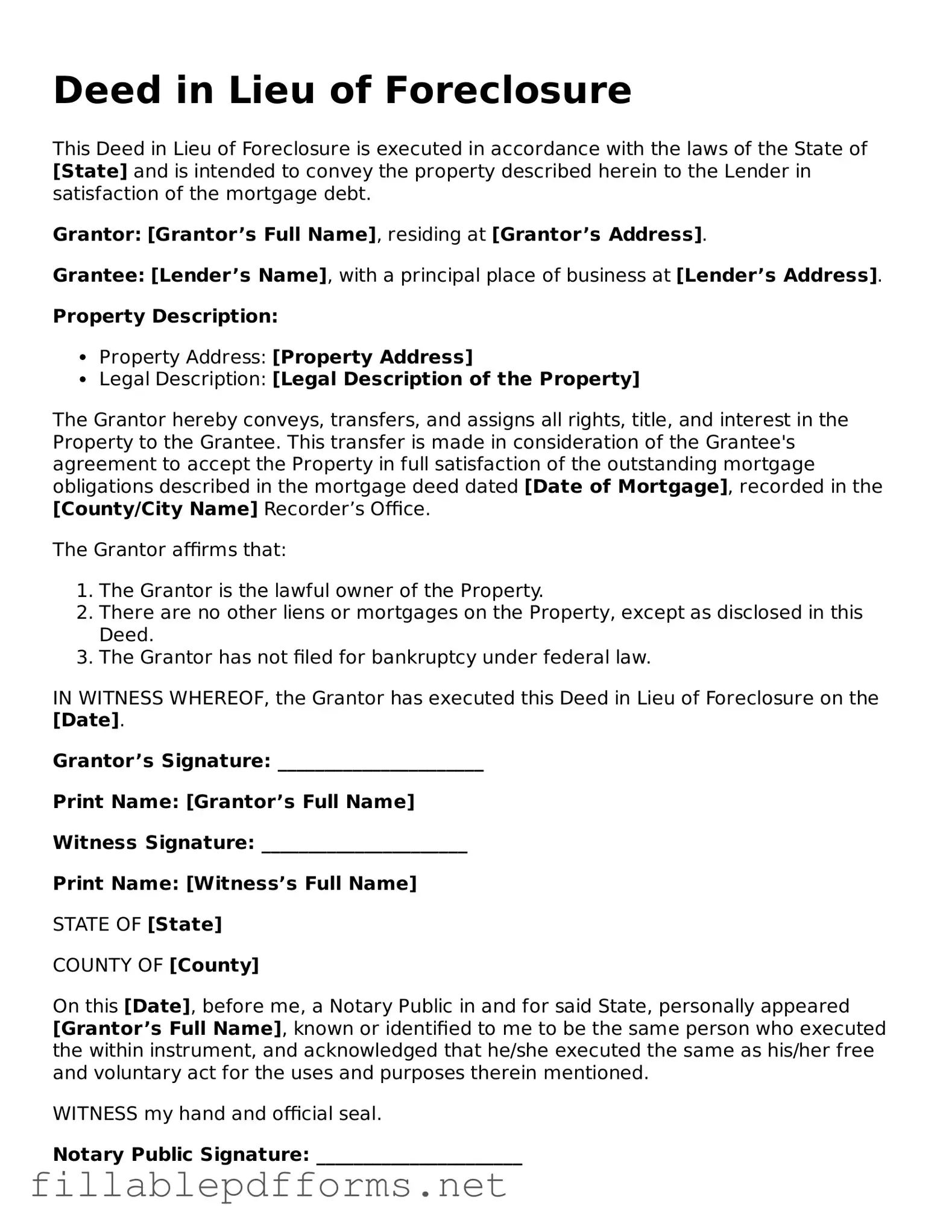

Blank Deed in Lieu of Foreclosure Template

A Deed in Lieu of Foreclosure is a legal document that allows a homeowner to voluntarily transfer their property to the lender in exchange for the cancellation of their mortgage debt. This option can provide a smoother exit from a challenging financial situation compared to the lengthy foreclosure process. Understanding this form can empower homeowners to make informed decisions during difficult times.

Launch Editor Here

Blank Deed in Lieu of Foreclosure Template

Launch Editor Here

Launch Editor Here

or

▼ Deed in Lieu of Foreclosure PDF

Almost there — finish the form

Complete Deed in Lieu of Foreclosure online fast — no printing, no scanning.