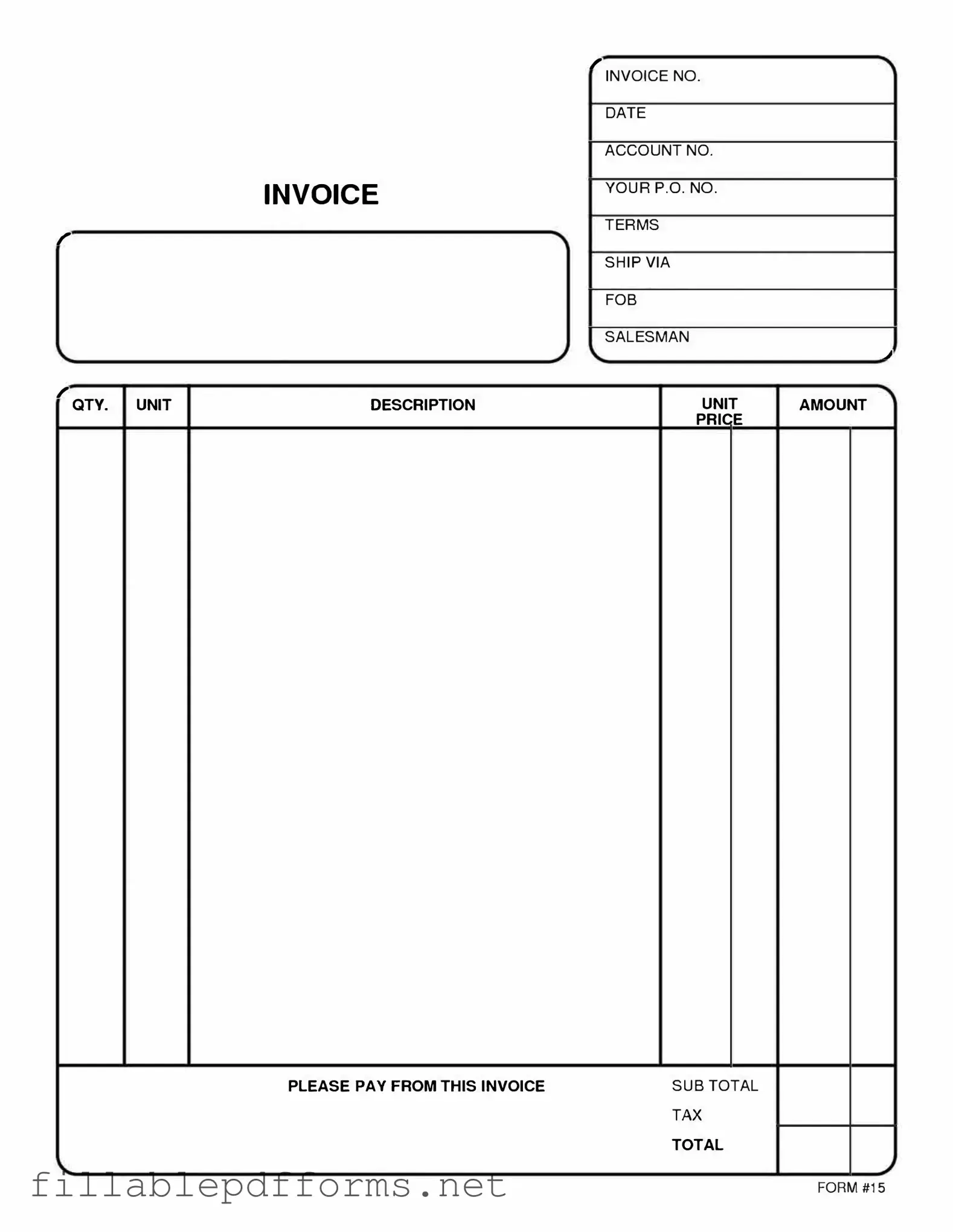

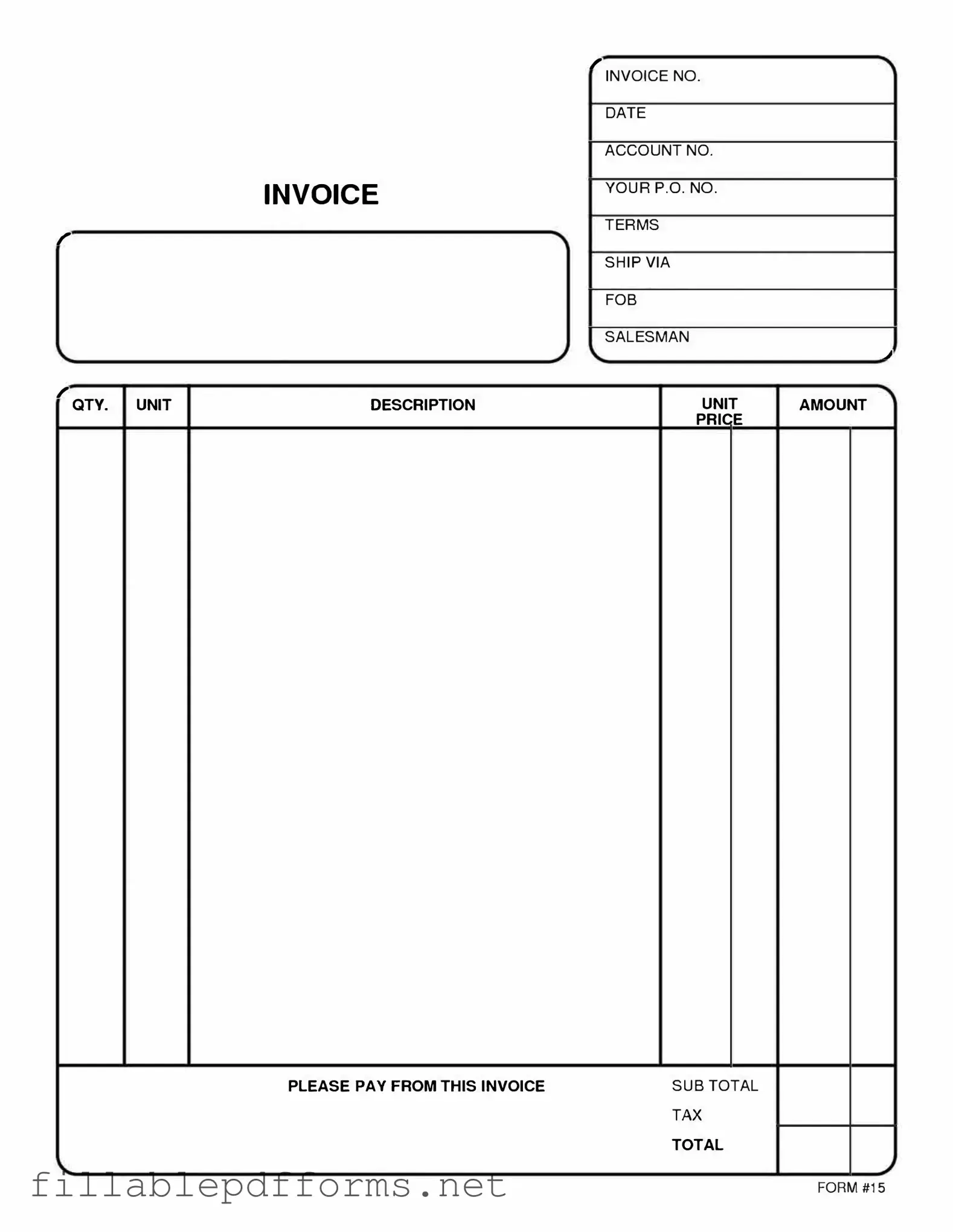

Free And Invoice Pdf PDF Template

The Free And Invoice PDF form is a versatile document designed to streamline the invoicing process for businesses and freelancers alike. This form allows users to create professional invoices quickly and efficiently, ensuring that all necessary information is clearly presented. With its user-friendly format, it simplifies billing and helps maintain accurate financial records.

Launch Editor Here

Free And Invoice Pdf PDF Template

Launch Editor Here

Launch Editor Here

or

▼ Free And Invoice Pdf PDF

Almost there — finish the form

Complete Free And Invoice Pdf online fast — no printing, no scanning.