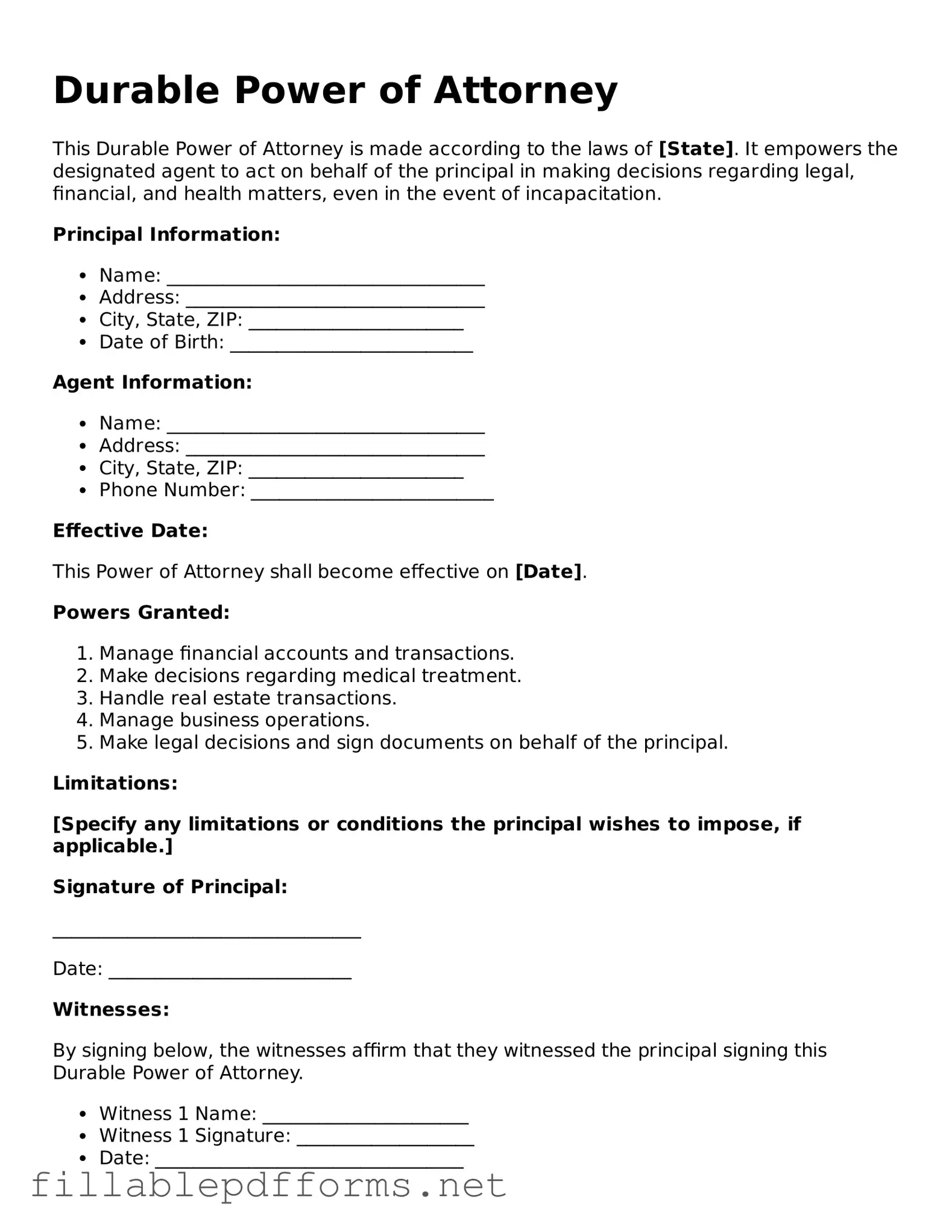

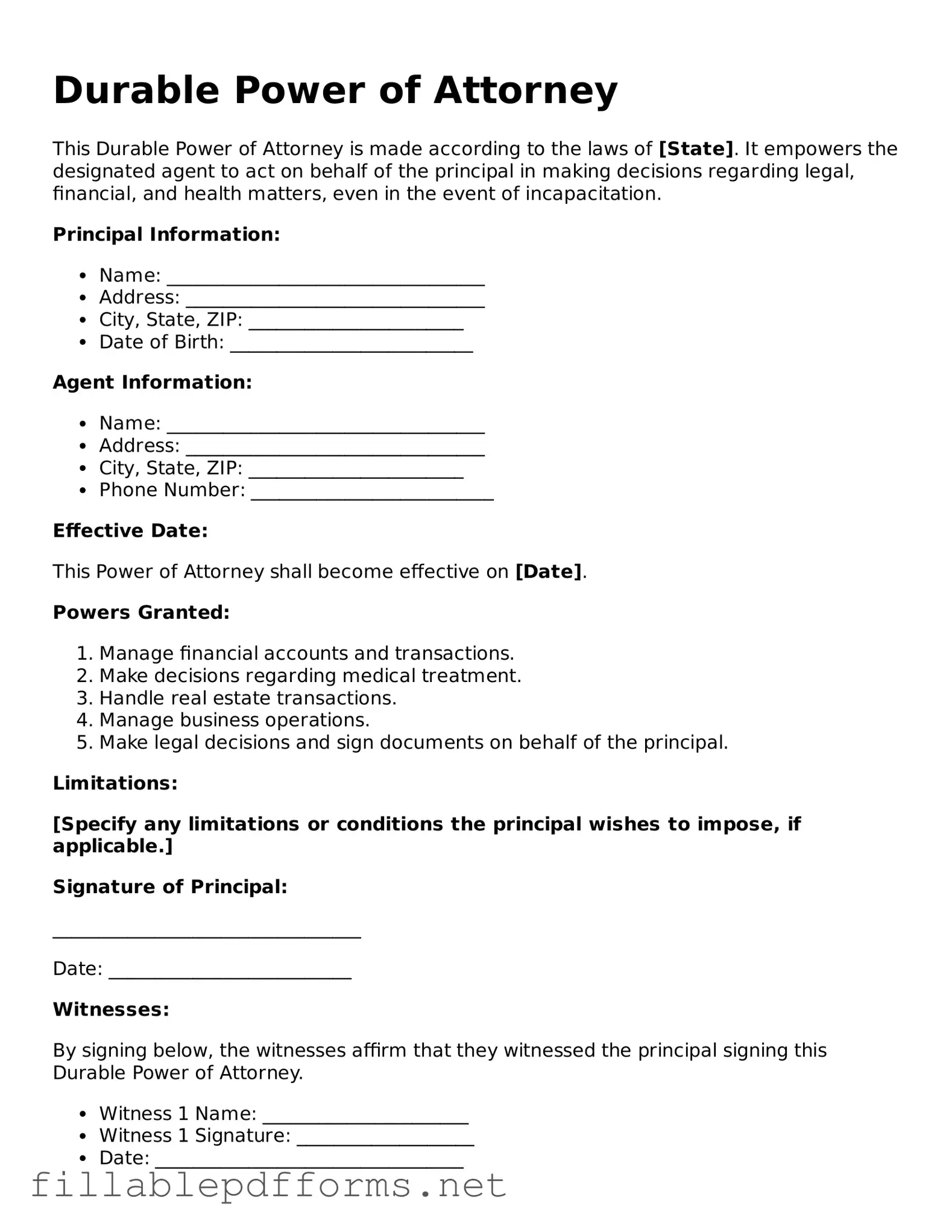

Blank Durable Power of Attorney Template

A Durable Power of Attorney is a legal document that allows an individual to appoint someone else to manage their financial and medical decisions in the event they become incapacitated. This form remains effective even if the person who created it loses their ability to make decisions. Understanding how this document works is essential for anyone looking to ensure their wishes are respected during times of vulnerability.

Launch Editor Here

Blank Durable Power of Attorney Template

Launch Editor Here

Launch Editor Here

or

▼ Durable Power of Attorney PDF

Almost there — finish the form

Complete Durable Power of Attorney online fast — no printing, no scanning.