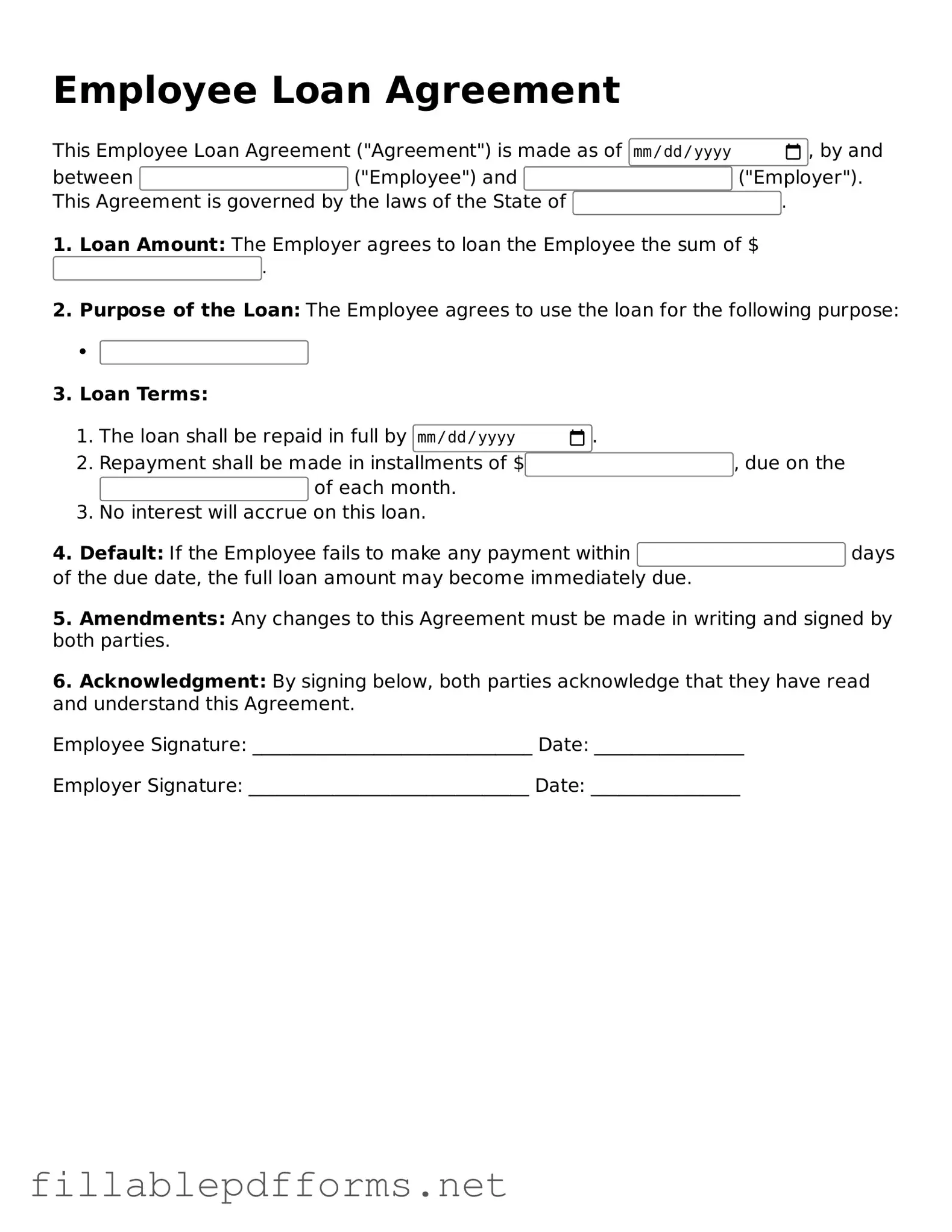

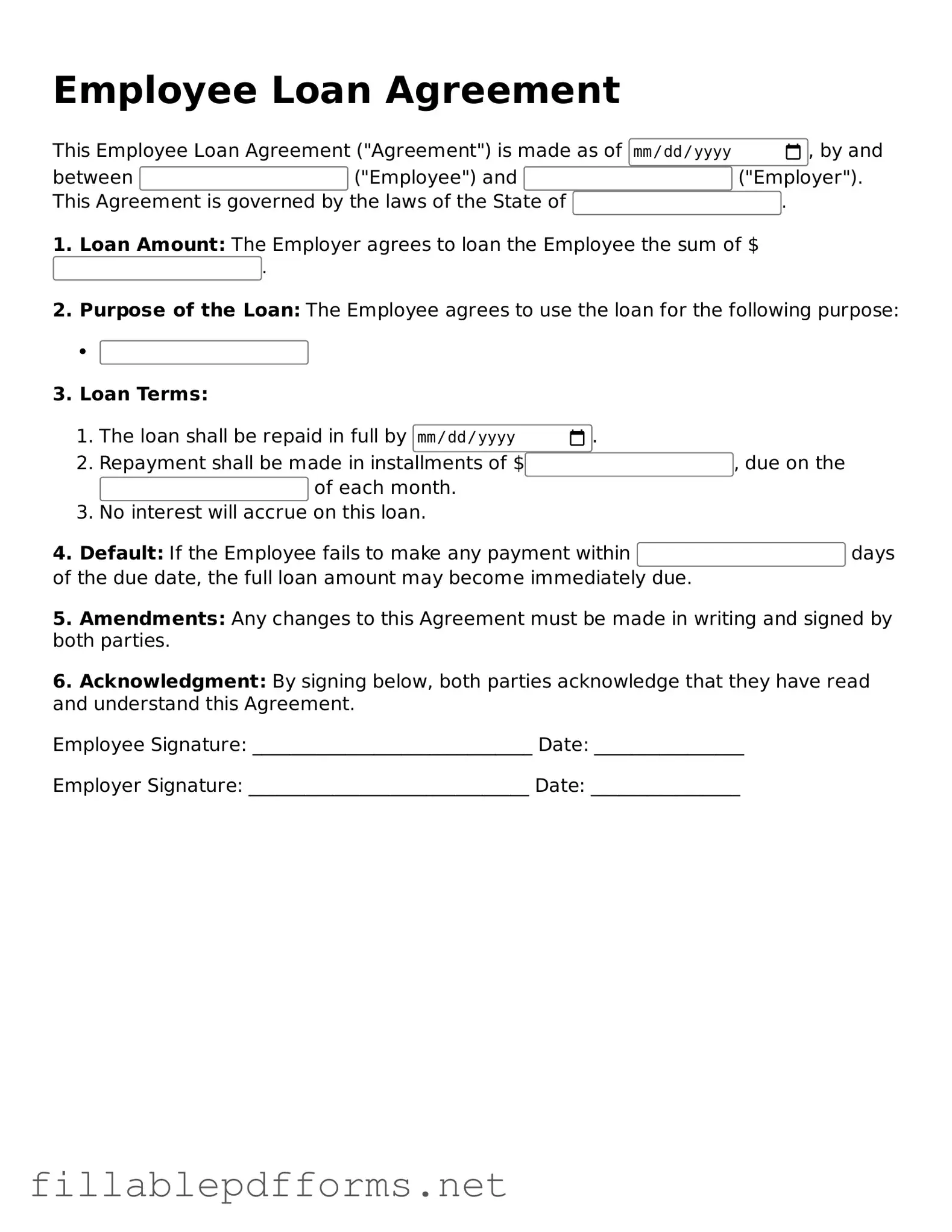

Blank Employee Loan Agreement Template

An Employee Loan Agreement is a formal document that outlines the terms under which an employer lends money to an employee. This agreement serves to protect both parties by clearly defining the loan amount, repayment schedule, and any applicable interest rates. Understanding this form is essential for fostering transparency and trust in the employer-employee relationship.

Launch Editor Here

Blank Employee Loan Agreement Template

Launch Editor Here

Launch Editor Here

or

▼ Employee Loan Agreement PDF

Almost there — finish the form

Complete Employee Loan Agreement online fast — no printing, no scanning.