Erc Broker Market Analysis PDF Template

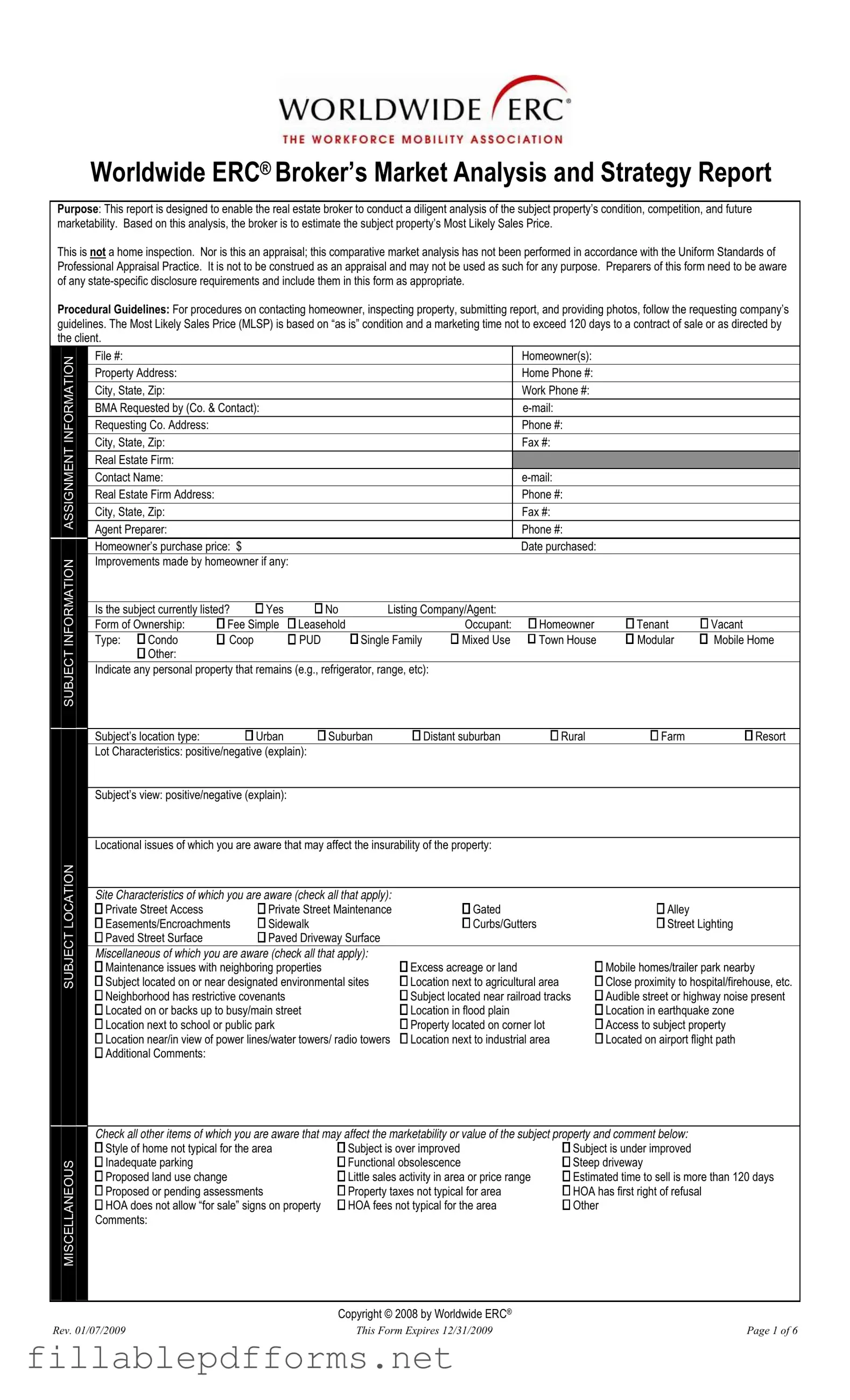

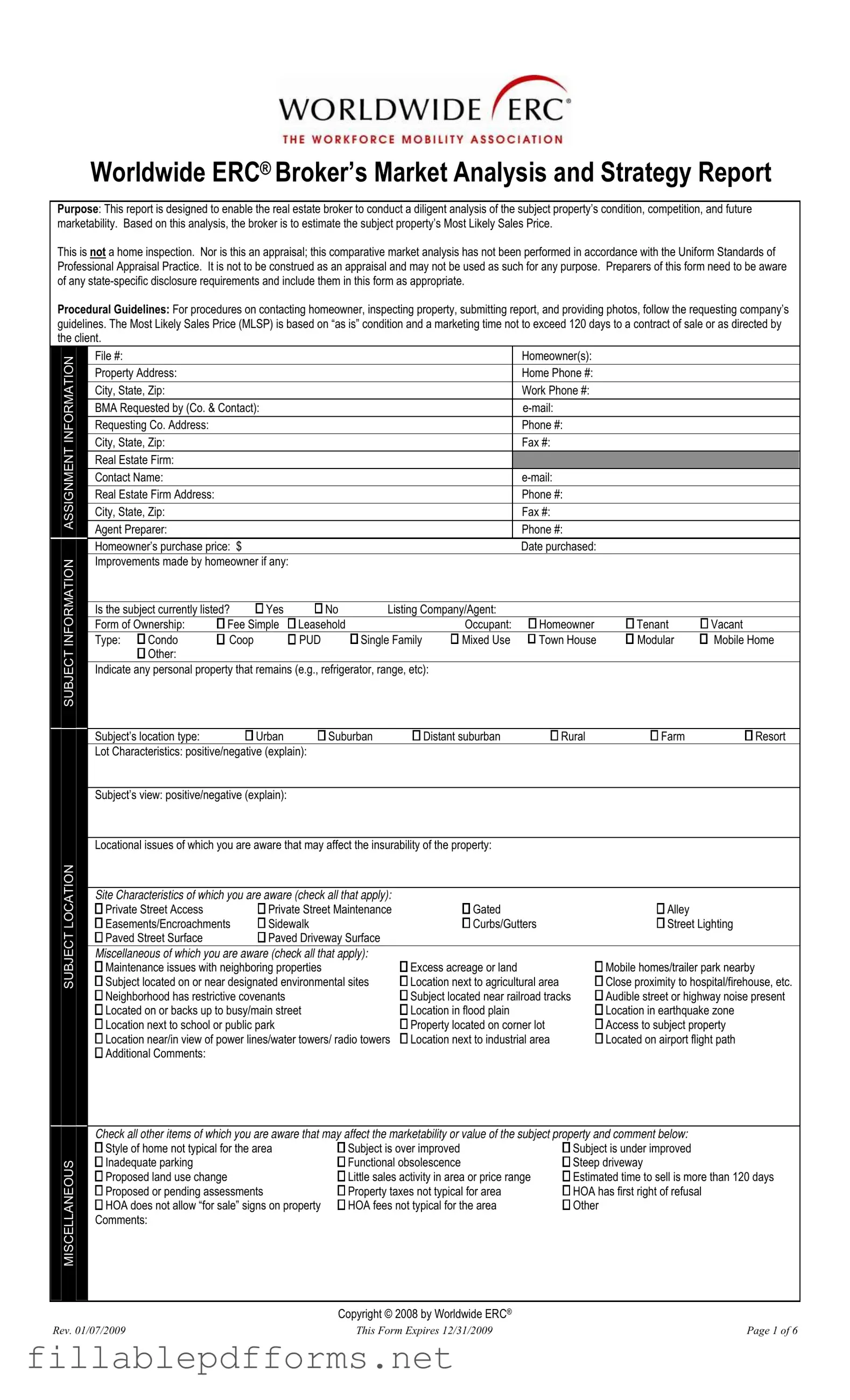

The Worldwide ERC® Broker’s Market Analysis and Strategy Report serves as a vital tool for real estate brokers, enabling them to thoroughly assess a property's condition, its competition, and its potential marketability. By utilizing this form, brokers can estimate the Most Likely Sales Price of the property, providing valuable insights for sellers and buyers alike. It is important to note that this analysis is distinct from a home inspection or appraisal, and must adhere to state-specific disclosure requirements.

Launch Editor Here

Erc Broker Market Analysis PDF Template

Launch Editor Here

Launch Editor Here

or

▼ Erc Broker Market Analysis PDF

Almost there — finish the form

Complete Erc Broker Market Analysis online fast — no printing, no scanning.