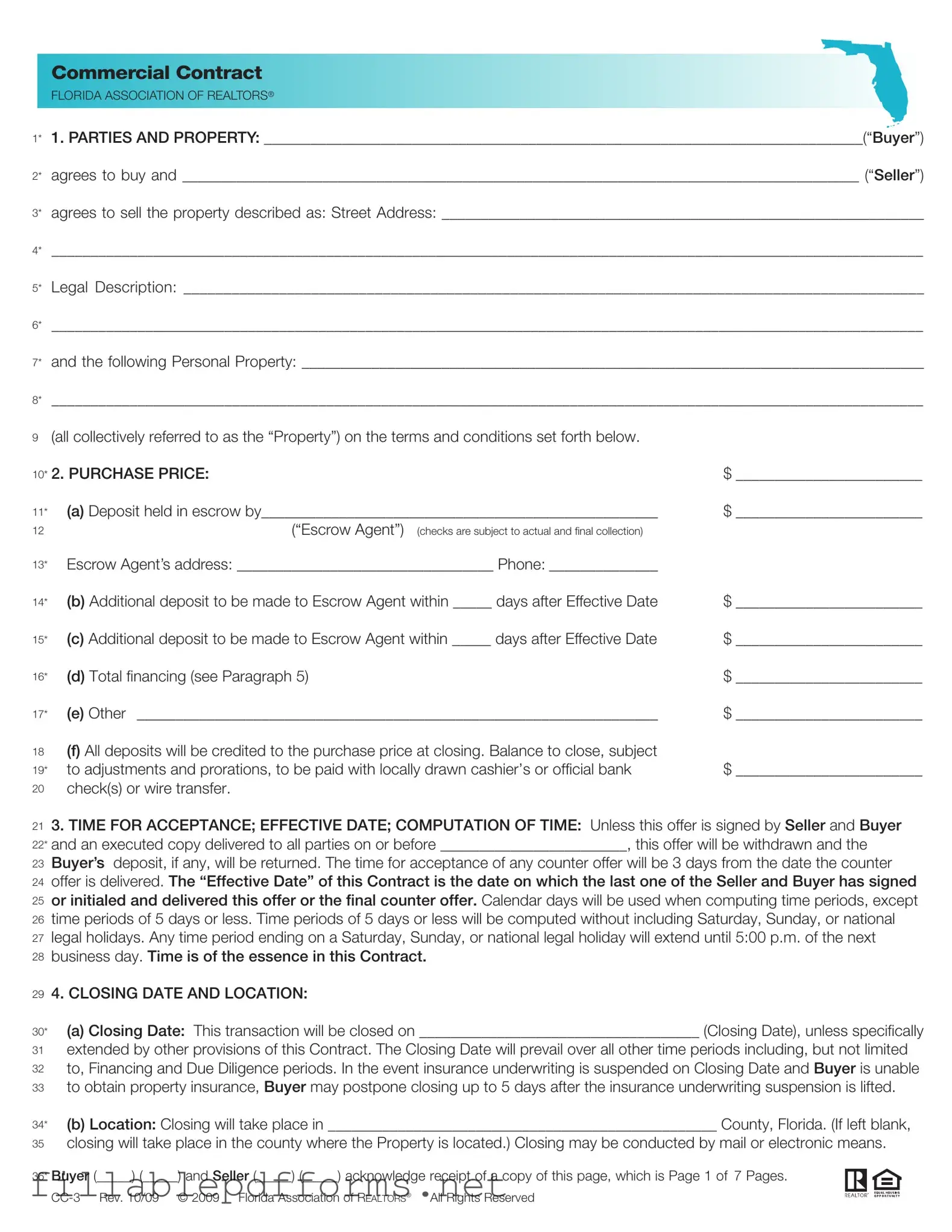

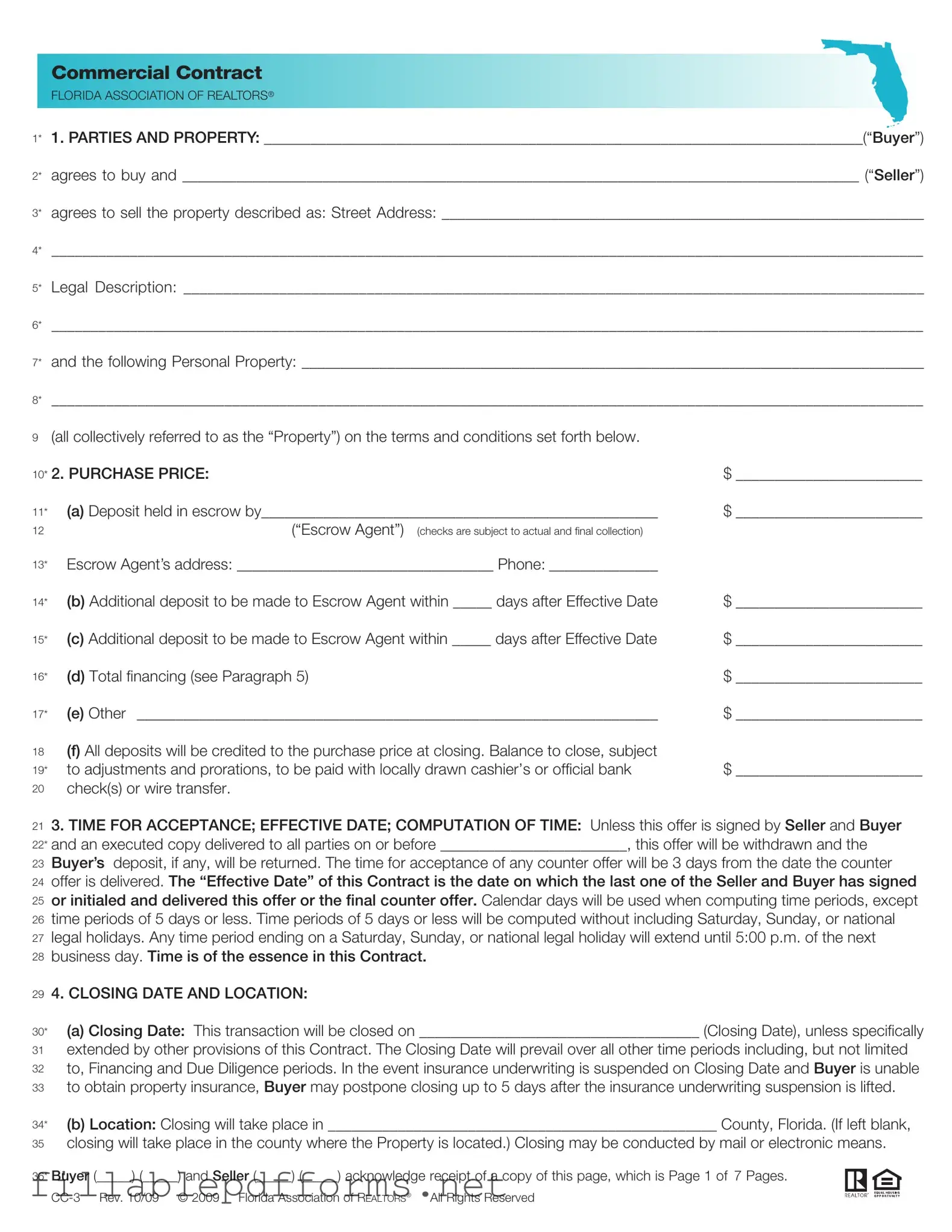

Florida Commercial Contract PDF Template

The Florida Commercial Contract form serves as a legal document that outlines the terms and conditions of a transaction between a buyer and a seller in a commercial real estate setting. This standardized form, utilized by the Florida Association of Realtors, facilitates the sale of property by detailing essential elements such as the parties involved, the property description, and the purchase price. Understanding this contract is crucial for anyone engaged in commercial real estate transactions in Florida, as it ensures clarity and legal compliance throughout the buying process.

Launch Editor Here

Florida Commercial Contract PDF Template

Launch Editor Here

Launch Editor Here

or

▼ Florida Commercial Contract PDF

Almost there — finish the form

Complete Florida Commercial Contract online fast — no printing, no scanning.